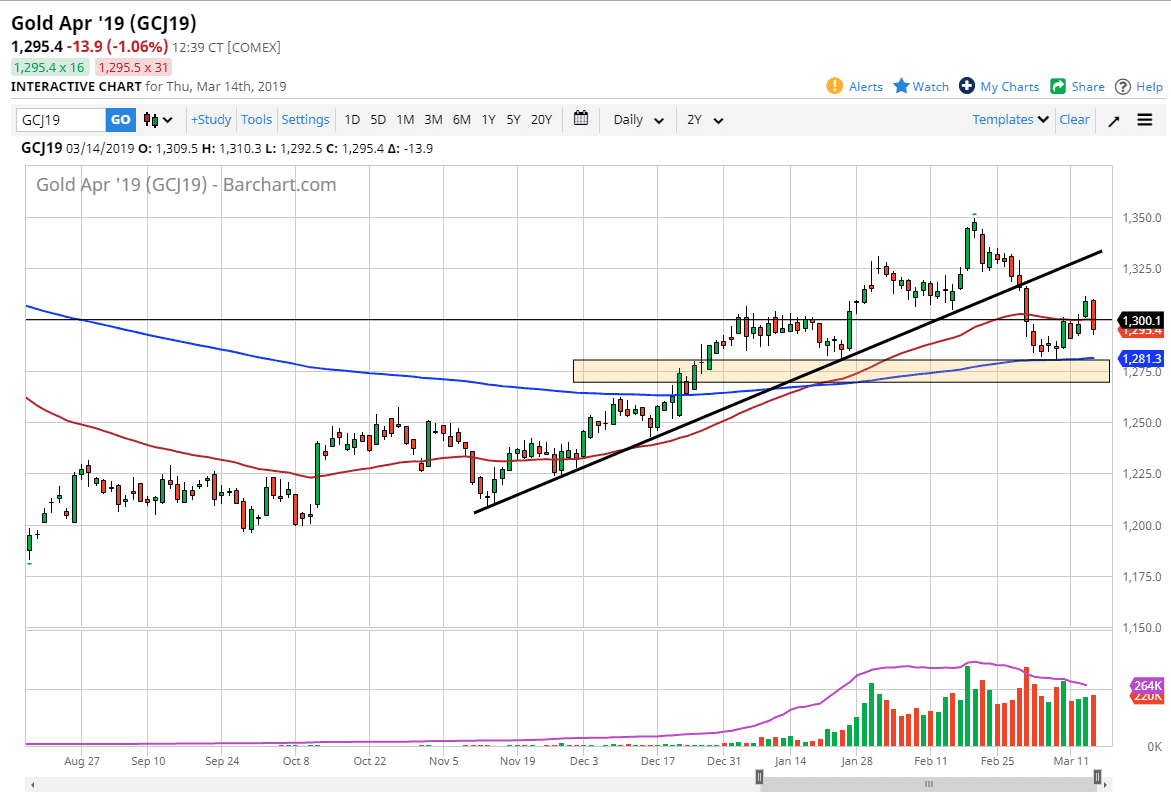

Gold markets fell rather hard during the Thursday session, slicing through the $1300 level as the US dollar picked up strength against several currencies. Ultimately though, there are a lot of buyers underneath so I think that the downside is somewhat limited in the short term. The 50 day EMA, pictured in red on the chart, is slicing through the candle now, and hanging about the $1300 level. The 200 day EMA is just below at the $1280 level.

Gold continues to move against the US dollar, but at this point it’s very likely that the market will continue to find plenty of interest at the 200 day EMA which caused a major bounce. Beyond that, the $1275 level underneath has offered support as well. With that being the case I think that we probably have a buying opportunity at lower levels if we get a little bit of follow-through.

The alternate scenario is that we turn around and break above the $1300 level and recapture those losses. If we do that, then I think gold probably takes off from there as well. As for selling gold is concerned, I’m not interested in doing that until we break down below the $1275 level, which could open up the door down to the $1200 level next. That would probably demand some type of rush to the US dollar, which at this point I don’t see that happening.

Ultimately, I think the $1325 level is major resistance, and the next target. That doesn’t mean that it’s going to be easy to get there, but it does look as if we are going to make another attempt at that region based upon short-term charts during the Thursday session.