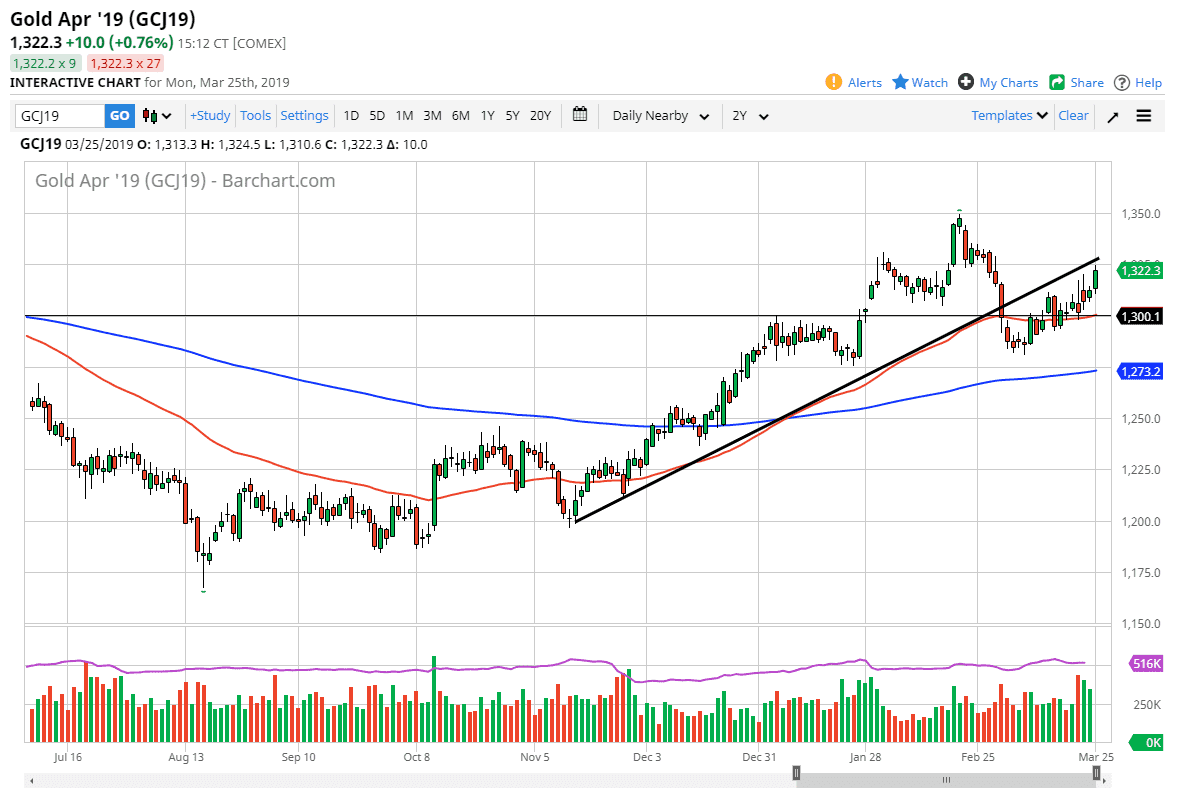

Gold markets have rallied again during the trading session on Monday, reaching towards the $1325 level. This is an area that has been important more than once, as we have seen both support and resistance at that level. The market has not only seen all of that, but it also is now starting to coincide with the previous uptrend line. That uptrend line should now offer resistance, and quite frankly has for several weeks.

That being the case, we could run into a bit of resistance at this area to turn things around. I don’t necessarily think that we are going to see the market fall apart, but a pullback would be well within the realm of normalcy. I see the $1300 level underneath as massive support, as it is not only a large, round, psychologically significant figure, but also the 50 day EMA. Those are a couple of reasons why this market should continue to find buyers just below.

What I do like about this chart is that we have broken above the top of a couple of shooting stars, which of course is a very bullish sign. However, if we can break above the $1325 level, then the market will probably reach towards the $1350 level which has been the most recent high. If we were to turn around and break down below the 50 day EMA, that could open the door down towards the $1280 level, possibly as low as the 200 day EMA which is colored in blue on the chart, right below the $1275 handle.

Ultimately, this is a market that I think will probably be driven by the US dollar, or perhaps risk tolerance in general. If we start see a lot of fear in the market, that could lift Gold. However, if we see the US dollar chain, that could also lift Gold.