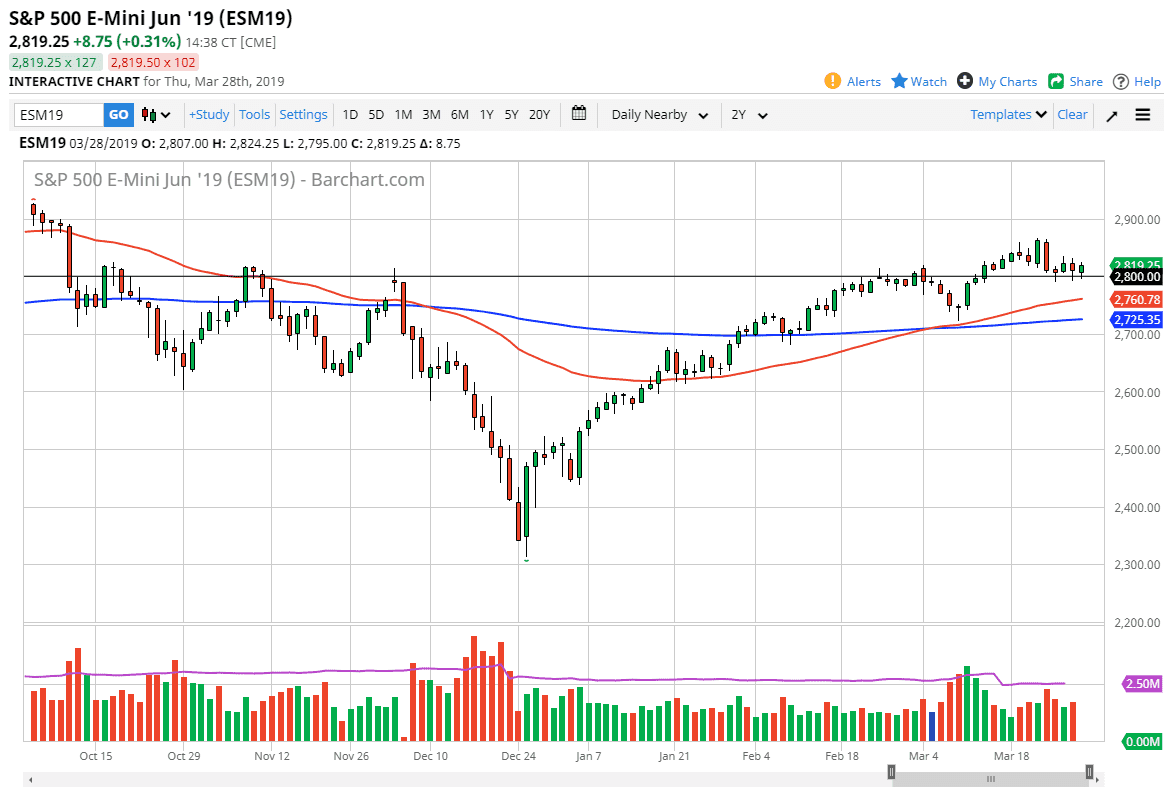

S&P 500

The S&P 500 has had an interesting session, initially trying to dip below the 2800 level but then broke higher as the massive support just below that level continues to hold. At this point, it looks as if we are in fact killing time, perhaps trying to find some type of reason to break out to the upside. It’s obvious to me that there is a ton of support near the 2790 handle, so therefore I’m more than willing to buy that dip when it occurs on short-term charts.

To the upside I see a lot of resistance at 2860, just as it was the most recent high. If we can break above there then it opens up the door towards the 2900 level. If we were to break down below 2790, then we could see a move towards the 2760 level which is where the 50 day EMA currently resides. Regardless, this is a market that seems to have more of an upward proclivity.

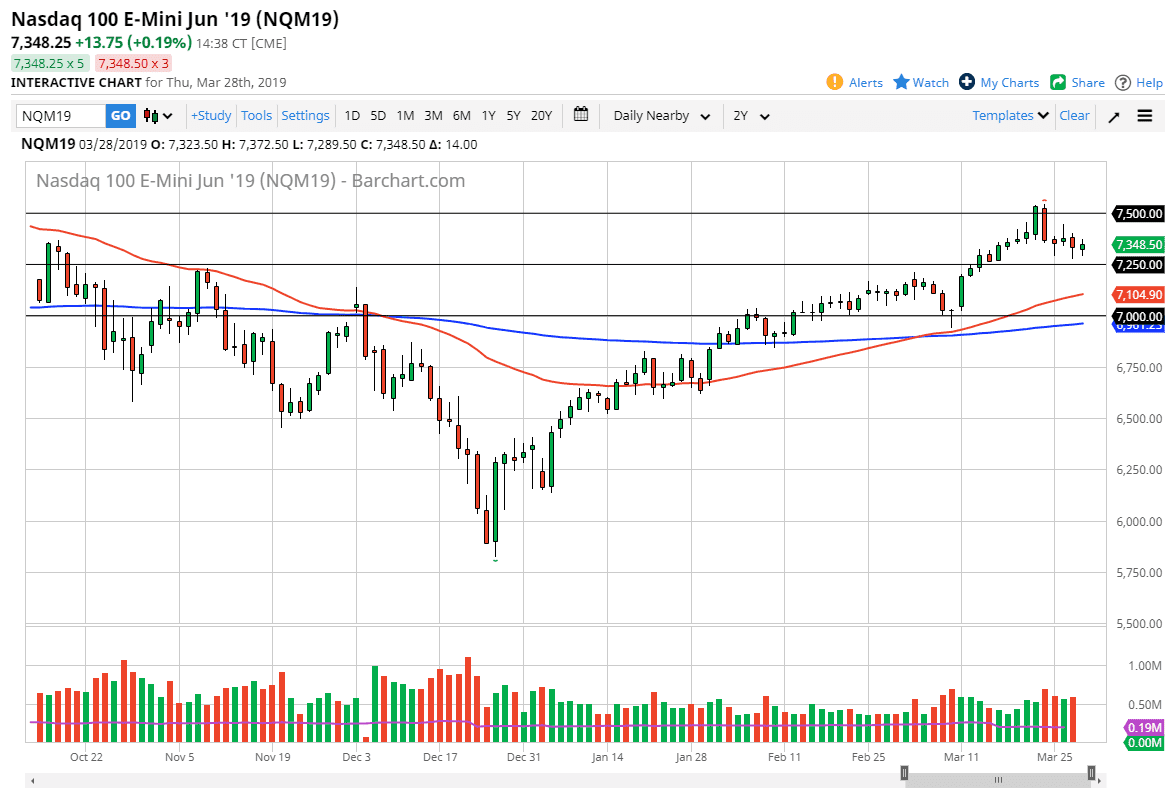

NASDAQ 100

The NASDAQ 100 also pulled back a bit during the day only to recover a bit later on. It looks as if the 7250 level continues to be support, and of course the 7500 level above there continues to be resistance. We are closer to the bottom so it makes sense that there are a lot of value hunters down here. If we did break down below the 7250 level then I think we go looking towards the 7100 level, but at this point in time the resiliency of the buyers can’t be ignored. This means that buying on the dips is probably going to remain the best way to play this market, at least from a shorter-term perspective.