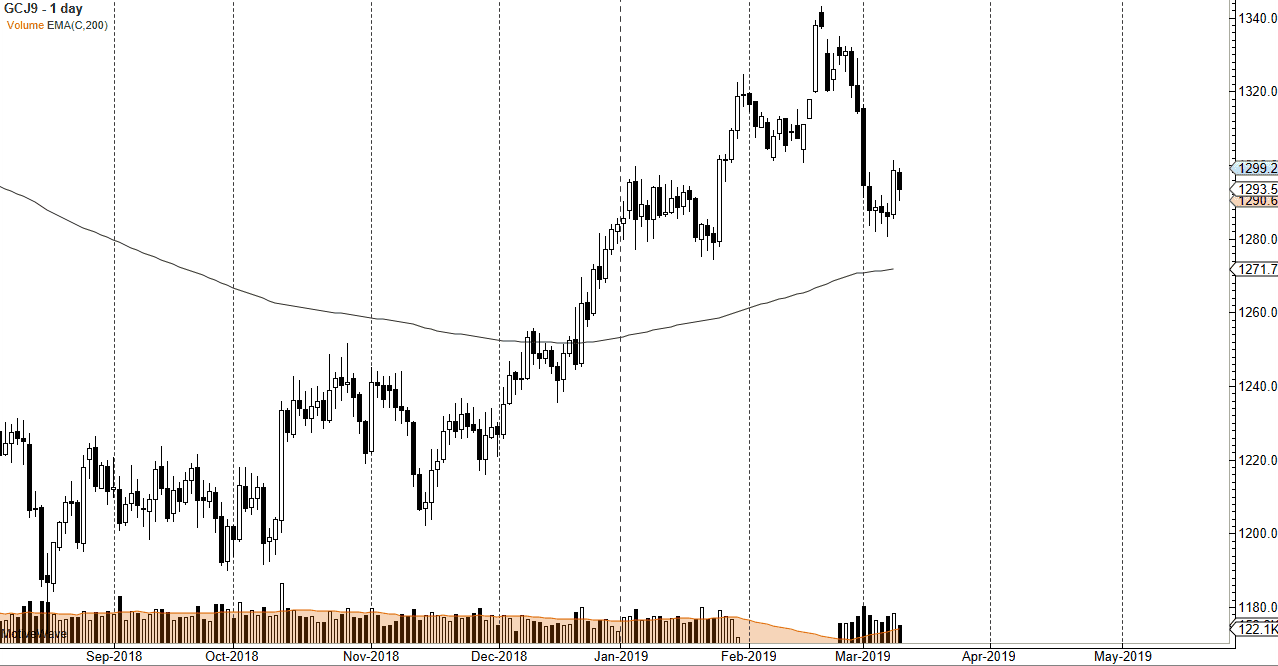

Gold markets pulled back a bit during trading on Monday to kick off the week, perhaps in an attempt to take advantage of strong profits had on Friday. The Thursday candle before that had formed a perfect camera, so the move higher made quite a bit of sense. However, as we reached towards the $1300 level during Monday trading, we saw enough resistance to turn the market back around.

That being said, it’s very likely that there are buyers underneath, and the spike in volume of course has helped give a strong bit of presence to the Friday move. Volume on Monday was a bit lighter, and we are off of the lows for the session. It is because of this that I believe the Gold markets are going to try to rally from here and go higher.

This isn’t to say the $1300 will be easy to get above, just that we are going to make another attempt to climb above there in continue going higher. As of late, we have seen a bit of volatility but keep in mind that the Federal Reserve and the European Central Bank have expressed a bit of dovish attitude that should continue to propel precious metals higher. After all, if the US dollar and the Euro were both going to be somewhat soft, it makes sense that people will be running into precious metals to protect their wealth.

That being said, if we break down below the $1275 level, then we will make a serious push to try to break down below the 200 day EMA pictured on the chart. A slip below that level could open the door all the way back down to the $1200 level, which is the bottom of the longer-term consolidation area.