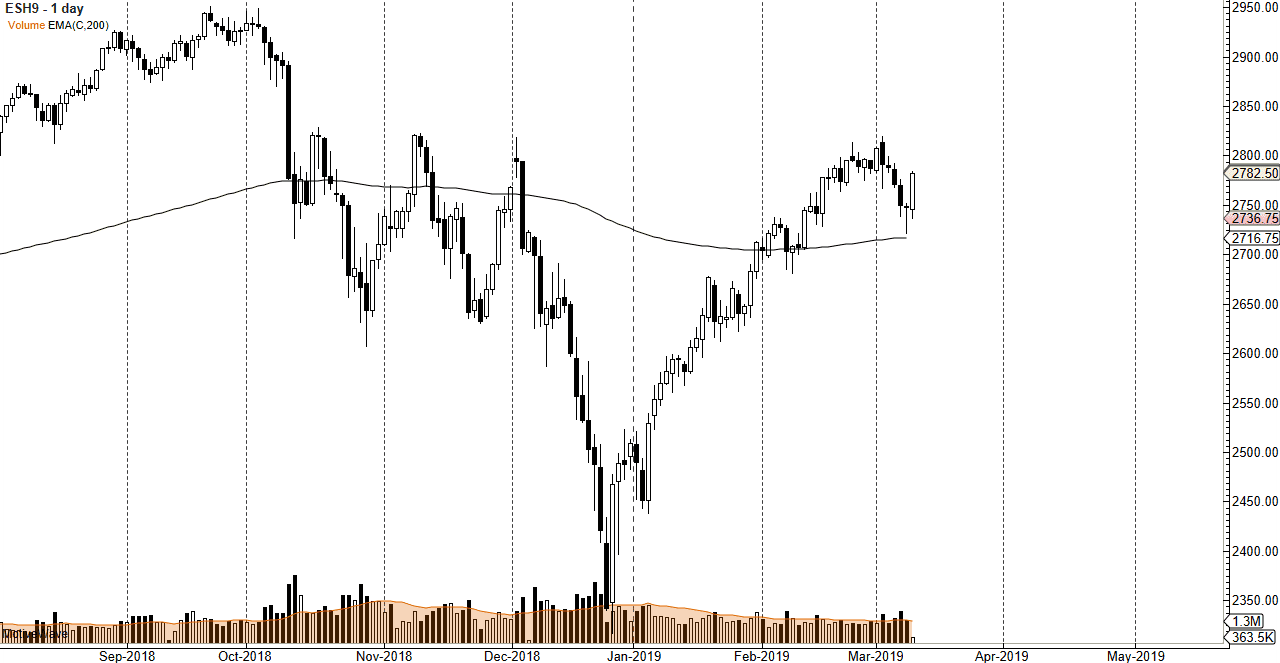

S&P 500

The S&P 500 shot higher during the trading session on Monday as traders came back to work. The Friday candlestick had been a massive hammer, so it’s not a huge surprise to see that the market had a little bit of follow-through. Beyond that, the candlestick on Friday pressed down towards the 200 day EMA where we turn around and bounce. This was a crucial event, as the jobs number was very poor but people looked past that. At this point, the market looks as if it is ready to continue to press higher, but it’s obvious that we have a lot of problems near the 2820 handle. If we can break above there, then things will change drastically. We most certainly have seen the lot of bullish pressure, and it does look like short-term pullbacks will continue to offer buying opportunities. However, the closer we get to the 2820 handle, the more likely we are to see those pullbacks.

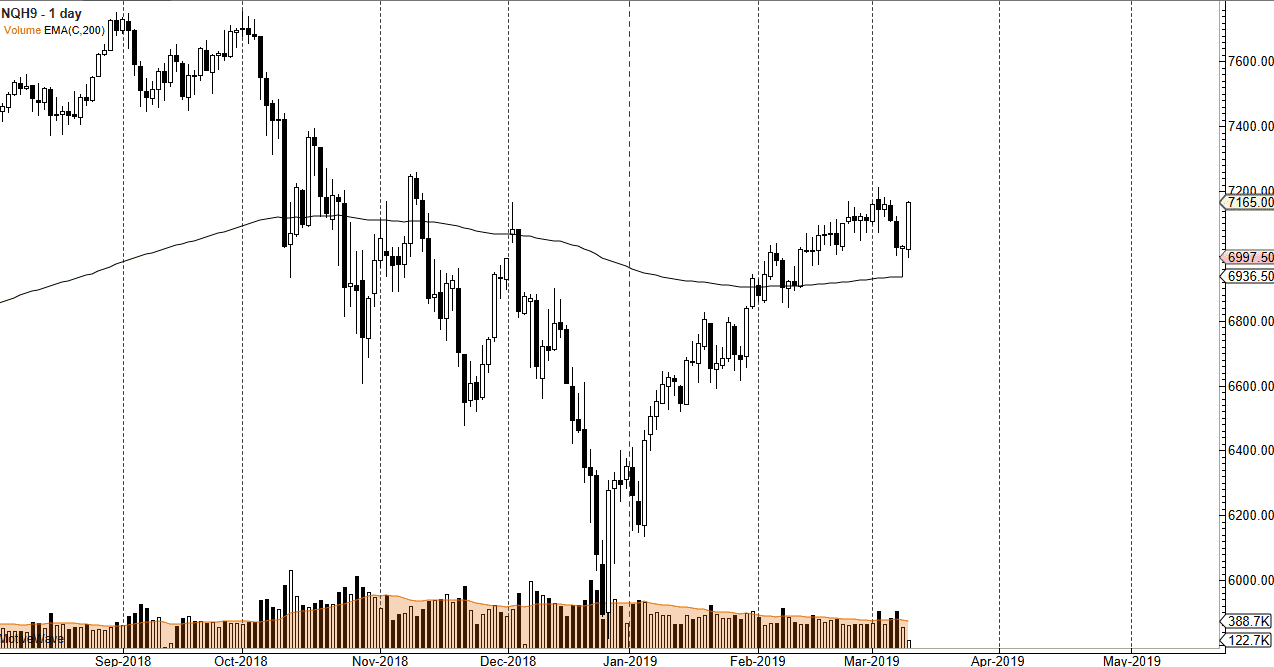

NASDAQ 100

The NASDAQ 100 also shot higher during the trading session on Monday, reaching towards the highs again at the 7200 region. The candle stick was very strong, and it does look as if we are trying to break out. I suspect at this point it's very likely that the NASDAQ 100 will lead the way forward, and therefore short-term pullbacks here will probably be thought of as buying opportunities as well. Overall though, I do think that this is where we should be looking at for clues to trade not only the NASDAQ 100, but also the S&P 500 and other such US-based markets. If we were to turn around and break down below the 200 day moving average though, it would be a catastrophic sign for all US indices.