Gold markets rallied after initially pulling back a bit during the trading session on Wednesday, as the Federal Reserve released its statement and held a press conference afterwards. After all, the Federal Reserve now has stated that there is no chance of it raising interest rates during the year of 2019, that has put a bit of a beating on the greenback, which of course puts the gold market at higher levels.

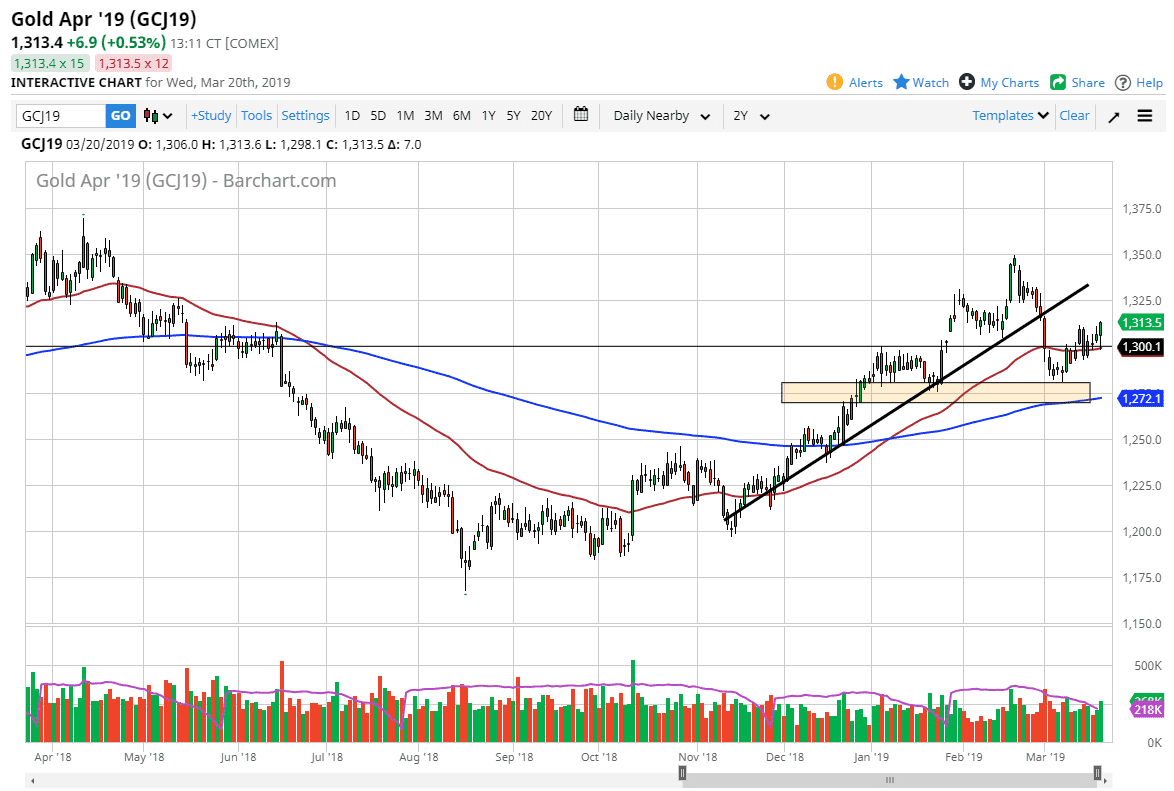

By breaking above the $1310 level, it looks as if we could go grinding towards the $1325 level above. Ultimately, it looks as if we continue to buy the dips in this market, as the $1300 level looks to be very supportive. Beyond that, the 50 day EMA underneath continues to offer a bit of structural support as well. While we did break down below a significant uptrend line a while back, it looks as if we are at the very least going to go looking towards the bottom of that uptrend line to see if it’s going to be resistance now.

To the downside, I see a significant amount of support at the $1275 level as well, so if we do turn around and break down below the 50 day EMA, which is red on the chart, then that’s probably where we will go looking to find buyers next. Overall, this is a market that looks like it will try to go higher, but we always have to keep in the back of the mind that there is an alternate scenario.

If we can break above the $1325 level, then we could go a bit higher, perhaps even $1350 level, and then possibly even the $1400 level which is the top of the ultra-longer-term consolidation area. If the Federal Reserve is going to allow inflation to run a little hot, it’s possible that we may have more room to the upside.