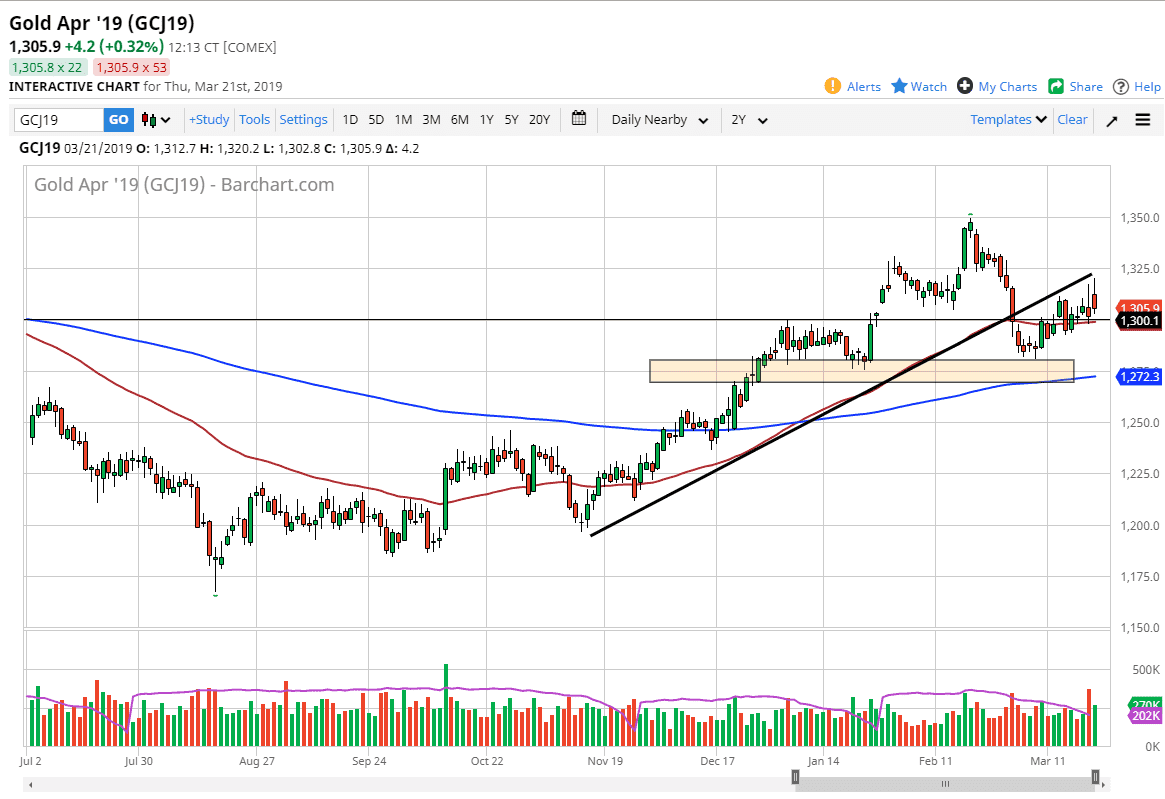

Looking at the Gold markets on Thursday, we have seen the market try to reach higher, but have rolled over significantly. The candle stick for the day looks very ugly, and at this point it’s likely that we will continue to see a bit of trouble above. The $1300 level underneath continues to be crucial, so if we can break down through there, we could start to see even more downward pressure.

This is particularly telling, considering that the Federal Reserve suggested on Wednesday that there is no hope of an interest rate hike in 2019. Overall, it’s likely that this should weaken the US dollar. However, on Thursday we have seen the exact opposite. That is a very interesting change of attitude, considering that one would assume that it should be negative for the greenback, but there seems to be enough concern around the world that money is flowing into the treasury markets. That of course is US dollar positive, and that may be part of what’s going on.

The $1300 level underneath of this area is very supportive, and of course the 50 day EMA is just below as well. Structurally speaking, this should cause a bit of buying pressure, so will have to see how things play out. The fact that we are at the end of the week could cause a bit of profit taking as well, but I would also point out that more importantly than anything else I see on the chart, we have tested the bottom of the uptrend line, which of course is now potential resistance. This would make a break above the $1325 level especially impressive. Overall though, I think what we are looking at is a short-term pullback that could offer value if you are patient enough.