Gold

Gold markets will be very interesting during the trading session on Wednesday, because quite frankly we have a lot of potential volatility due to the Federal Reserve coming out with an interest rate statement and more importantly a statement in general. The market is waiting to see whether the Federal Reserve is going to push back the idea of a rate hike past 2019, which would be very negative for the US dollar. By extension, this should be bullish for gold, as traders will look to protect their wealth using precious metals.

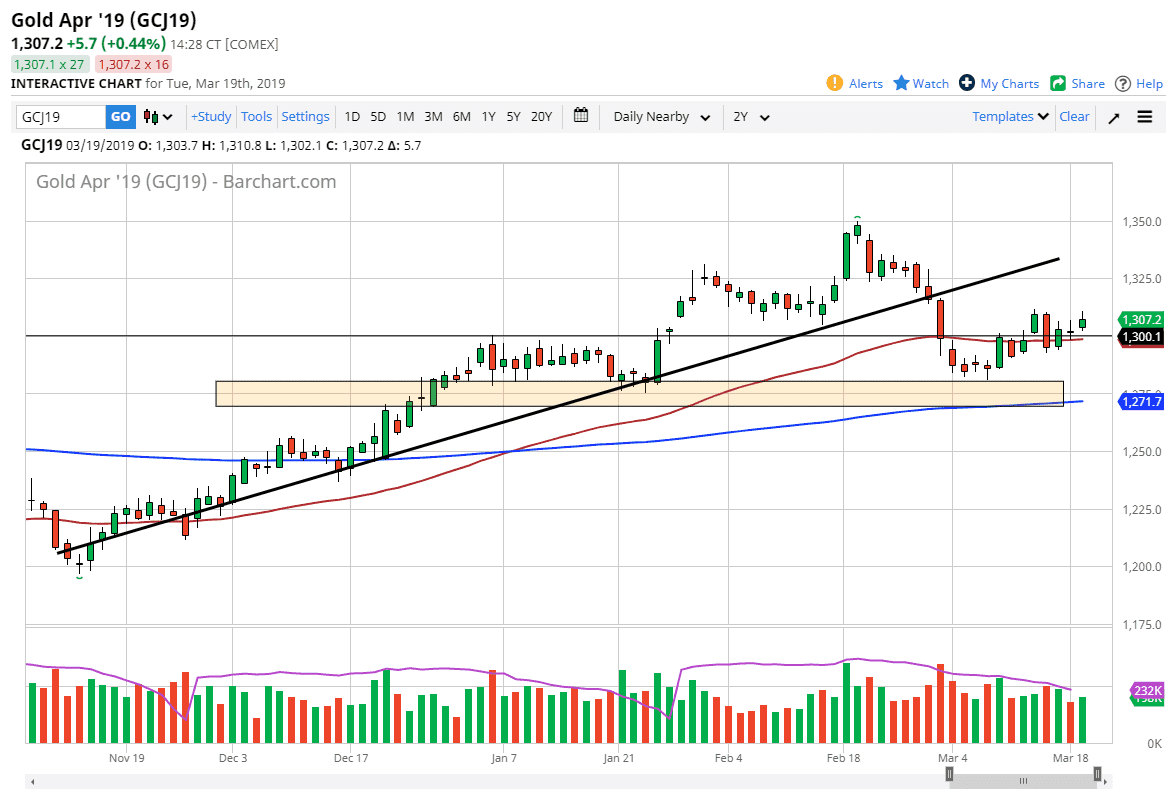

Looking at this chart, there’s an obvious significant support level just below the $1300 level as shown by the 50 day EMA. We could see a breakdown below that level, and if we do then the next support level we closer to the $1275 level. To the upside, if we can break above the $1310 level, it’s very possible that we go looking towards the $1325 level next which should have a certain amount of resistance built into it.

Regardless what happens, the Wednesday session should be rather crucial, towards the end of the day in America as we continue to see a lot of questions asked about the monetary policy of the Americans, which by extension will have a massive influence on what happens with the greenback overall. If they remain very loose, then it’s likely that we continue to see the US dollar fall apart, and that should help currencies around the world and precious metals markets. If they on the other hand suggests that we are still looking at rate hikes later in the year, we could see precious metals suffer as the greenback rallies.