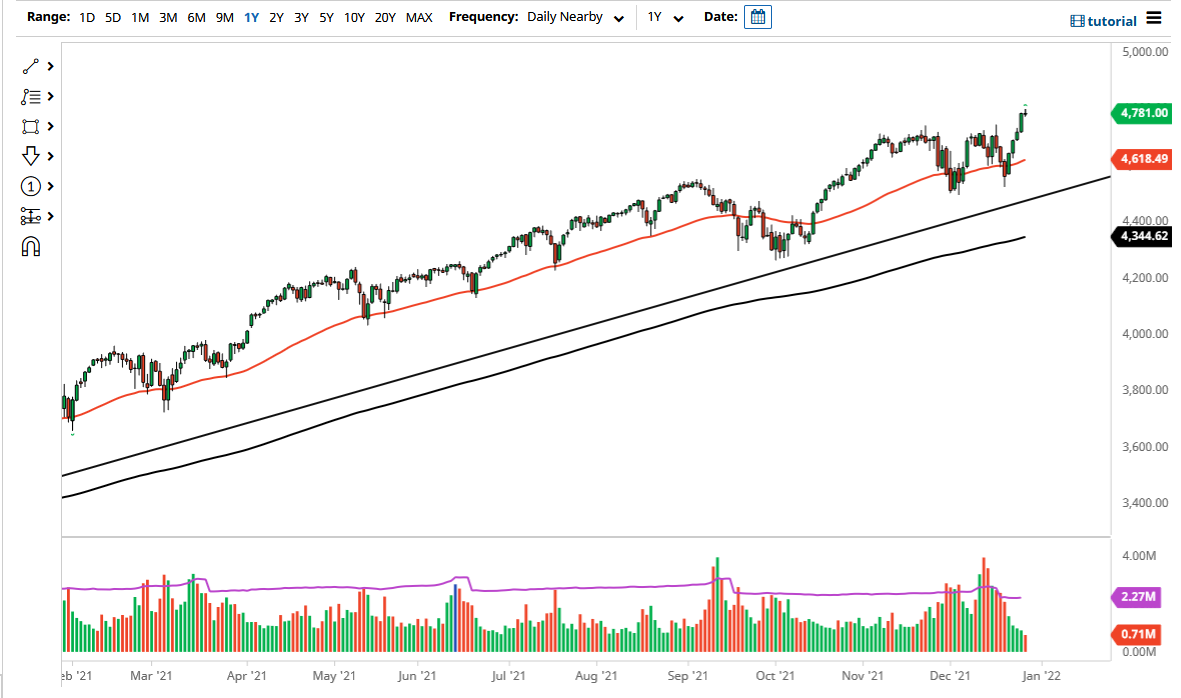

S&P 500

The S&P 500 initially fell in overnight trading, but then got hammered after the jobs number came out at just 20,000 jobs at it for the month of February. Needless to say, this was far below consensus and had sellers out in force. However, the 50 day EMA has offered support, and it now looks as if the market may be somewhat stabilizing before the close. If that’s the case, the damage has been limited and it shows that there is still a proclivity for the market to rally from here. That being the case, I am a buyer of dips and I do think that we revisit the 2800 level eventually. It doesn’t mean tomorrow, it doesn’t even mean this week, but it does look as if the buyers are willing to come in and pick up value as it occurs. However, if we were to break down below the 2700 level, that would be an extraordinarily bearish turn of events.

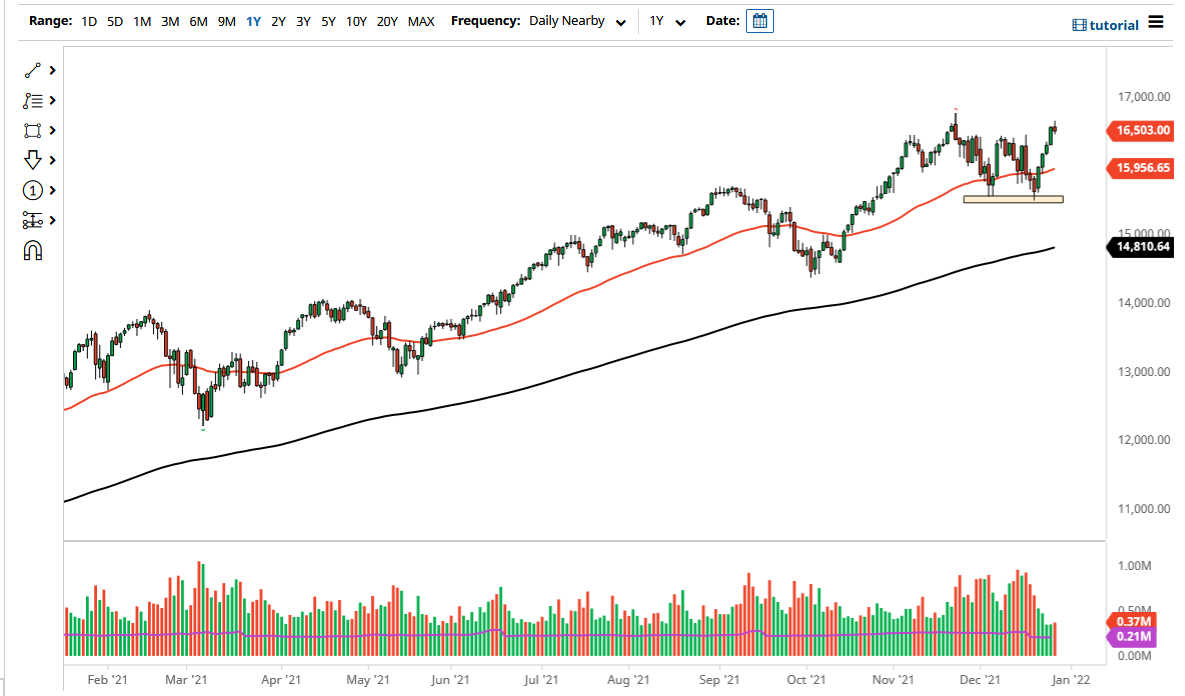

NASDAQ 100

The NASDAQ 100 formed an even more impressive candlestick, as it is a bit of a hammer and sits just above the 7000 handle. That being the case, it looks like the NASDAQ 100 will continue to lead the way, perhaps rallying and dragging the S&P 500 right along with it. All things being equal, it looks like we will continue to try to go to the upside and therefore buying the dips continues to work in this market as well. The markets had everything they could possibly have thrown out of this week, and although we have had a pullback, it has been relatively resilient. I would say that the candlestick shape by the end of the day is rather encouraging considering what it could have been.