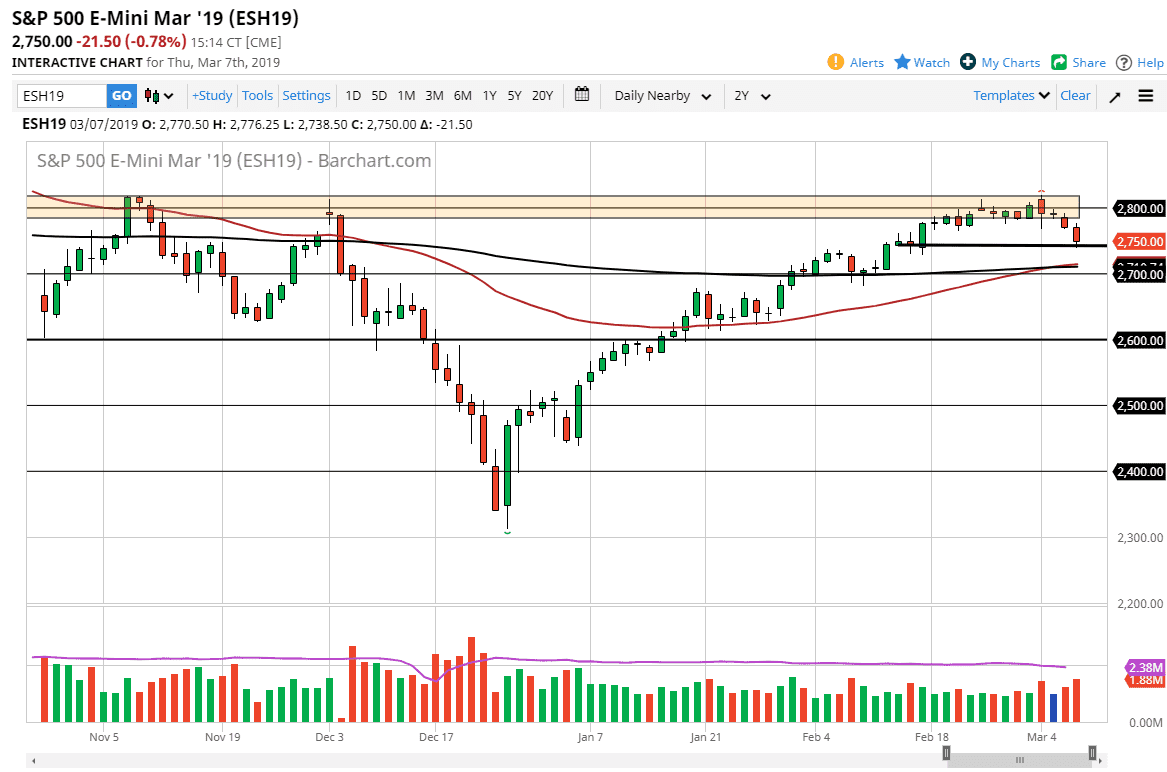

S&P 500

The S&P 500 broke down significantly during the trading session on Thursday as we may have gotten a bit over stretch, and of course the ECB President suggested that global growth was going to struggle in general, but unfortunately New York traders saw that as a sign that the world was falling apart. At this point though, is very likely that we are going to continue to see a lot of volatility mainly because not only of the words of Mario Draghi, but now we have the jobs number coming in focus. That being the case, it’s very likely that we are going to continue to see a lot of noise, so it’s not until we finish the trading session on Friday that we can decide whether or not we are ready to do something. That being said, the 2750 level is support, and most certainly the 2700 level is so I suspect that value hunters are waiting underneath.

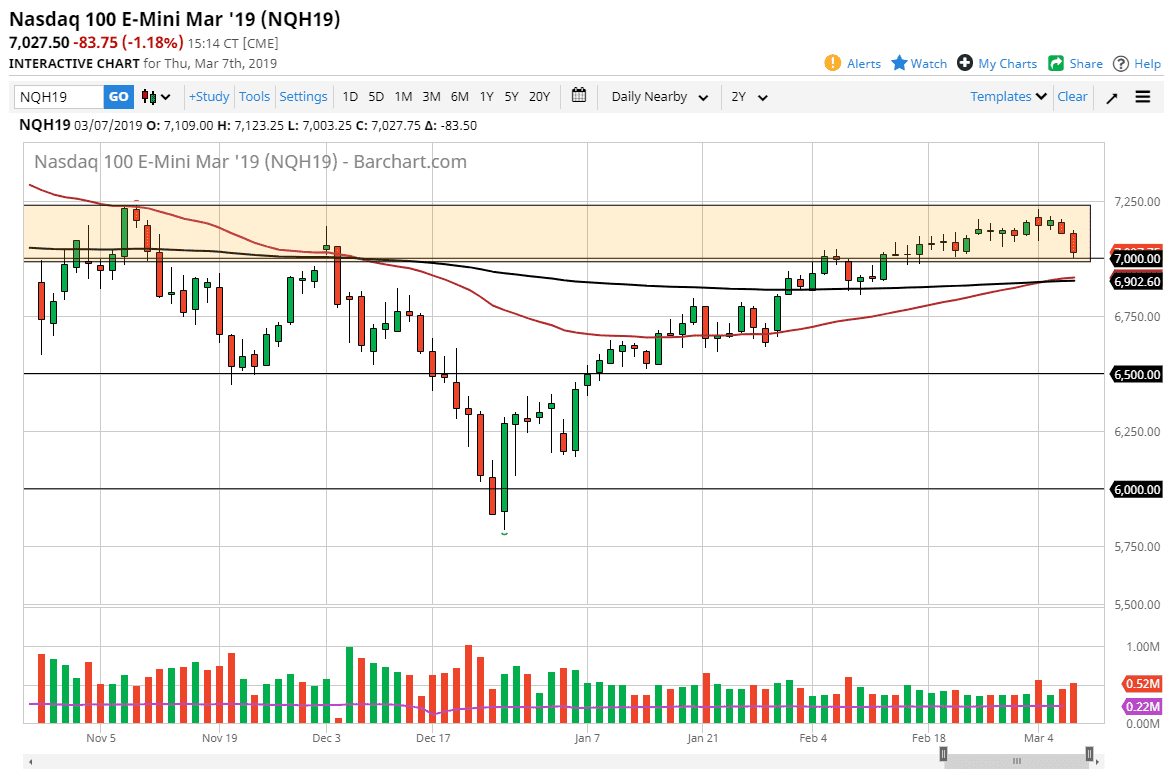

NASDAQ 100

The NASDAQ 100 broke down during the trading session as well, but found the 7000 level to be supportive. At this point, it’s very likely that we should find value hunters coming in, but it may have to wait until after the jobs number. It’ll be difficult to hang on to the trade, especially around 8:30 AM Eastern Standard Time, but at the end of the day we are still in and uptrend, and unless we get some type of catastrophic news it’s very unlikely that we will break through the moving averages underneath. Overall though, the candle stick for the close of the session on Friday should be crucial in this market as well, telling us what to do for the next several sessions.