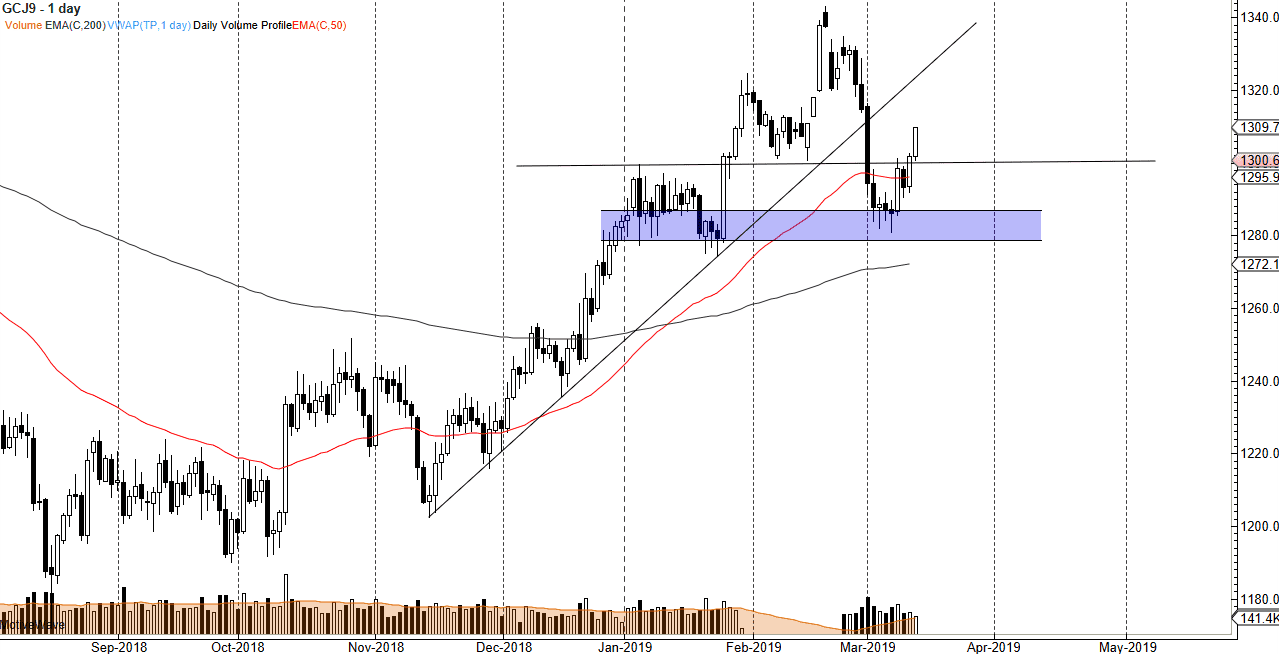

Gold markets rallied significantly during trading on Wednesday, reaching towards the $1310 level by the end of the day. We close towards the top of the candle, which of course is a very bullish sign. At this point, the market looks as if it is ready to continue going higher, but we do have a previous uptrend line that will now start to enter the picture as potential resistance. Beyond that, we also have a very bearish candle stick that was the beginning of the breakdown, near the $1316 level.

It is at that level that we could run into some trouble, but in the short term it looks very likely that we will see an attempt to at least get there. By the fact that we closed so high in the daily range it’s very likely that there should be a certain amount of follow-through when it comes to gold.

The US dollar has remained a bit mixed, but if it starts to fall a bit that should also help gold. Beyond that, the major central banks around the world continue to look a bit soft and loose with their monetary policy, which of course is good for gold as well. After all, larger traders are trying to protect their wealth more than anything else, and that of course brings a natural demand for gold. Beyond that, a lot of central banks around the world are starting to accumulate gold which of course puts a natural bid underneath price.

As you can see on the chart, I have a blue box near the $1280 level which I see as natural support. I also recognize that the $1300 level underneath should be supportive as well. I like the idea of buying gold on dips that show signs of support in the meantime, and will reevaluate everything near the $1316 level, and then again at the $1320 level after that.