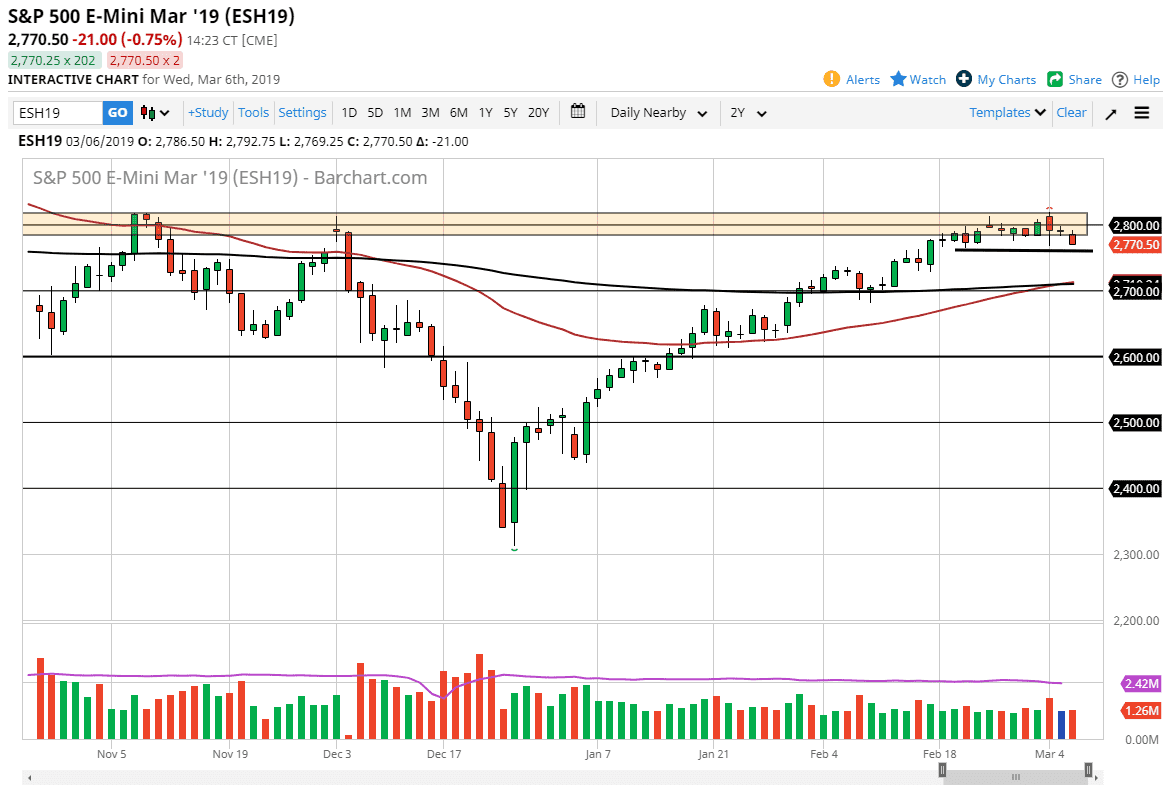

S&P 500

The S&P 500 initially tried to rally during the trading session on Wednesday, but then rolled over significantly, especially late in the day. That in general is a negative sign, but at the same time we have significant support just below that has held several times. While this candlestick is not a good look, the reality is that we haven’t broken out of any particularly significant area. If we do break down below the 2765 handle, then we could drift a little bit lower. I think the market during the day focused more on the very poor inventory numbers for crude oil than anything else. This could be a sign of severe slowing in the economy, but with the jobs number coming out on Friday that’s probably going to have more influence on the next bigger move. Although we have seen some negativity show itself during the day on Wednesday, it’s not time to start selling quite yet.

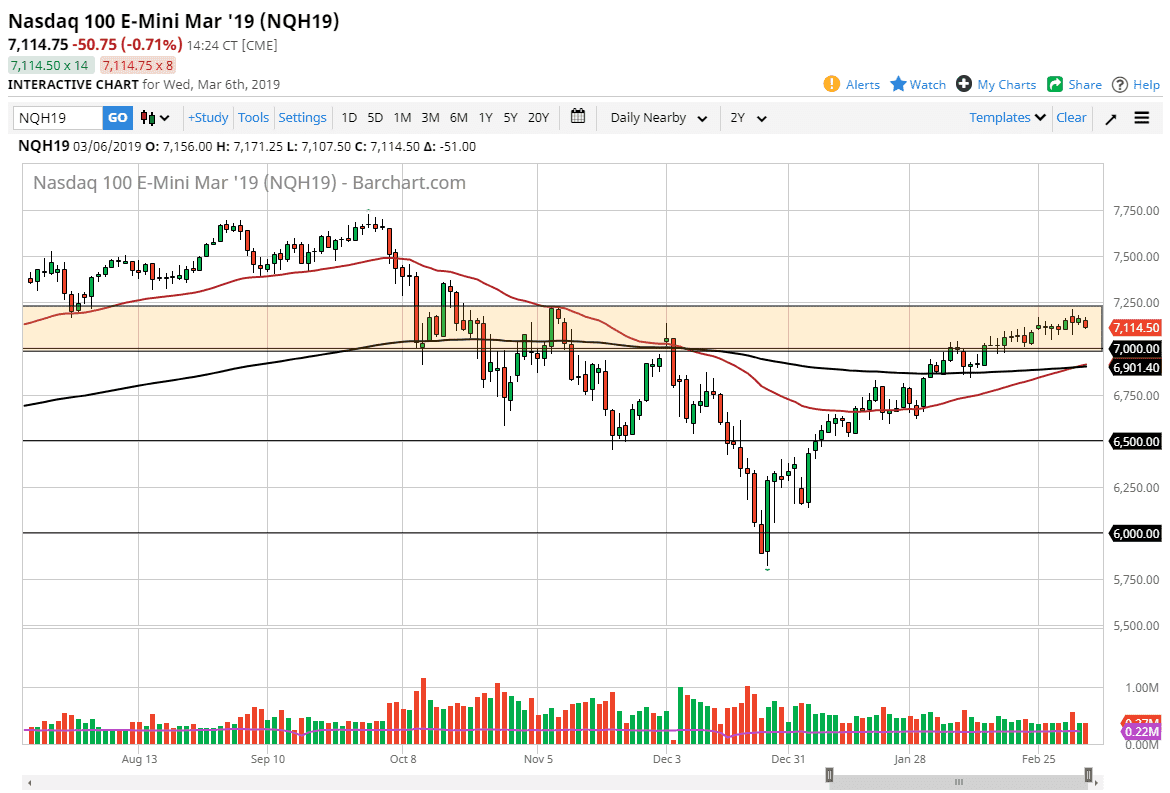

NASDAQ 100

The NASDAQ 100 rolled over a bit during the day as well, but we certainly have seen more strength in this market than the S&P 500, so I think it will be the leader as to whether we can go higher or not. There seems to be a significant amount of support down at the 7000 handle, so it’s very likely that we will see buyers show up in that area if we get a short-term pullback. Keep in mind that this market is highly sensitive to the US/China trade relations. At this point, a little bit of a pullback could make sense, but there is a significant amount of buying pressure underneath. That being said, we have just completed a “golden cross”, so all we need is a little bit of good news to push towards the 7250 handle, and perhaps break out yet again.