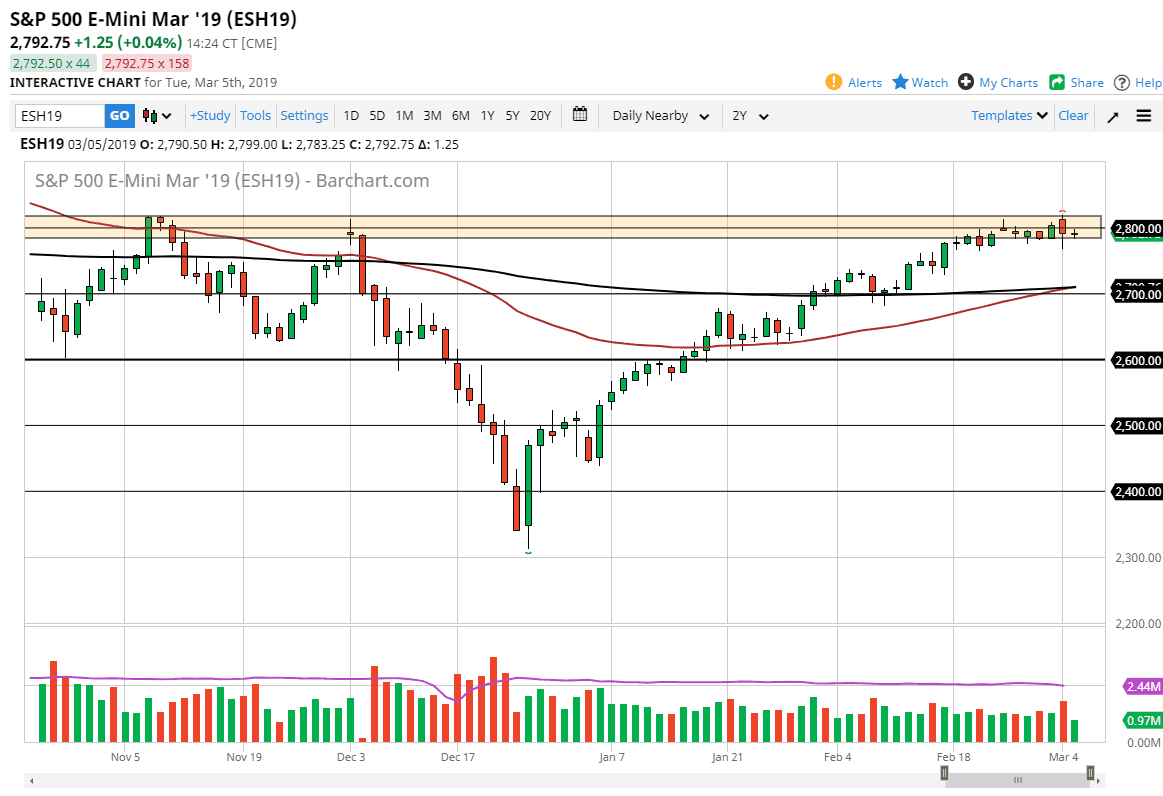

S&P 500

The S&P 500 went back and forth during trading on Tuesday in a very lackluster session. The 2800 level has offered rather significant resistance, but to be honest the downside was relatively limited as well. Looking at the bigger picture, the fact that we are hanging about this level without selling off drastically tells me that people are relatively comfortable with the S&P 500. I suspect that selloffs are going to end up being buying opportunities, unless of course we were to break down below the 200 day EMA, pictured in black on the chart. That being said, it doesn’t mean were ready to go higher in the short term. If we can break above the 2825 level, then it’s possible that we may continue to grind even higher, perhaps the 2900 level. For what it’s worth, we are starting to get the “golden cross” on the S&P 500 near the 2700 level.

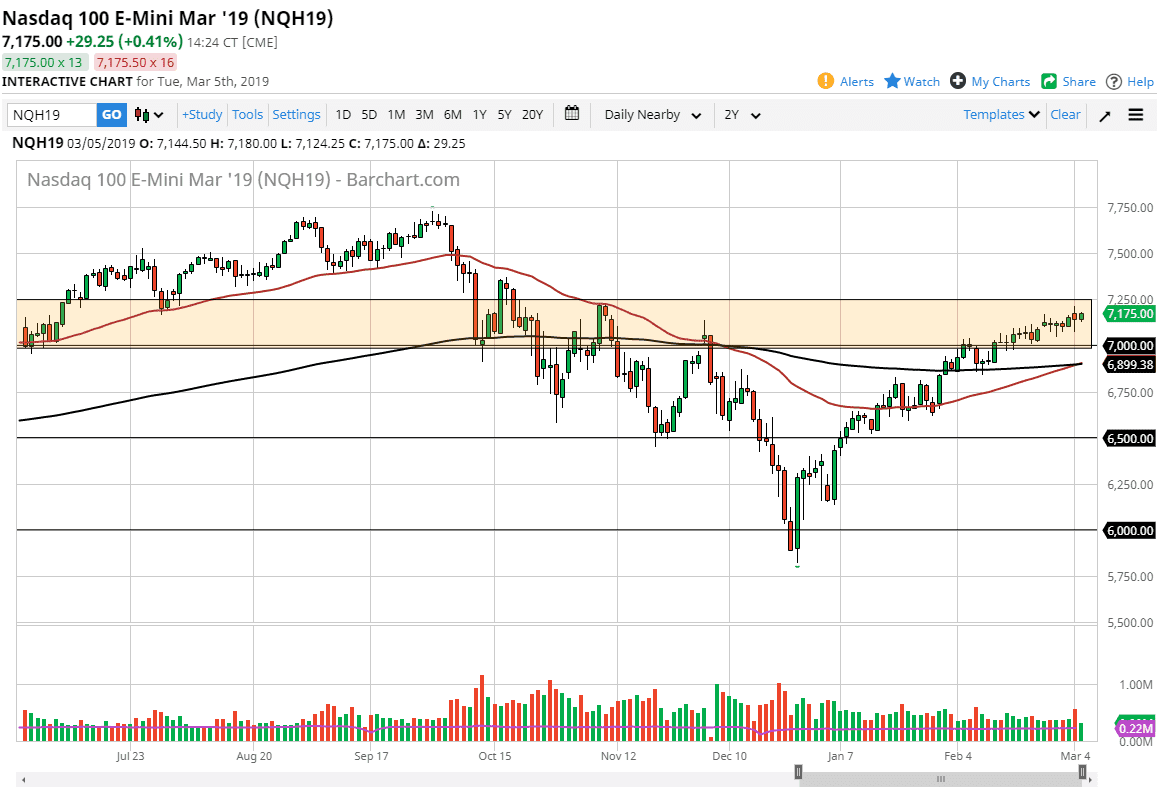

NASDAQ 100

NASDAQ 100 traders rally during the trading session on Tuesday, as we continue to grind higher. The 7250 level above is significant resistance, so if we can break above there I think the NASDAQ 100 can continue to go much higher. Short-term pullbacks should continue to be buying opportunities, especially if we can stay above the 7000 handle. I believe that the “golden cross” that we see forming underneath is yet another sign to think that longer-term traders are starting to throw money back into this. Looking at this chart, I don’t have any interest in shorting until we get some type of negative news out of the US/China trade negotiations, or perhaps some type of horrific jobs number on Friday. Otherwise, it’s a “buy on the dips” scenario.