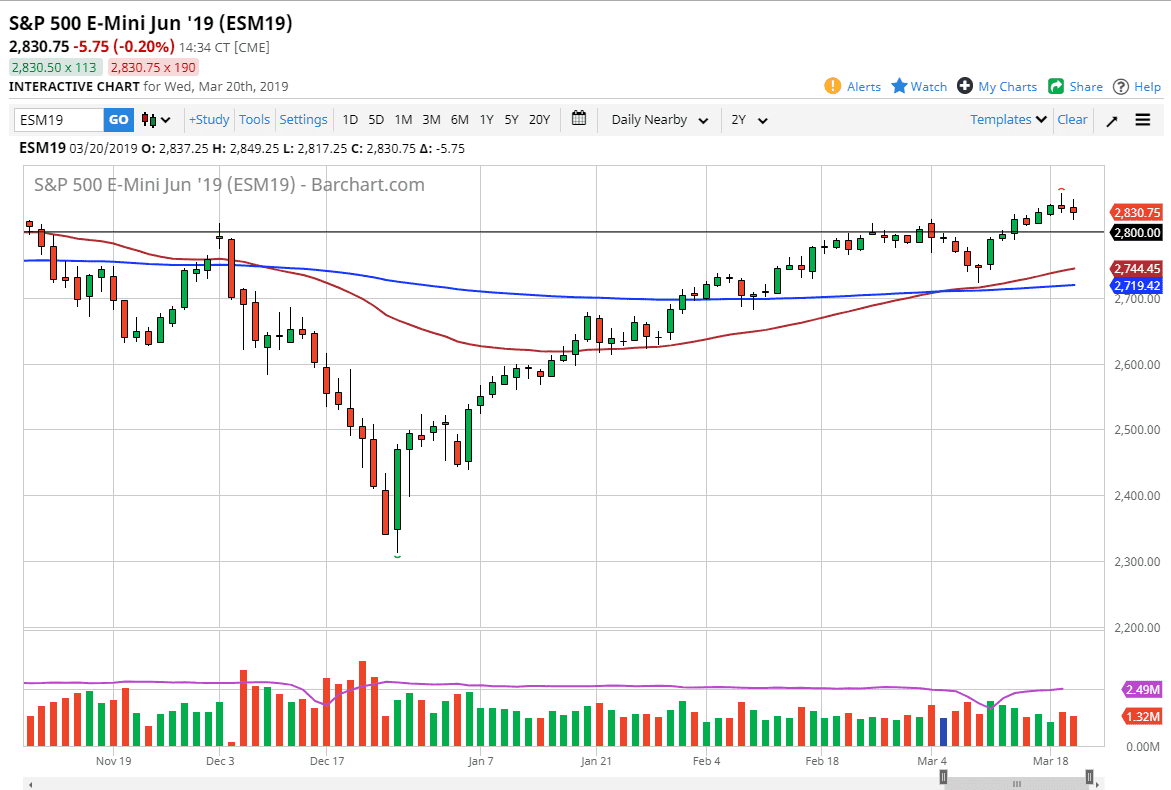

S&P 500

The S&P 500 had a choppy and wild day as the Federal Reserve released its interest rate decision. The most important thing that was stated is that there will be no interest rate hikes this year, and that of course is good for the market. However, by the end of the day we were slightly negative and that tells me that perhaps people are concerned about whether or not the there are bigger concerns with the economy. At the end of the day, not much was settled so I would assume that the longer-term uptrend continues, with 2800 offering support underneath. Ultimately, this is a market that you should probably take advantage of value when it occurs, with pullbacks offering an opportunity to pick up the market “on the cheap.” All things being equal, it’s very likely that we will continue to see the uptrend continues, as we reach towards the 2900 level.

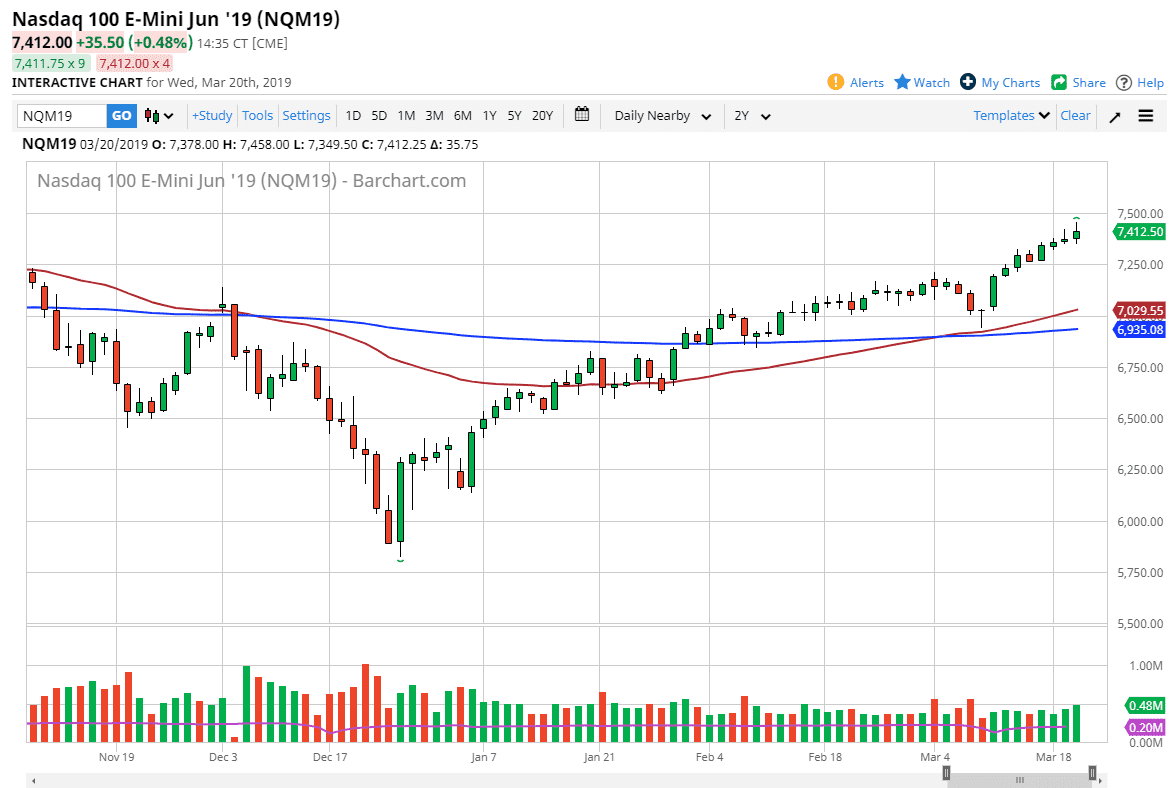

NASDAQ 100

The NASDAQ 100 did little bit better, closing out the day in the green. That being the case, it looks like the one thing that is keep in the market down a bit is the 7500 level, but I do think that we will eventually get to that level, and then perhaps break out. It is going to be a scenario where we are looking at a potential break out and melt up, but in the short term it would not surprise me at all to see a little bit of a pullback, with the 7250 level offering a bit of a “floor” in the market, and as a result it’s not until we break down below there that I reconsider the uptrend. The NASDAQ 100 has been a leader, and I expect that will continue to be the case.