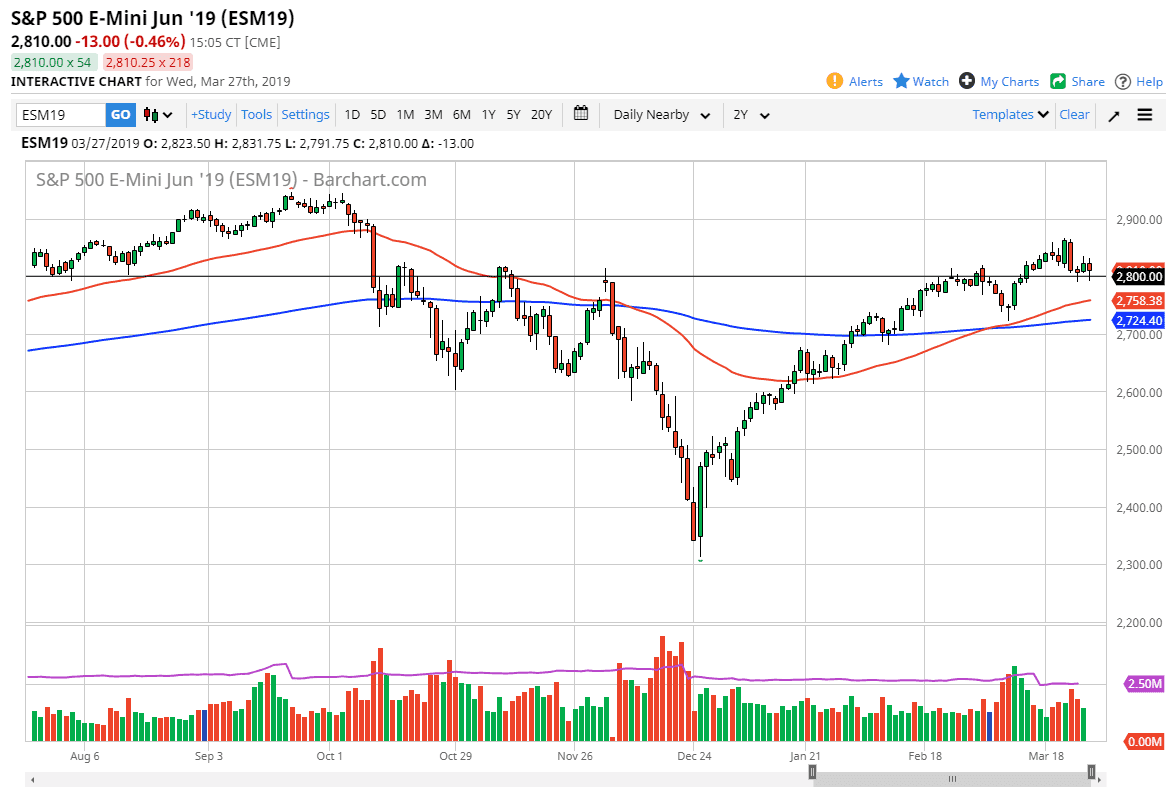

S&P 500

The S&P 500 initially pulled back during trading on Wednesday but found enough support yet again at the 2800 level to turn around and show signs of bullishness. We ended up forming a hammer for the trading session, which of course is a very strong sign indeed.

That being the case, it appears that the 2790 level continues to offer major support. At this point, I think that short-term pulling back offers short-term buying opportunities. If we break down below the 2790 handle, then it’s likely that we probably go looking towards the 50 day EMA which is pictured in red on the chart. To the upside, we could go looking towards the highs again, which is closer to the 2860 handle. One thing is for sure, it’s going to continue to be very volatile in this market but seems to be somewhat resilient.

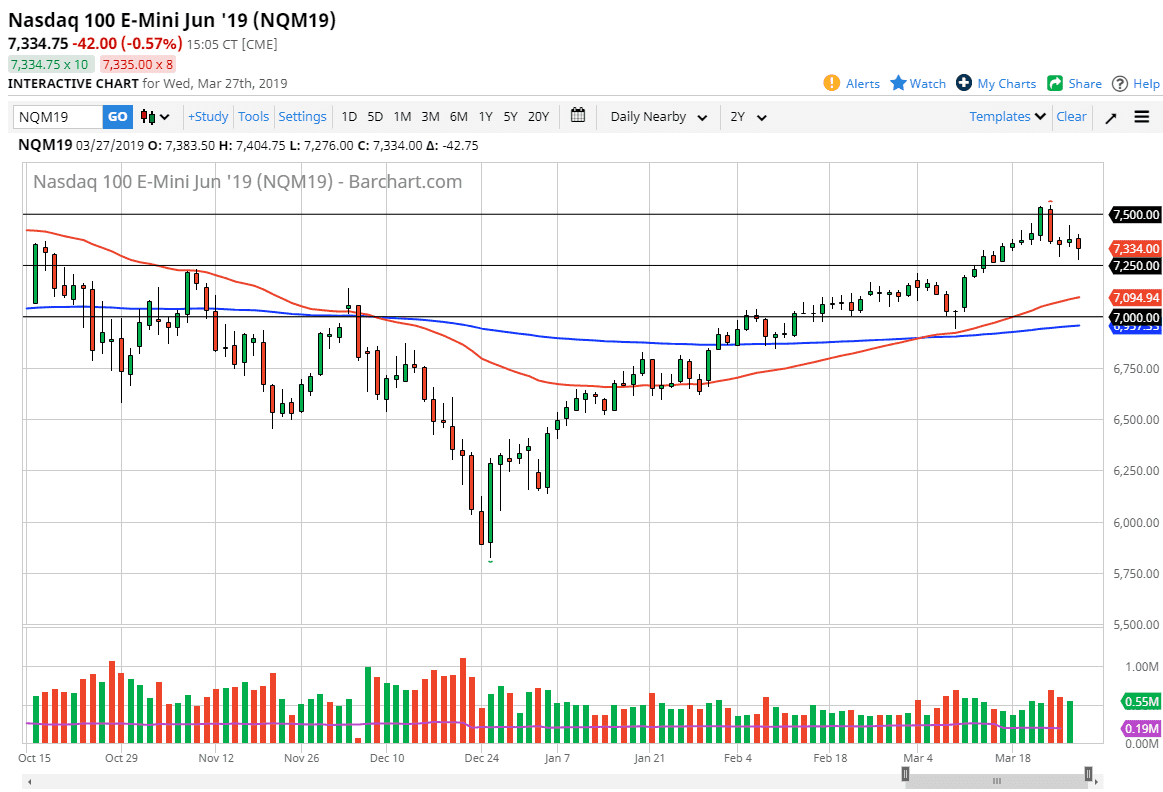

NASDAQ 100

The NASDAQ 100 initially fell during the trading session as well but has bounced from just above the 7250 level yet again. We have turned around of form a hammer which flies in the face of the shooting star from the previous session. At this point, I’m using 7250 as the “floor” of the market, and short-term pullbacks should be buying opportunities. I have no interest in trying to short this market, and I think that as long as we can stay above that level it’s probably easier to buy this market than it is to sell it. That being said, keep an eye out for a move below the 7250 level because it could open up a move down to the 50 day EMA. If we do continue to find buyers I anticipate that eventually we will go looking towards the 7500 level again.