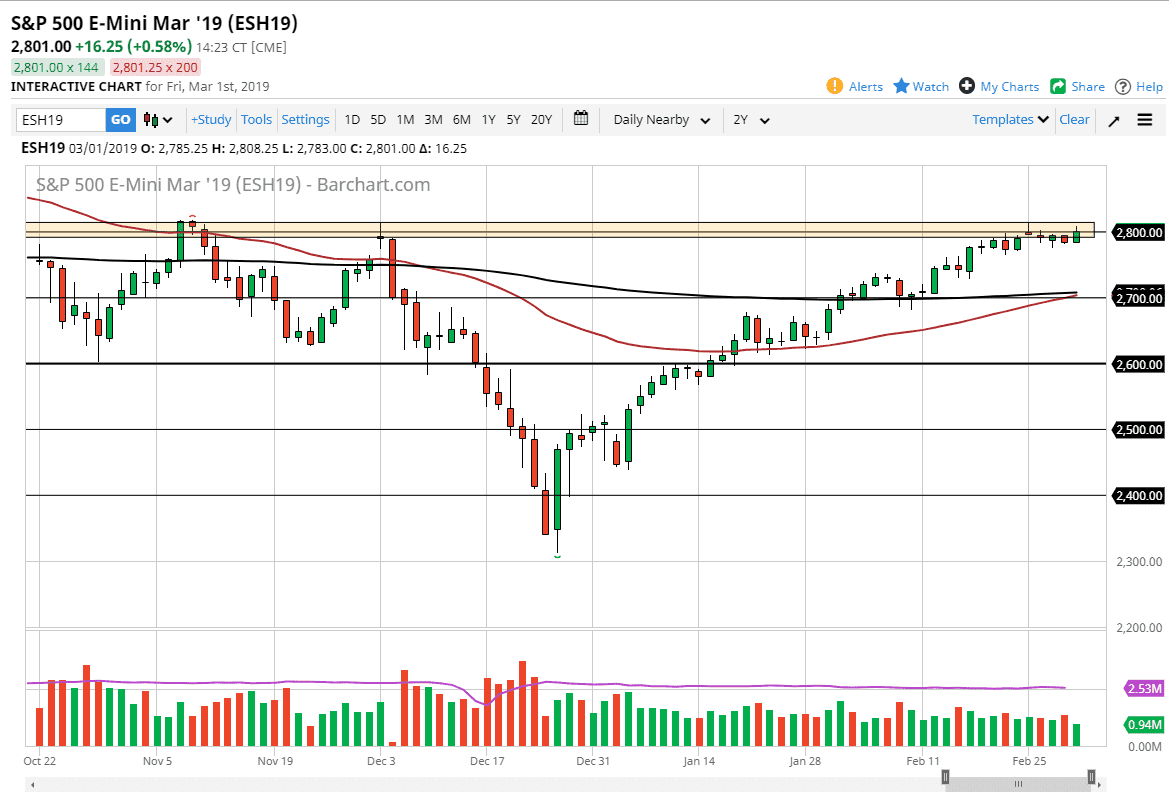

S&P 500

The S&P 500 rallied during the trading session on Friday, although it has been a very rocky trading session. The 2800 level continues to be a magnet for resistance, and it’s not until we break above the 2820 handle that it’s likely we will have the “all clear” to continue going higher. That being said, and the fact that there is a massive amount of resistance there, you would think that the market would have melted down by now. However, we haven’t. In fact, unlike the three previous times we reached towards the 2800 level, we have not pulled back in a knee-jerk reaction. This suggests that perhaps there are buyers under this area that should continue to press the issue. It isn’t that I think it’s time to start buying, it’s more like I’m a bit cautious about shortening until we get a very negative candle.

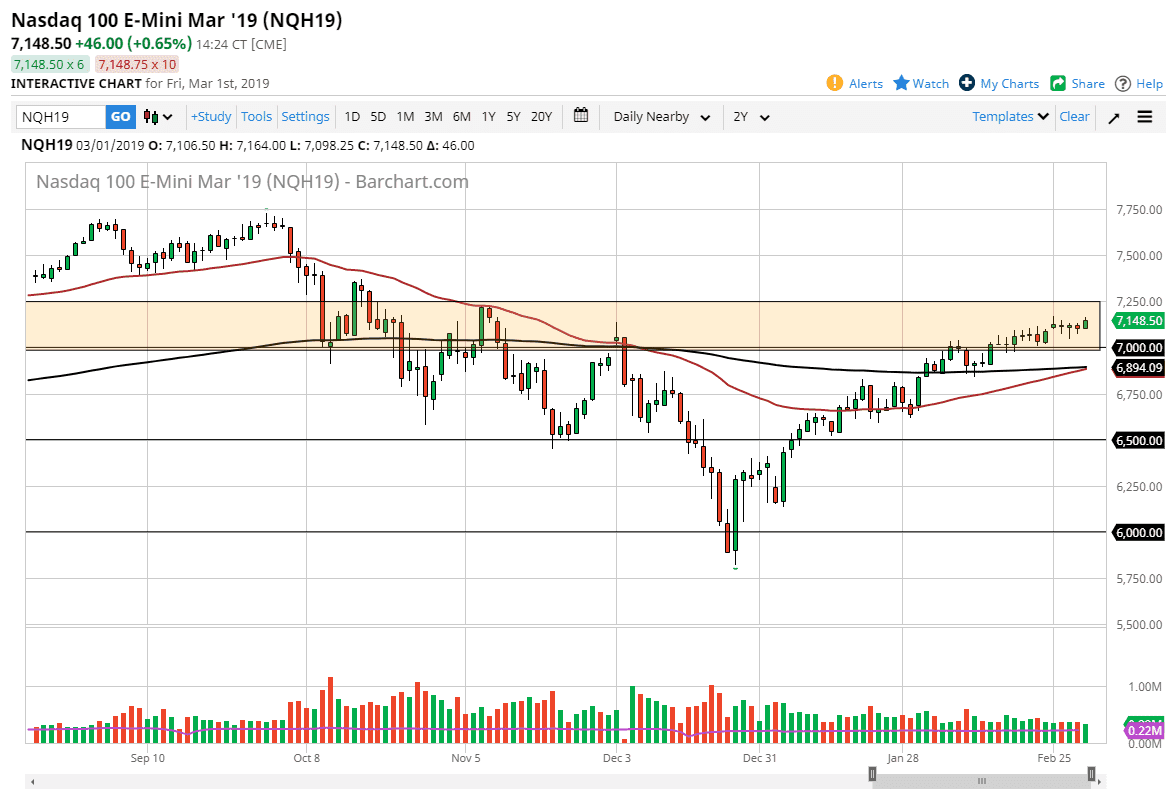

NASDAQ 100

The NASDAQ 100 has also rallied during the session on Friday, as we continue to see a lot of noise just above. However, the NASDAQ 100 looks like it is trying to lead stock markets higher overall. At this point, I believe that buying dips probably continues to work, and it’s not until we break down below the 7000 level that I could consider selling. Overall, I don’t necessarily think that it’s an easy market to start buying, but I see nothing on this chart that tells me it’s time to start selling. In fact, I suspect that we will more than likely see this market pull the S&P 500 up with it at this point. However, if we break down below the 7000 handle, then the market will probably go down to the 200 day EMA.