Gold markets rallied a bit during the trading session on Tuesday again, as we have seen a nice move to the upside. The market looks very likely to continue going higher, as the $1300 level, albeit a large come around, psychologically significant figure, has been pierced.

By breaking the top of the Friday candle, that is a very strong sign indeed and it looks like short-term pullbacks will continue to be attractive for buyers, as the US dollar has been soft, and of course we already know that the ECB is on the sidelines. In other words, we have a lot of central-bank loose monetary policy, and that tends to be very good for precious metals overall.

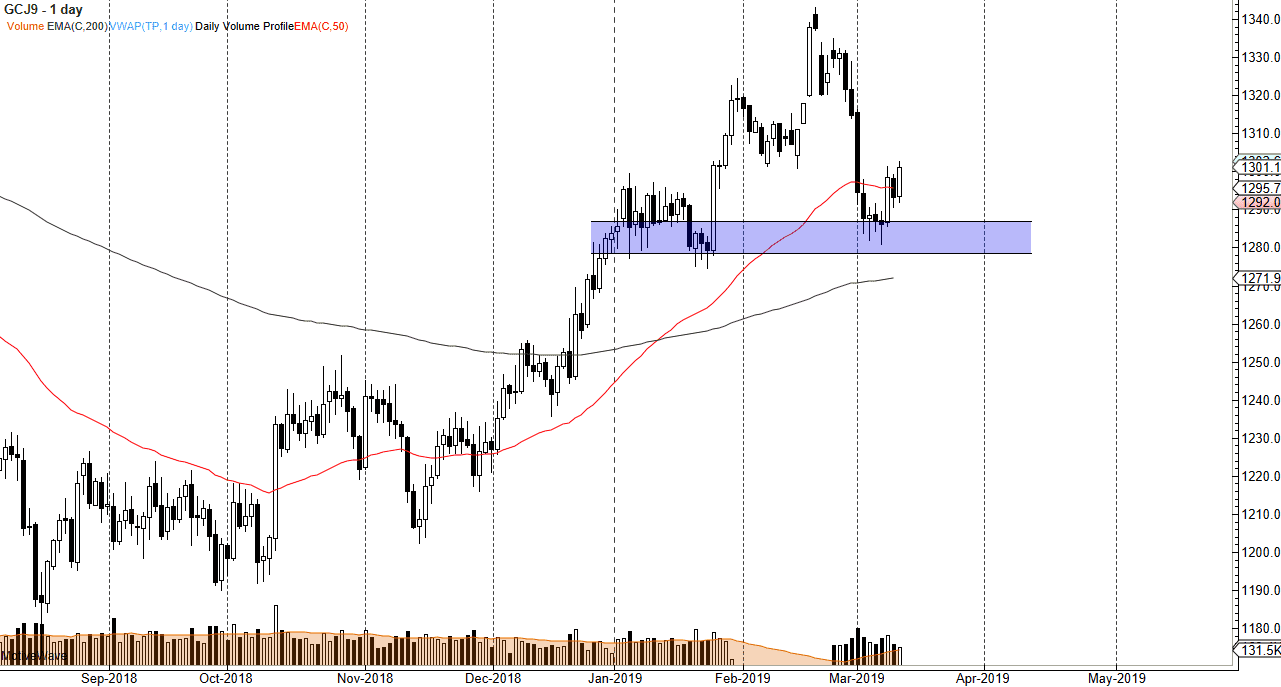

Pullbacks at this point should continue to find plenty of support near the $1280 level, as we have seen as recently as Thursday. The 50 day EMA is right in the middle of this current trading block, and of course that will attract a lot of attention as well. Lower than that, there is a 200 day EMA pictured in black, and it’s very likely that it will continue to act as a “dynamic floor” for gold. Don’t get me wrong, I don’t think that the market is going to shoot straight up, but clearly the overall attitude is to the upside and that has not changed despite the fact that we had a major selloff.

Short term back and forth trading with a slightly upward bias will more than likely continue to be the way we see this market move. The US dollar is expected to lose value going into later 2019, and that of course typically does good things for the Gold markets. With that, I don’t have any interest in shorting and I do think that the buyers will continue to push higher in $25 increments.