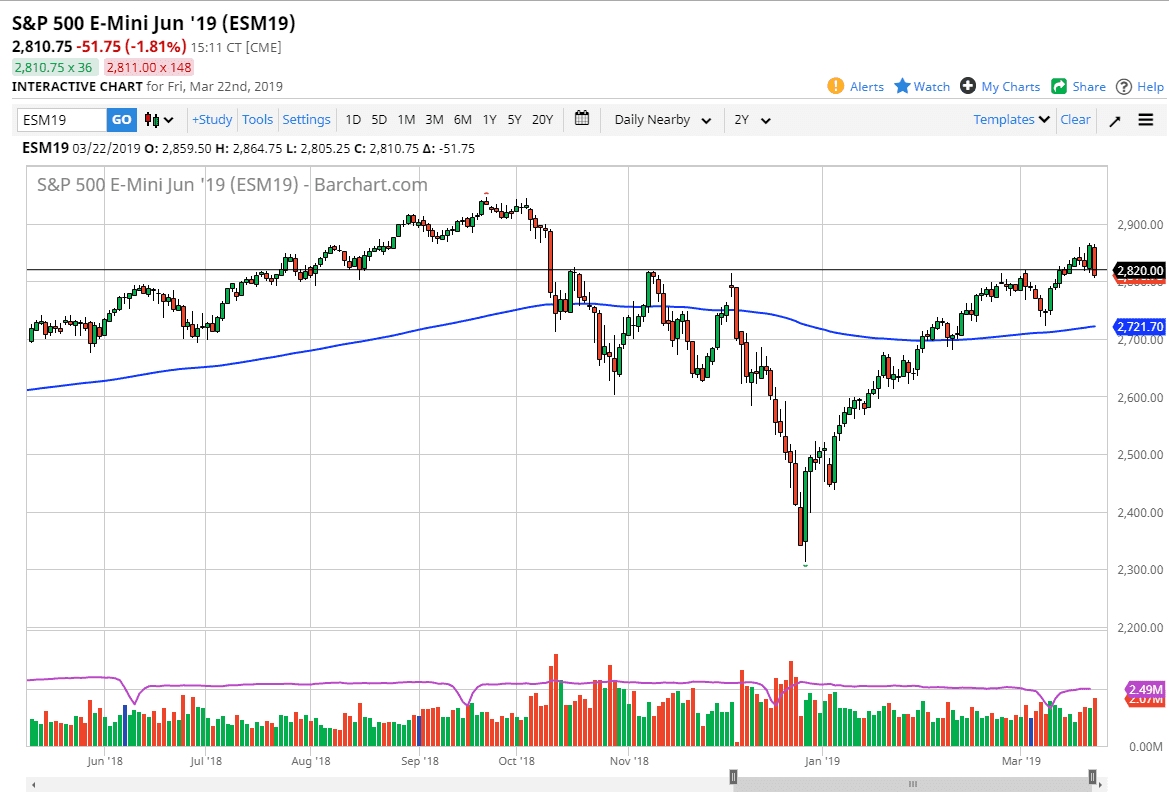

S&P 500

The S&P 500 had a rough day on Friday, losing almost 2% at one point. The recession fears continue to extend going forward, as we got poor economic figures out of the United States and Germany. With that being the case, we have formed a very bearish candle stick, but we are sitting above a significant support at the same time. At this point, it’s probably best to sit on the sidelines and let the market tell you what it is going to do next, and then react accordingly.

I suspect that we could go looking for buyers underneath, so therefore I am still somewhat bullish but recognize that these pullbacks could represent a nice buying opportunity if you are patient enough. However, we are probably going to have a rough couple of days. Even though we have a very negative candle stick for Friday, I’m not quite ready to start shorting yet.

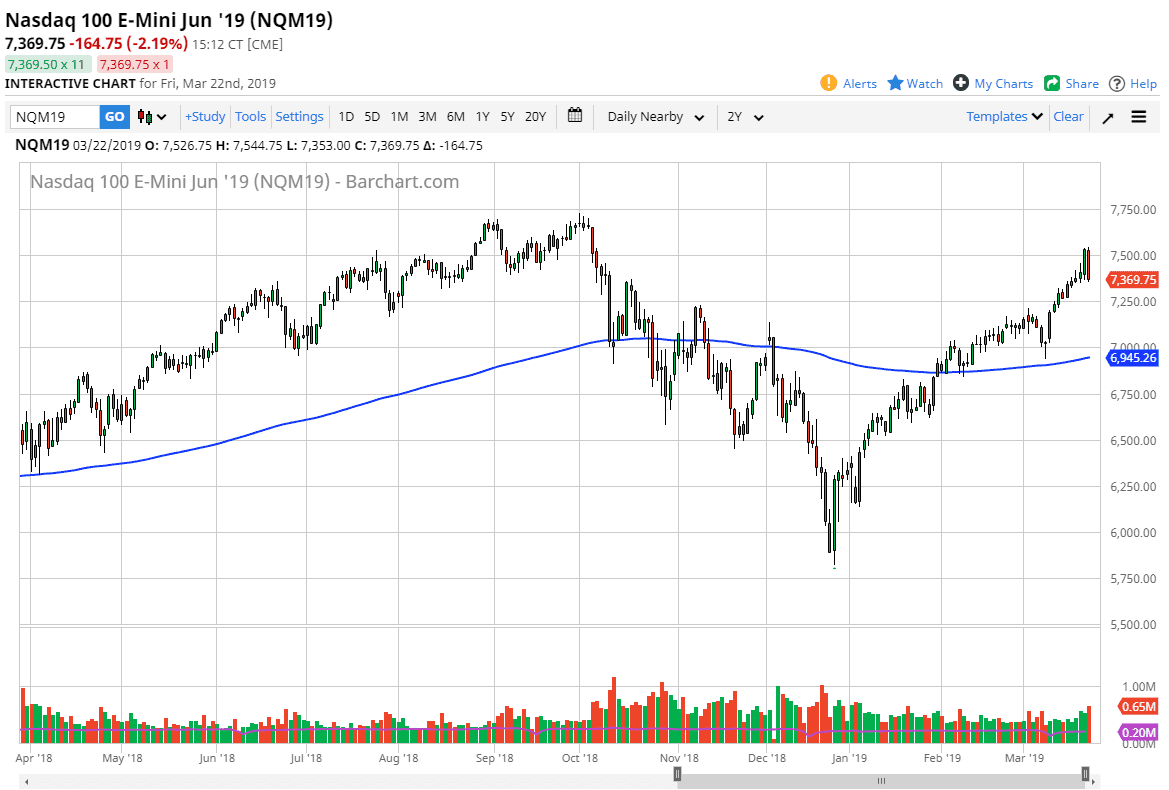

NASDAQ 100

The NASDAQ 100 fell during the trading session as well, wiping out the gains from the previous session. I suspect we probably have a significant amount of support near the 7250 level, so I’m more than willing to buy this market down there on some type of supportive candle stick or bounce. If we break down below that area, it would of course be a very negative sign and could send the NASDAQ 100 looking towards the next support level in the form of the 7000 handle.

Remember that the NASDAQ 100 has been leading the S&P 500 lately, and I don’t expect that’s going to change in the short term. Overall, I like buying dips but if we did break down below the 7000 level, then I have to start to reevaluate the entire situation.