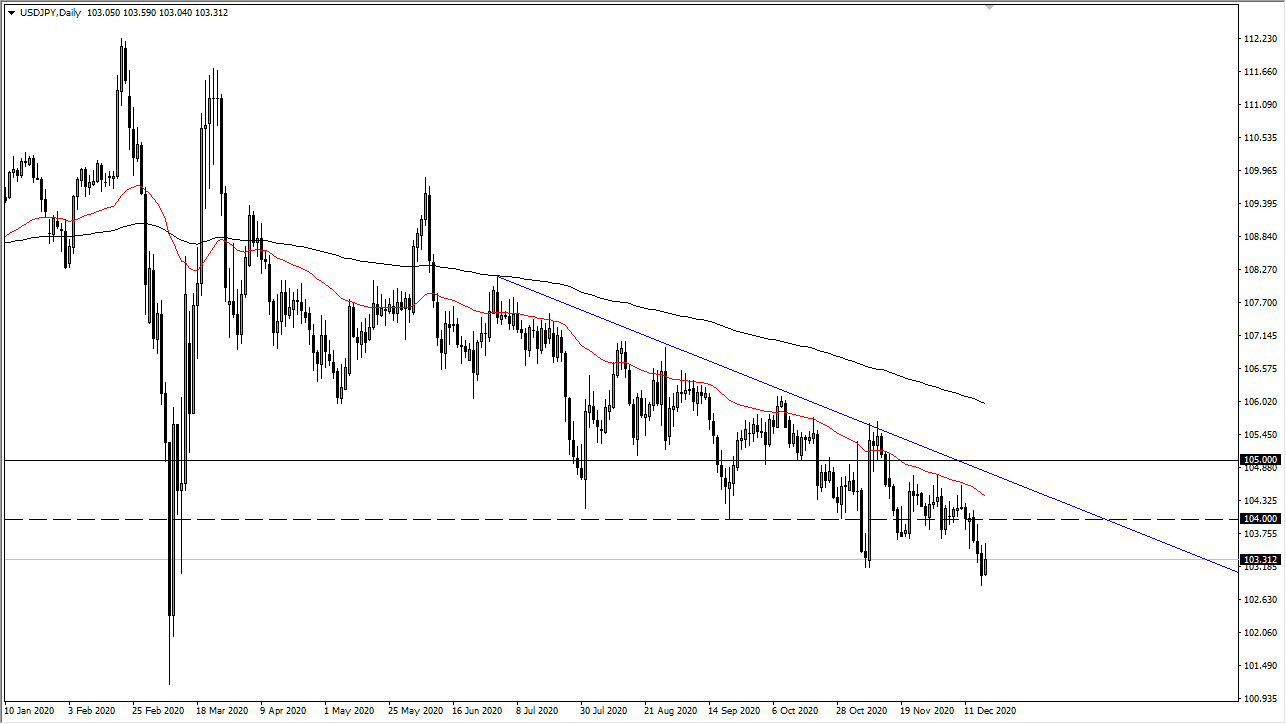

USD/JPY

The US dollar fell hard against the Japanese yen initially during the trading session on Friday after the ¥111.50 level gave away. Beyond that, we had a jobs number that was horrific, in the sense that only 20,000 jobs were added last month, as opposed to the expected 180,000. In that scenario, the dollar was always going to lose but we have found a certain amount of psychological and structural support lining up at the ¥111 level, not only because of the round number, but the previous order flow and the 200 day EMA. The way we have stabilized late in the day it suggests that we very well could see a bounce from here. At this point, I suspect it’s very likely that we will go looking towards the ¥111.50 level again.

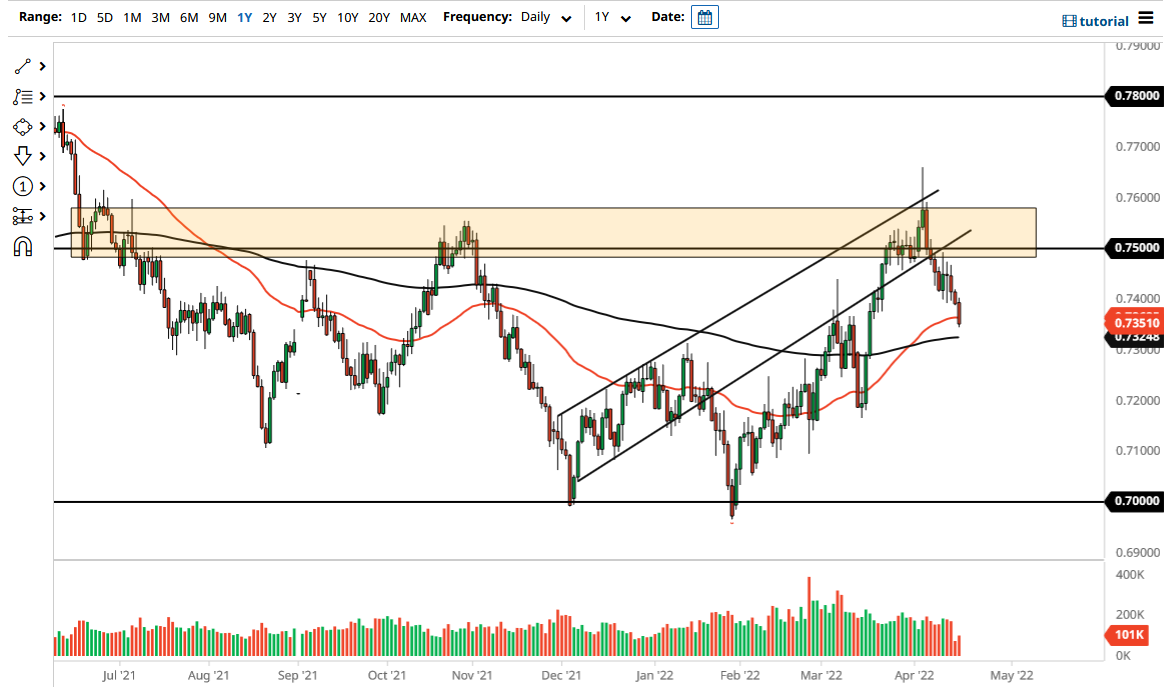

AUD/USD

The Australian dollar initially fell during the session as well, but the 0.70 level has held yet again. This is an area that has been massive support more than once, and it makes sense that he would continue to be. Closing out about 50 pips above there, it makes sense that the market could continue the same action that we have seen in the past, as the 0.70 level leads all the way down to the 0.68 level in a massive support area on the monthly charts. I find it very difficult to think that we are going to break down below there, unless of course there is a complete capitulation of any hope of a US/China trade deal, something that neither country wants at this point. With that, I do believe that the Australian dollar will start to grind its way back to the upside, although in a very choppy manner.