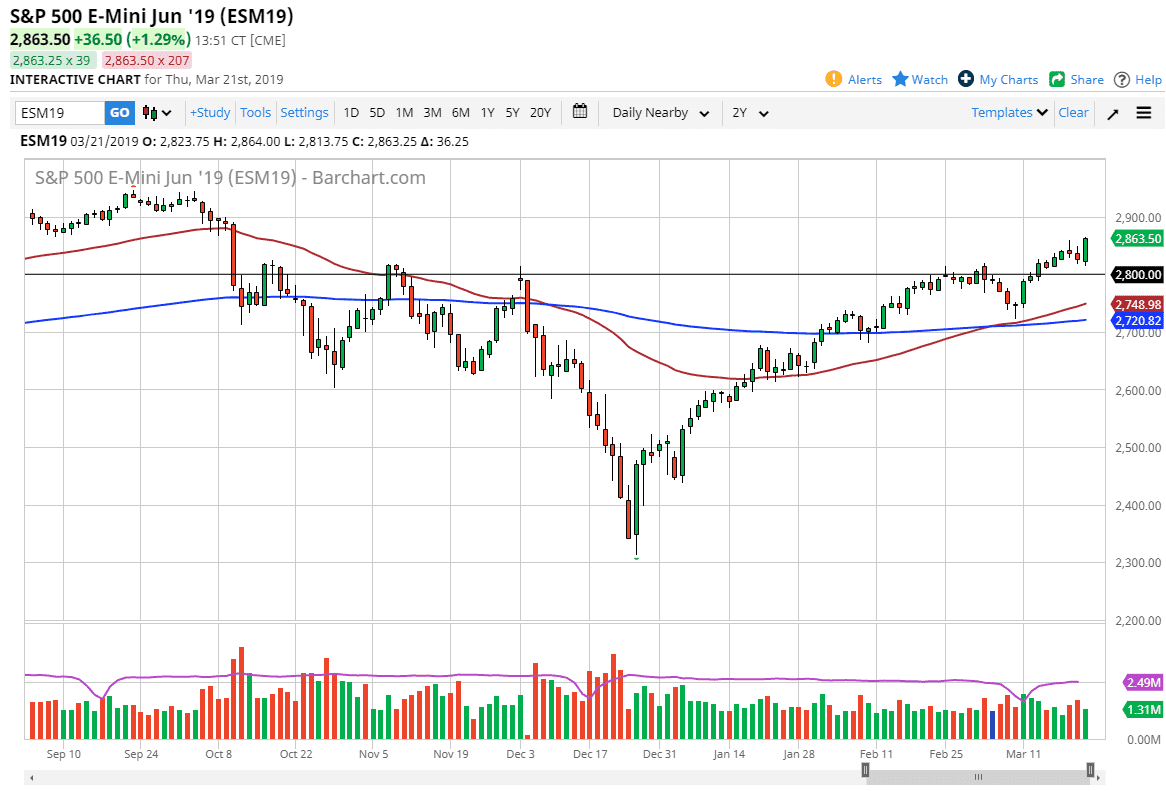

S&P 500

The S&P 500 shot straight up in the air during the trading session on Thursday, after initially selling off during the Globex session. The market has rallied enough to wipe out the last couple of shooting stars on the daily chart, so that’s obviously a very bullish sign. The 2860 level has been captured, which of course is a very bullish sign. At this point, short-term charts should give us opportunities to pick up the S&P 500 “on the cheap.” Short-term pullbacks will be thought of as buying opportunities as I think we are trying to roll up enough momentum to go looking towards the 2900 level.

The 2800 level is significant support, as it was previous resistance. At this point, the fact that we have formed a bullish outside candle tells me that the buyers are still very much in control, so I’m looking at buying only, and have no interest in shorting.

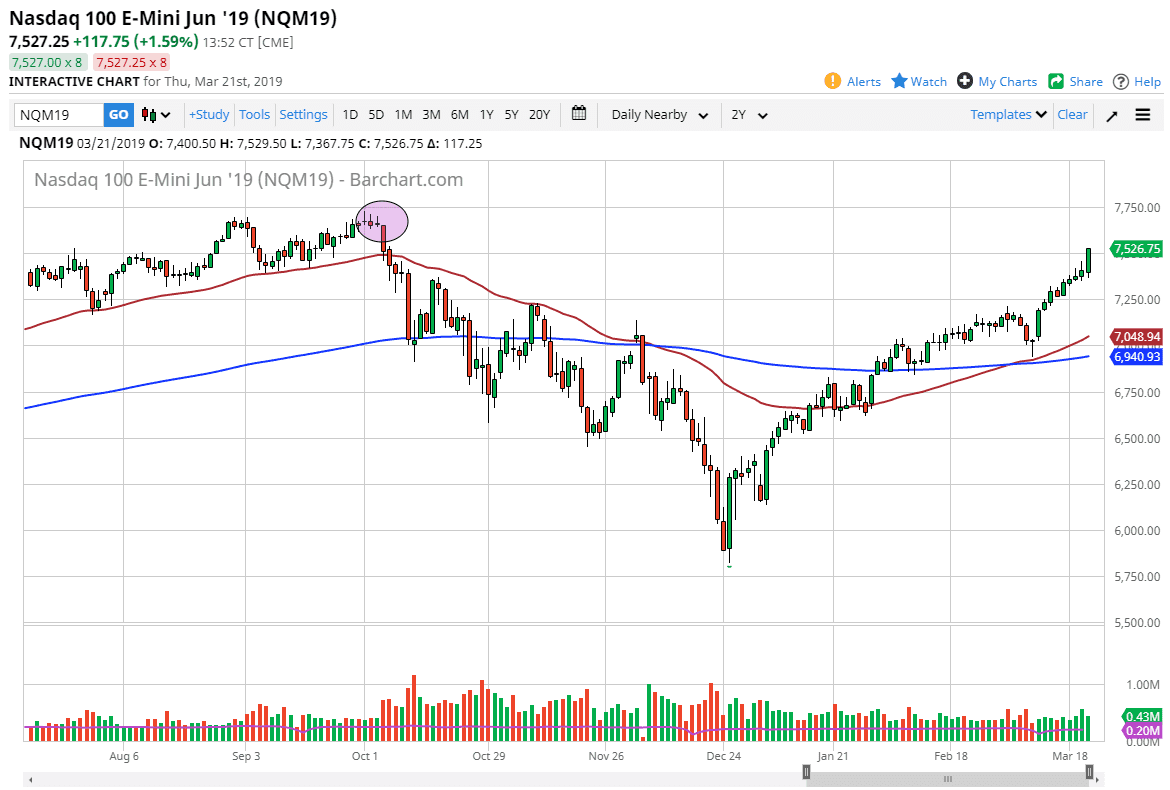

NASDAQ 100

The NASDAQ 100 broke higher during the trading session, wiping out the top of the two shooting stars from the past couple of daily candles. We are now above the 7500 level, so it looks very likely that we are going to continue to go higher. Short-term pullbacks should be thought of as buying opportunities, as we are in a situation that we are approaching major resistance. The 7250 level underneath should offer significant support as well, so this point I think that the NASDAQ 100 is a “buy on the dips” scenario going forward, and therefore I have no interest in shorting. If we can get some type of good resolution between the US and China, that will be extraordinarily bullish for this market.