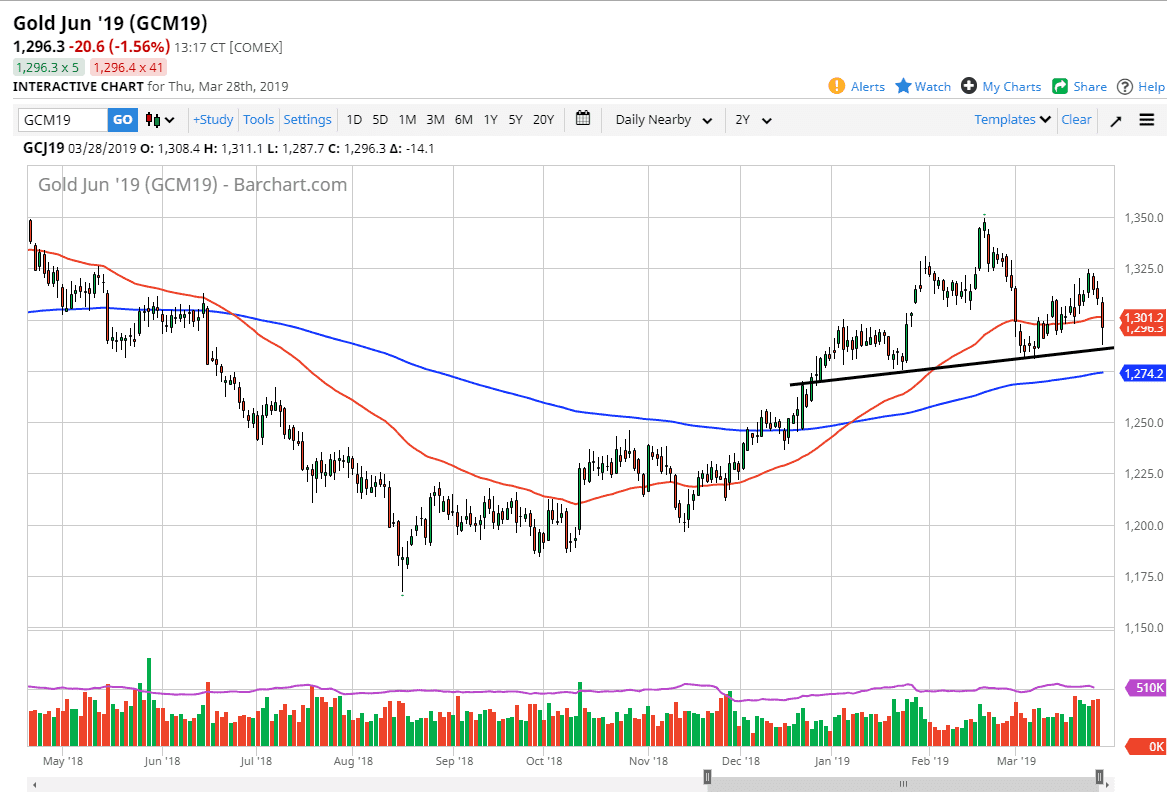

Gold markets fell significantly during the Thursday session as the US dollar accelerated its gains. However, we have seen a bit of a recovery later in the day so it’s likely that the market will hold its own. Looking at this chart it’s likely that the trend line now on the chart will be something to pay serious attention to, as it could now be the neckline for a head and shoulders pattern. With that in mind, it’s important to pay attention to and therefore will continue to be crucial.

One thing to pay attention to is that we have had a nice bounce though, so it’s very likely that we will see a lot of back-and-forth trading. You will have to pay attention to the US dollar overall, and by proxy if you do not have the capability to track the US Dollar Index with live data, you can use the EUR/USD pair as it is the largest part of that index.

If we do break down below the uptrend line though, that could open up a move all the way down to the $1225 region. This would be the measured move from the height of the head and shoulders and could lead to a quick and drastic move. However, it’s not until we get a daily close below that level. On a bounce, we could reach towards the $1225 level which is the major resistance above. At this point, I think it’s very likely that we will see a lot of choppiness and volatility so using the uptrend line and the $1325 level, we can probably look for short-term back and forth trades and what’s going to be a volatile market.