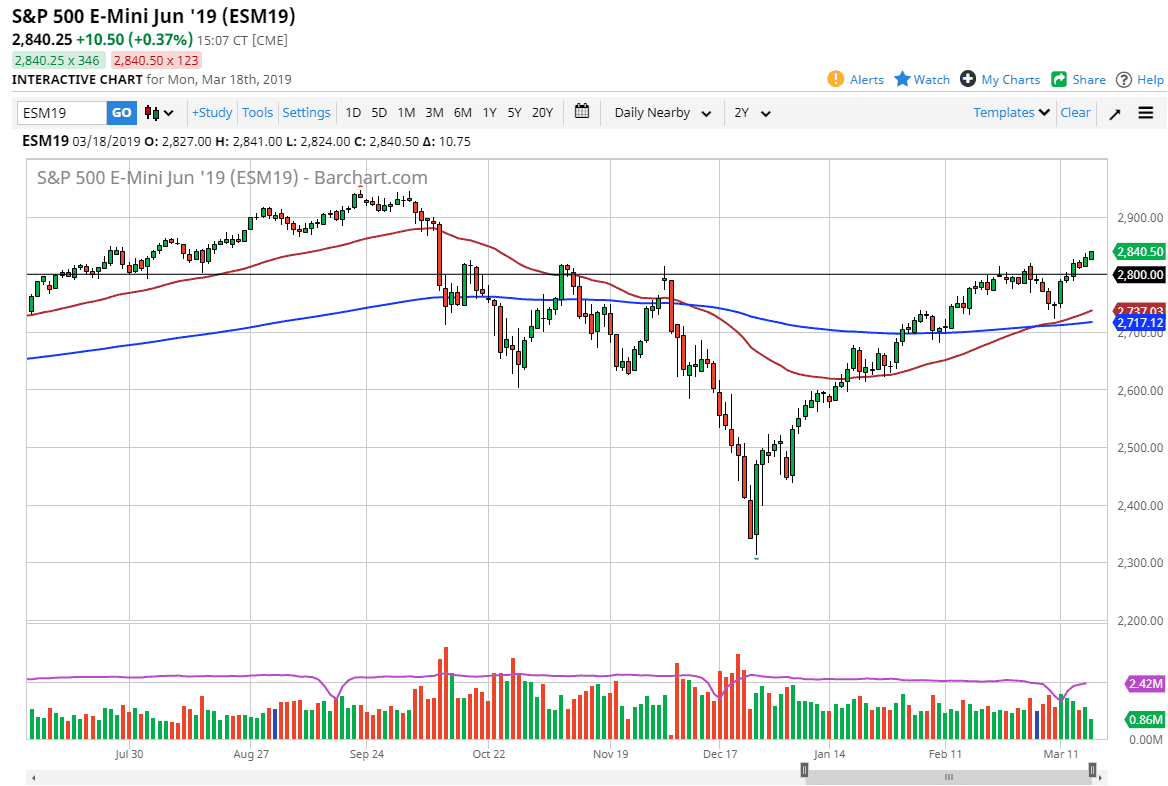

S&P 500

The S&P 500 rallied a bit during the trading session on Monday, breaking to a fresh, new high yet again. As we close at the 2840 handle, that’s a very bullish sign and it looks like we are ready to continue to grind to the upside. In fact, we closed towards the very top of the range for the day, which of course is very strong. Just below, we have the 2800 level that will offer significant support based upon the fact that it is a large come around, psychologically significant number, and of course the scene of a significant resistance barrier. To the upside, I still look at the 2900 region as the targets and therefore I’m going to be looking at shorter-term charts, for opportunities to take advantage of value as they occur.

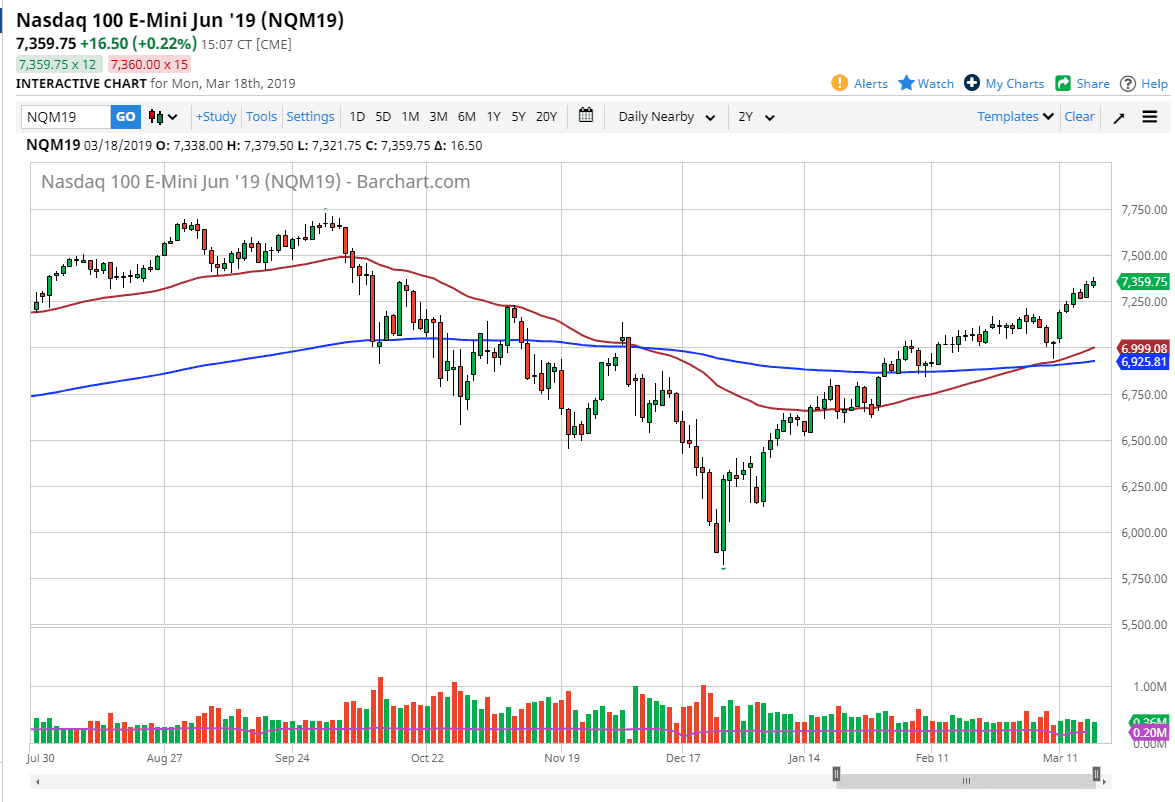

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Monday as well, but then turned around of form a bit of a shooting star. The body is a little bit thicker than a typical shooting star, so I do believe that we continue to go higher. That’s not to say that we will pull back, because quite frankly I think we probably will. Short-term buyers will come back into the market and pick up value as it occurs, and I have no interest in shorting until we break down below the 7250 level, and even then I will have to think about it rather deeply. Look for value, it’s a very good opportunity at this point as we have seen so much in the way of bullish pressure, which of course shouldn’t change as people continue to focus on the Federal Reserve and the fact that they are developing a loose monetary policy.