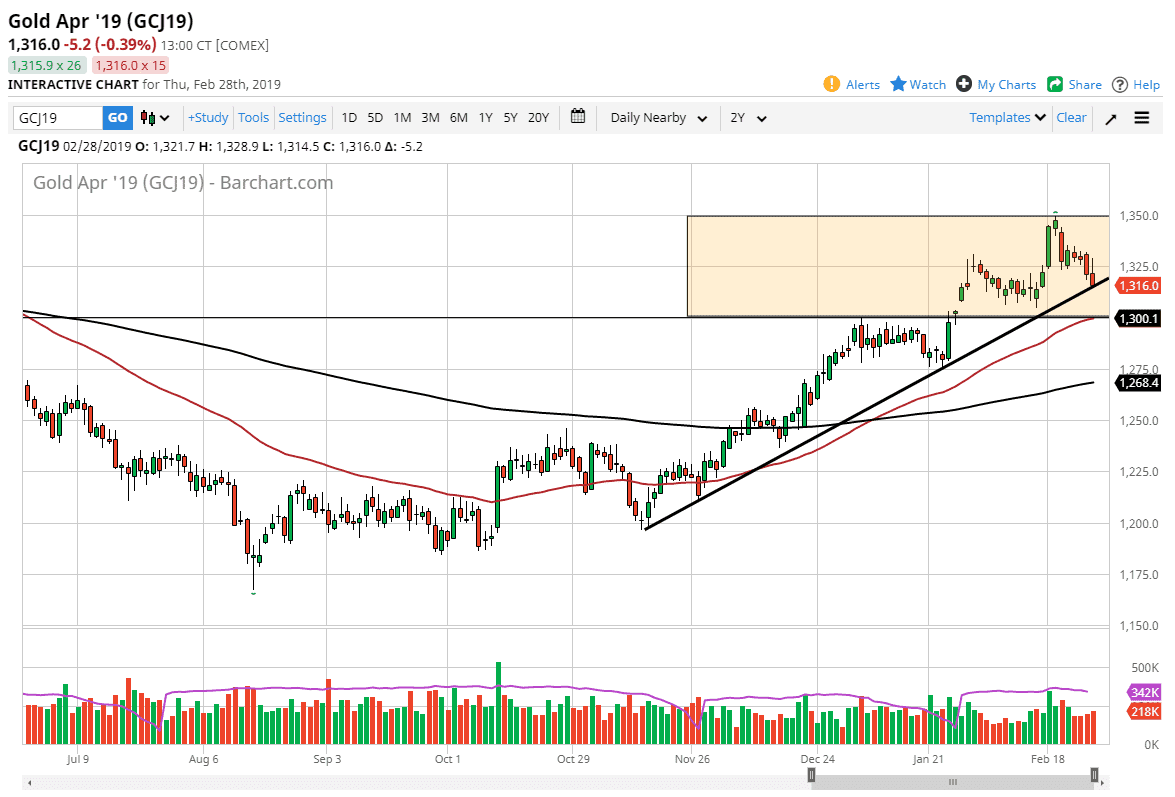

Gold markets initially rallied a bit during the trading session on Thursday but found enough resistance just below the highs of the previous session to roll over again, and now is sitting to test a major trendline. If we can break down below this trendline, we could unwind down to the $1305 level, which is where the next large group of buyers will be found.

Beyond that, we have the 50 day EMA just now crossing above the $1300 level, which of course will attract a lot of attention. That being said, breaking down below an uptrend line is a strong sign that something is changing, and I suspect it will start to weigh upon the gold market in general. Another pseudo-signal that I have been paying attention to is that silver has been making a bit shallow on the rallies, as each one gets a little less convincing. The two markets do tend to move in the same general direction, and it now looks as if there is a real threat for silver to pull gold down.

Pay attention to the US dollar, that may be one of the main drivers of gold as well, so I think the next 24 hours will be crucial, and the fact that it is a Friday could come into play as well. The daily close will tell us which direction we should probably be thinking next. If we are above the trendline, it's probably going to continue to reach towards the $1325 level. If we are below the trend line, then the previously mentioned $1305 level is likely.