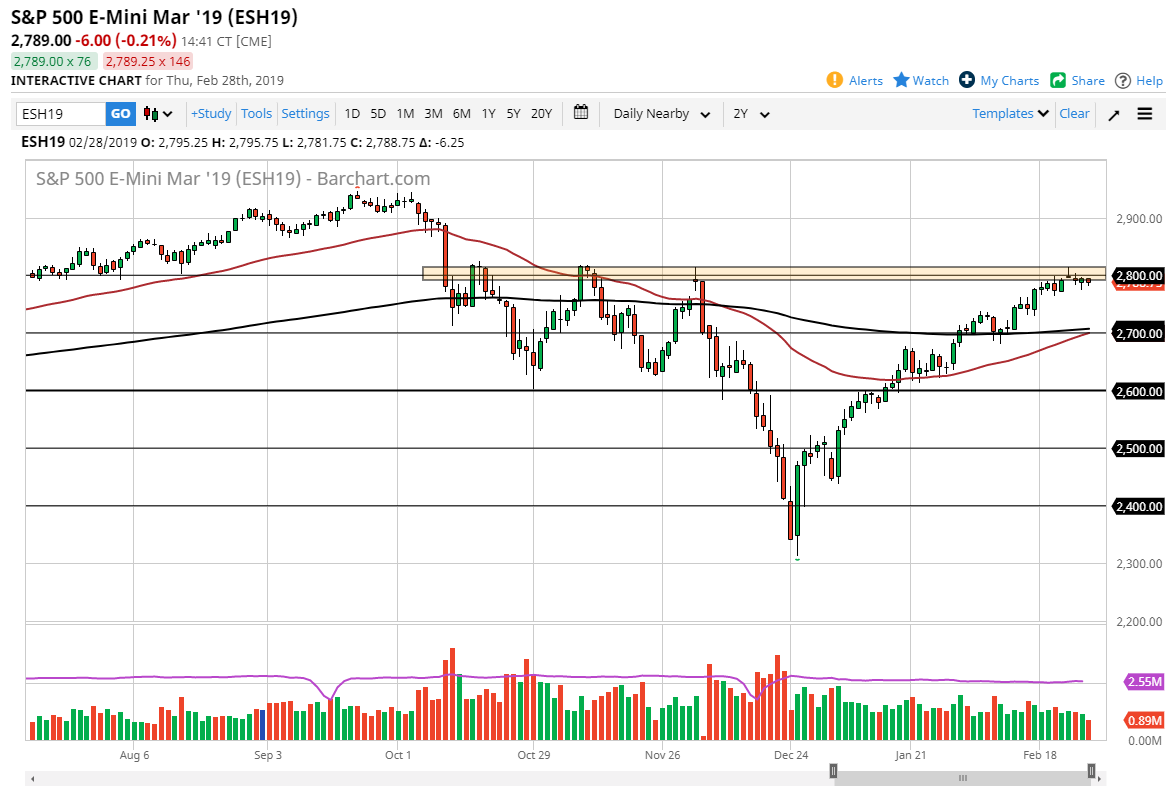

S&P 500

The S&P 500 pulled back a bit during the trading session on Thursday, as we continue to see a ton of resistance above at the 2800 level. Because of this, the market looks as if it is trying to break out, but obviously we don’t have the momentum to do that quite yet. If we can break above the 2820 handle, then I think the market could continue to go out towards the 2900 level. Until then, it looks as if short-term traders will continue to focus on buying the dips, unless we break down below the Friday session of last week, which would be very negative. At this point though, it looks like the market remains very driven to get to the upside. In fact, the 50 day EMA is getting very close to forming a “golden cross” above the 20 day EMA.

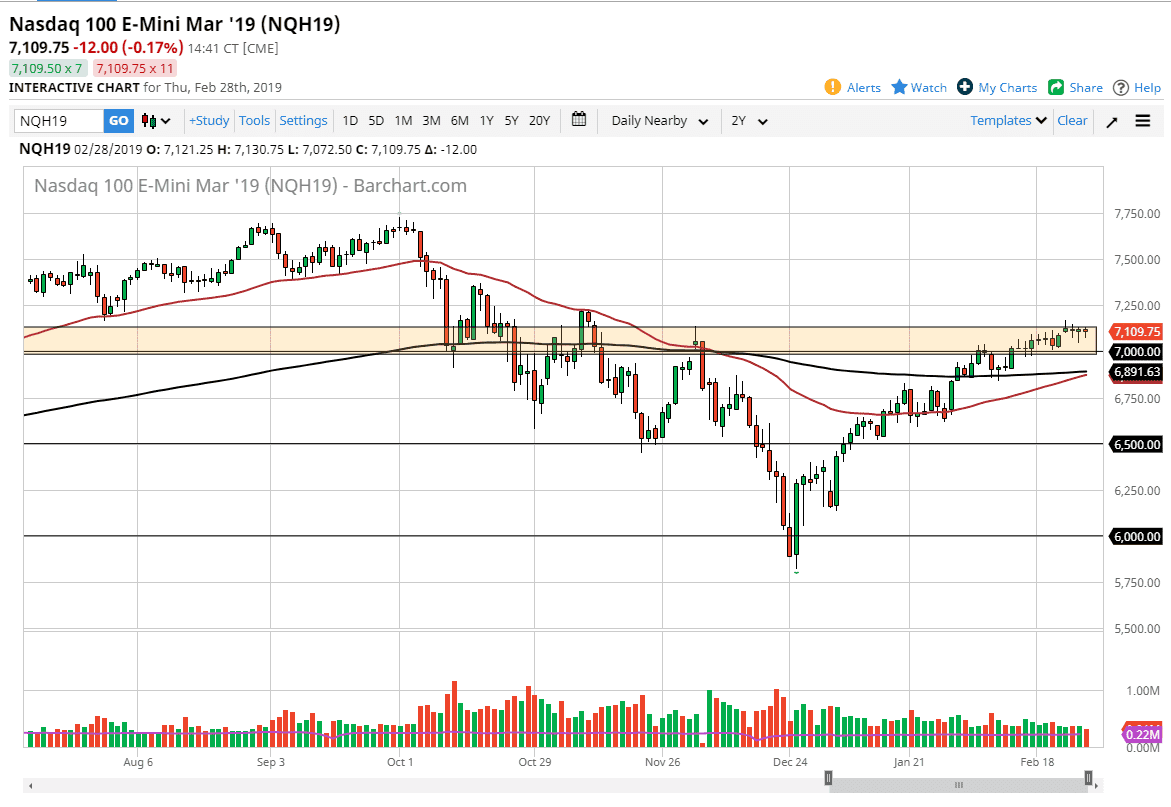

NASDAQ 100

The NASDAQ 100 initially pulled back during the trading session on Thursday as well but found buyers yet again. The market looks as if it is essentially stuck in a significant range, but if we can break out to the upside, perhaps the 7200 level, the market could go to the 7250 level, and then beyond their. While there are a lot of resistance levels above, it looks very likely that we are going to continue to try to break out to the upside. That being said, if we break down below the 7000 handle, the market probably reaches down towards the 200 day EMA which is closer to the 6900 level. The 50 day EMA looks likely to cross above the 200 day EMA, and that of course is the “golden cross” just as we are starting to see the S&P 500 as well.