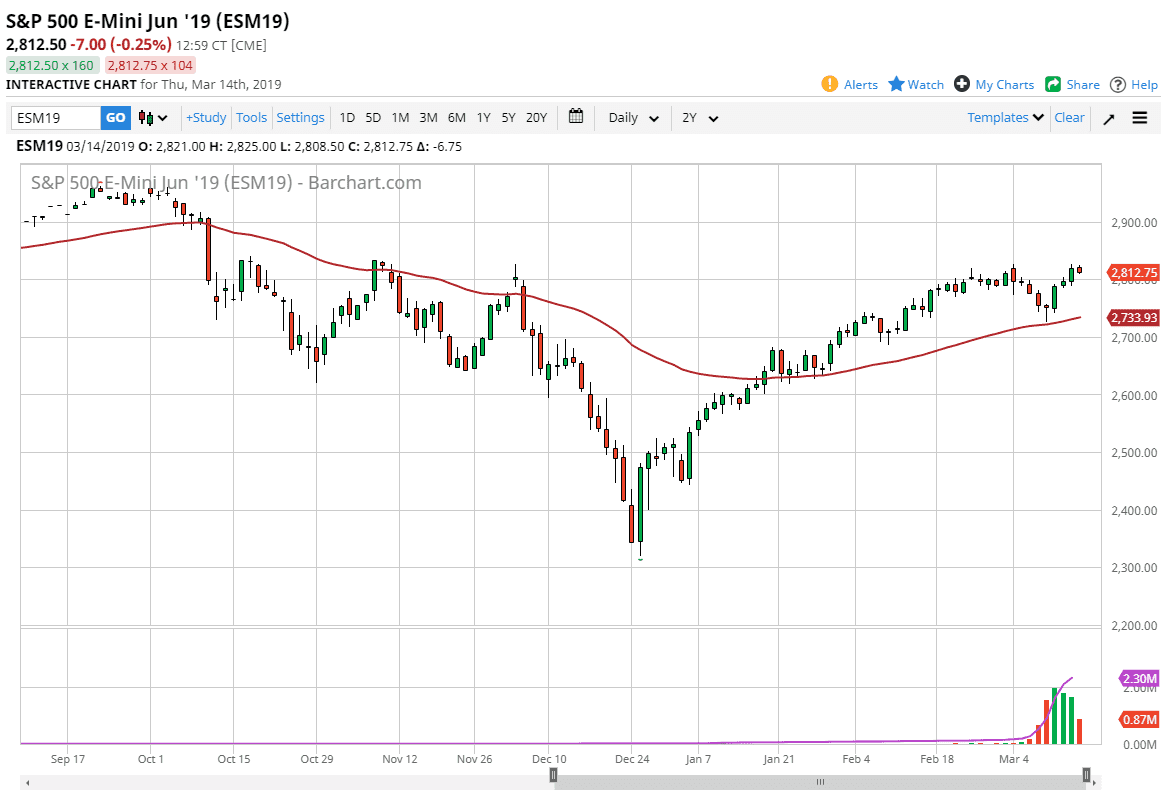

S&P 500

The S&P 500 pulled back slightly during the trading session on Thursday, as we have gotten a bit stretched. However, there is a lot of buying pressure underneath so I think a pullback will probably find a willing buyers given enough time. Overall, I think the 50 day EMA underneath continues to be dynamic support, so I don’t have any interest in trying to short this market and look at any pullback as value.

It should be pointed out that Friday is “quadruple witching”, meaning that there are four asset classes that have options expiration, and those tend to be days that are very difficult to trade. You would be forgiven for standing on the sidelines and looking for lower pricing to pick up on Monday. If we do break out to a fresh, new high, it won’t matter until we break above the 2825 handle.

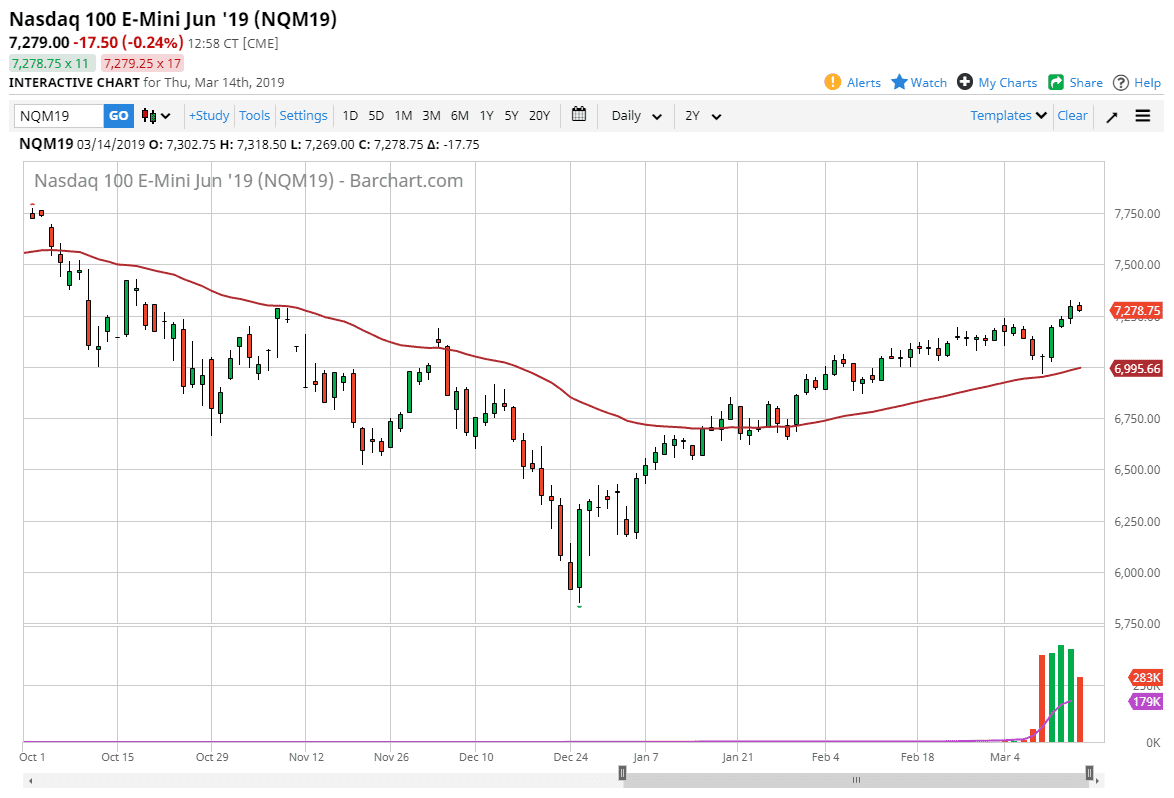

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session as well but then pulled back slightly. The 7250 level underneath should be supportive, just as the 7200 level will be. The 50 day EMA is acting as dynamic support, and the NASDAQ 100 has lead the way for the S&P 500, and therefore I think it will probably be the first to move, driving the market overall. Ultimately, I don’t have any interest in shorting this market, at least not yet as the market has been so resilient over the last several months.

This index is highly sensitive to global trade as most technology companies have exposure to China, so if we get some type of deal between the Americans and the Chinese or at least signs that we are progressing, the NASDAQ 100 will appreciate markedly.