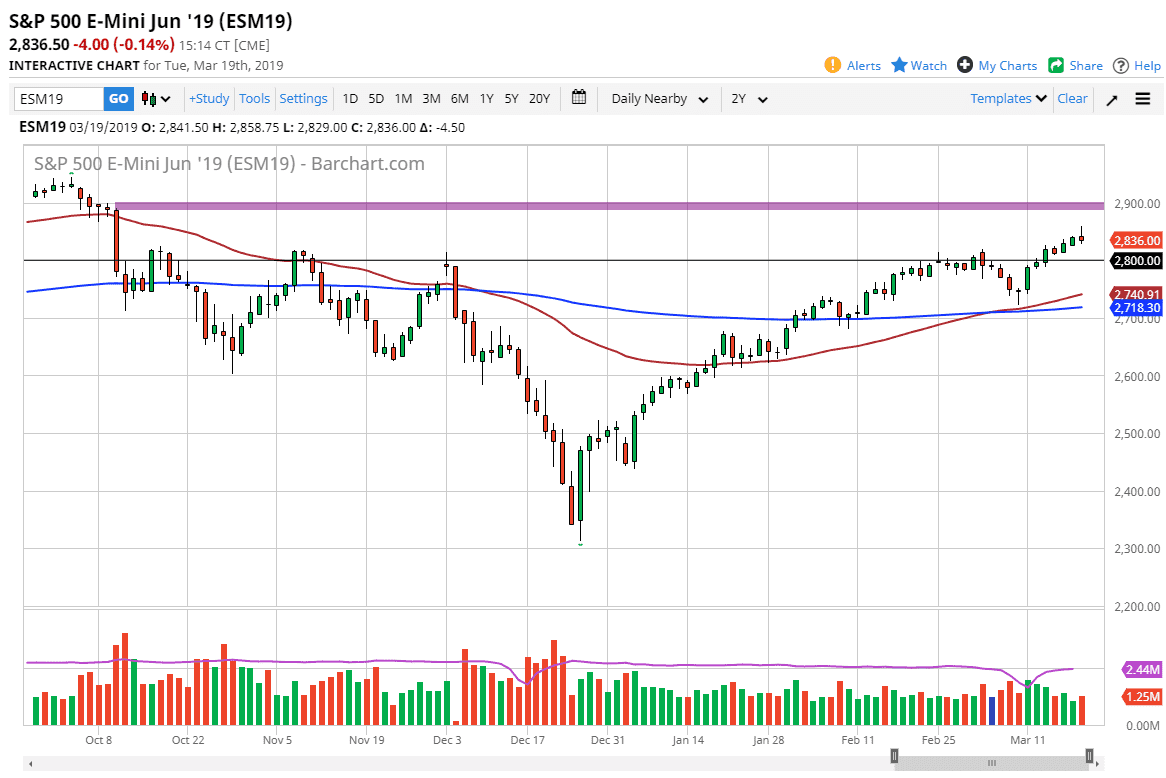

S&P 500

The S&P 500 tried to rally during the trading session on Tuesday but gave back the gains to form a shooting star. This is obviously a very negative sign, but at this point I’m not ready to start shorting the S&P 500. Overall, this is a market that is very bullish, but it may be a bit exhausted. Beyond that, we also have a problem in the form of the Federal Reserve during the trading session on Wednesday, and of course the statement that they will put out. The market is looking to see whether or not the Federal Reserve mentions any potential rate hikes towards the end of the year, and if we get the “all clear” for 2019, it’s likely that the stock markets will celebrate. In the short term, I think that were going to see a little bit of a pullback but I see the 2800 level as massive support.

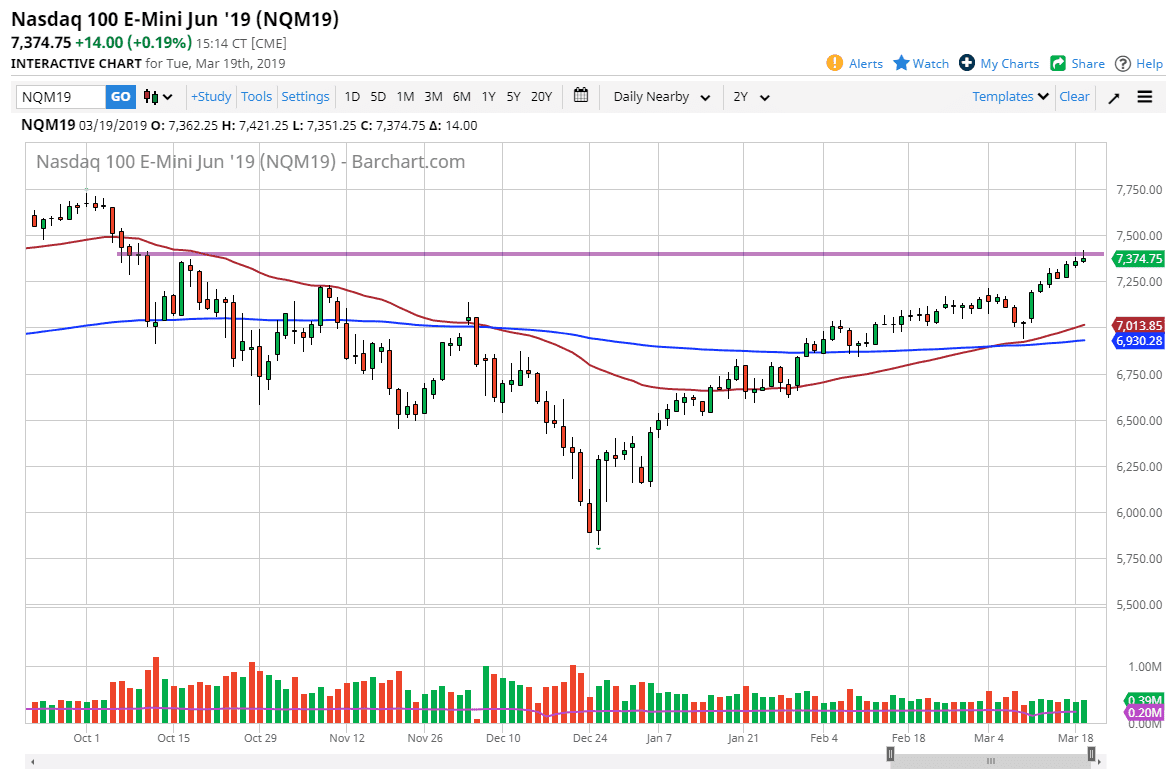

NASDAQ 100

The NASDAQ 100 also formed a bit of a shooting star as we are approaching a significant resistance barrier in the form of the 7500 level. The NASDAQ 100 has lead the way for the stock markets in general though, so I suspect that if we get a pullback, it’s very likely that the NASDAQ 100 will bounce before the S&P 500, or possibly even the Russell 2000. Looking at the chart, I think that the 7250 level will offer a significant amount of support, as we have seen that be an area that caused a significant amount of resistance.

The alternate scenario in this market, or the S&P 500 for that matter, is that we break above the top of the shooting star. That would obviously be very bullish and a sign of extreme strength.