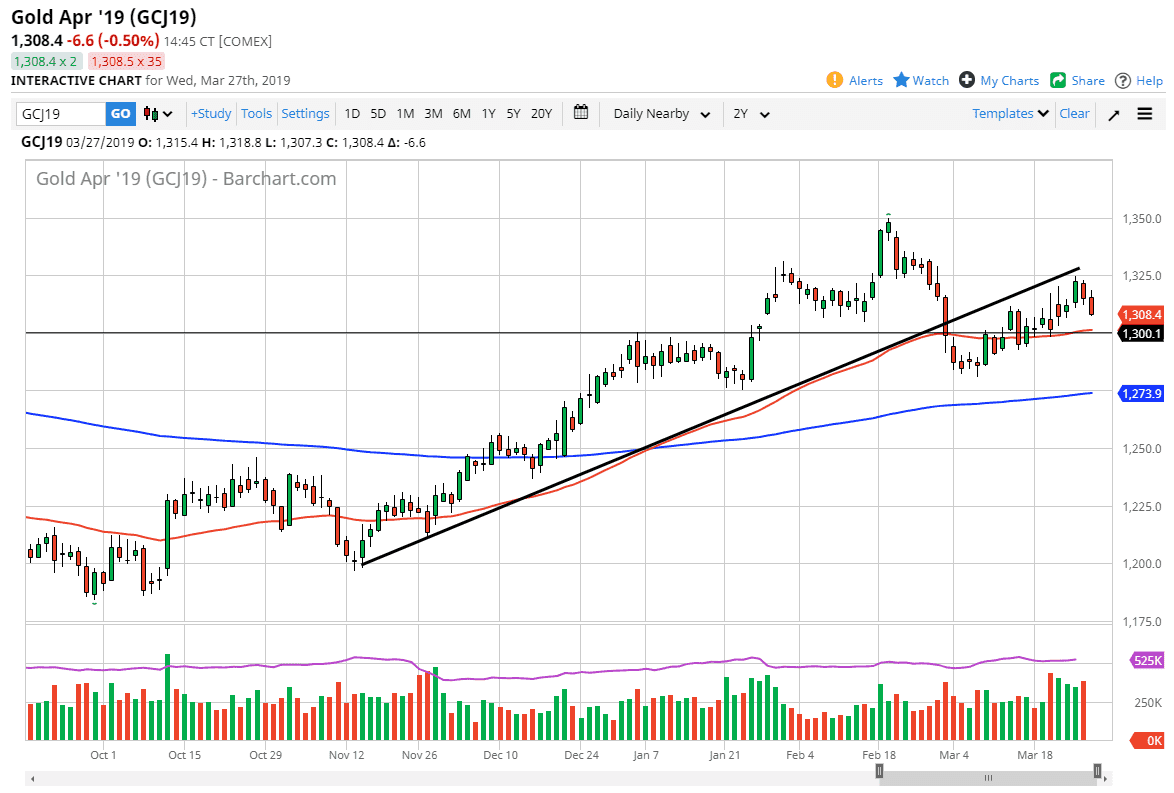

Gold markets had a volatile session during trading on Wednesday as we continue to see a lot of choppiness. Recently, we had reached towards the bottom part of the previous uptrend line which of course should be resistance now. We have in fact seen selling in the $1325 area, so it makes sense that we drop down to the $1310 level during the day. In fact, we have even broken down through that level, but at the end of the day I think we are still in a $25 range.

What I mean by that is that the $1300 level should offer a significant amount of support underneath based upon the large come around, psychologically significant figure, it of course the 50 day EMA which is sitting right at that level. If we were to break down through that area, although Barry she would necessarily be catastrophic quite yet. Keep in mind that the 200 day EMA is closer to the $1275 level, which would be yet another $25 on the chart, which seems to be the pattern that this market follows.

All things being equal the Federal Reserve and other central banks around the world continue to be very dovish and that should be good for precious metals such as gold. However, there are a lot of questions out there about whether or not the bond markets will calm down, as a stronger bond market creates demand for US dollars, which by its very nature will put a bit of a weight around the neck of gold. I do believe given enough time we will rally but we may get a somewhat significant pullback in the short term. $1300 offering a bounce would be an excellent short-term opportunity from what I see.