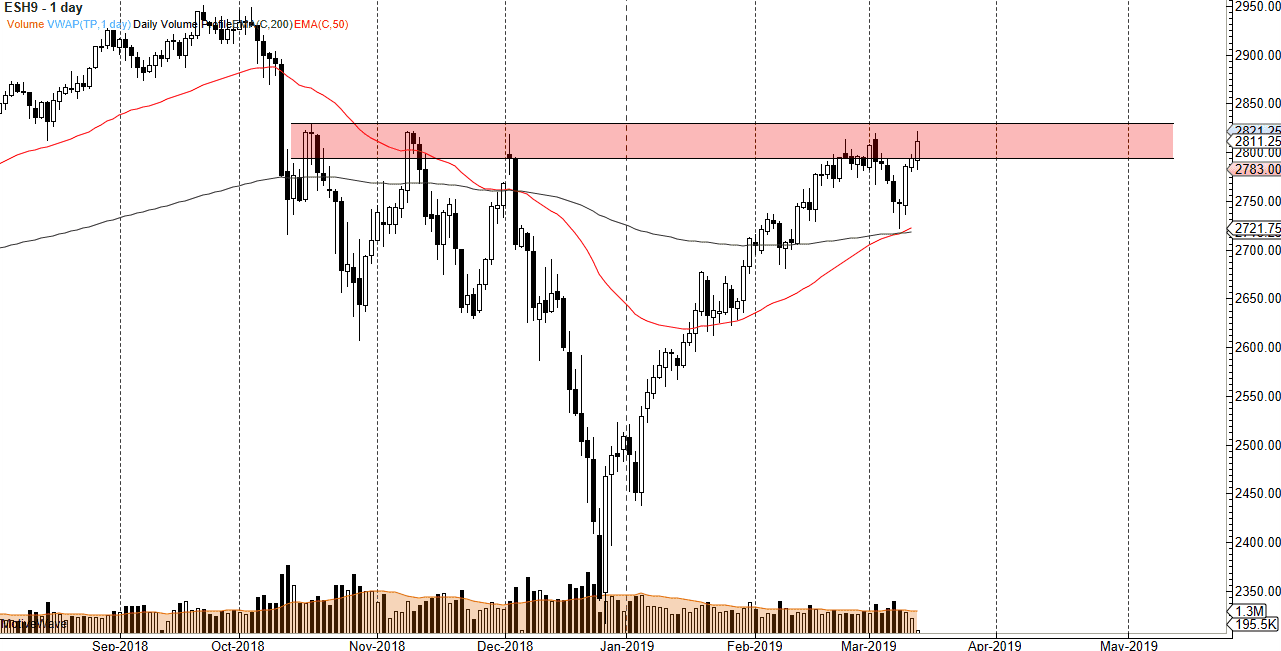

S&P 500

The S&P 500 rallied a bit during the trading session on Wednesday, reaching towards the highs again. We have given back a bit towards the end of the day though, so it shows just how much work there is to be done when it comes to breaking out. I think at this point we are likely to see a short-term pullback but that pullback should be thought of as a potential buying opportunity. As we are closing above the 2800 level, that’s a good sign but really it’s the 2820 region that we need to clear in order to have the “all clear” to go along for a bigger move. If we were to break down below the 2780 handle, we will probably drop to the 2750 level, so keep that alternative scenario in mind.

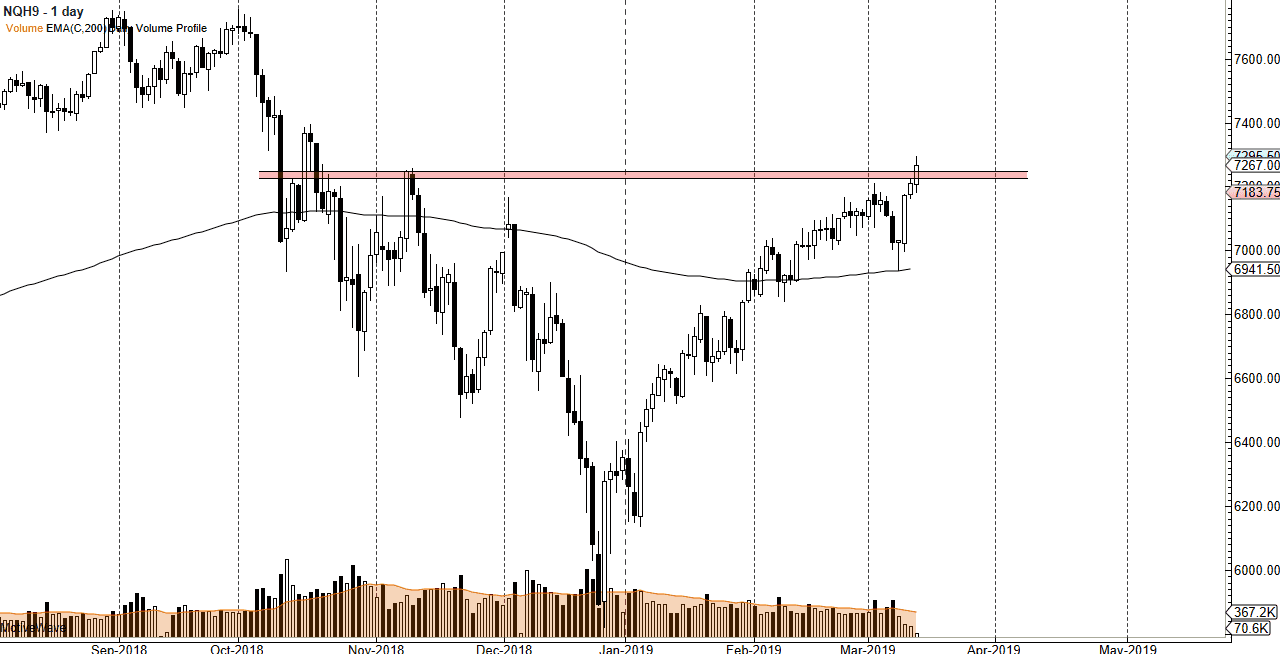

NASDAQ 100

The NASDAQ 100 broke higher during the trading session, clearing a bit of a resistance barrier to go higher. It now looks as if we are probably going to target the 7400 level, but we may need to pull back slightly to test the 7250 level for support on short-term charts. I would be very interested in buying a supportive candle on a shorter timeframe in that area, or a break above the daily candle stick for the Wednesday session. Both of those would be excellent opportunities to go long in aim for the 7400 level above which is the next major area of selling that we have seen in the past.

The alternate scenario is that we break down below the 7100 level. If we do, then we probably crash right back to the 7000 level, possibly even lower than that given enough time. Keep in mind that the 200 day EMA is right around that level though.