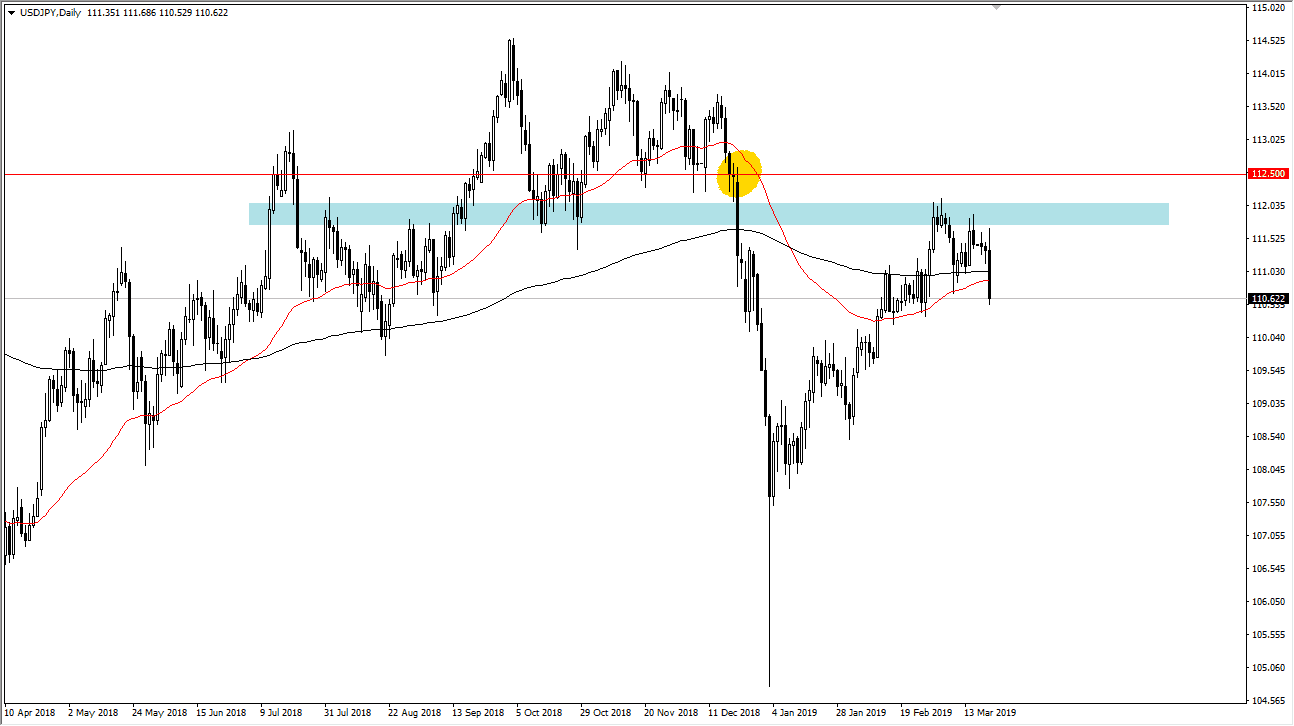

USD/JPY

The US dollar initially tried to rally during the trading session on Wednesday but then turned around to break through the 200 day EMA, as well as the 50 day EMA. With that being the case, the market has cleared the ¥111 level as well, which of course is a very negative sign. At this point, it looks likely that we will continue to see sellers come in on short-term rallies, as the Federal Reserve has all but ruled out the potential of an interest rate hike in 2019. With that being the case, we will have less of a carry trade going forward, and that will of course where this pair down, perhaps to the ¥110 level. In general, this is a market that continues to be very choppy, but we may have finally made a decision on Wednesday.

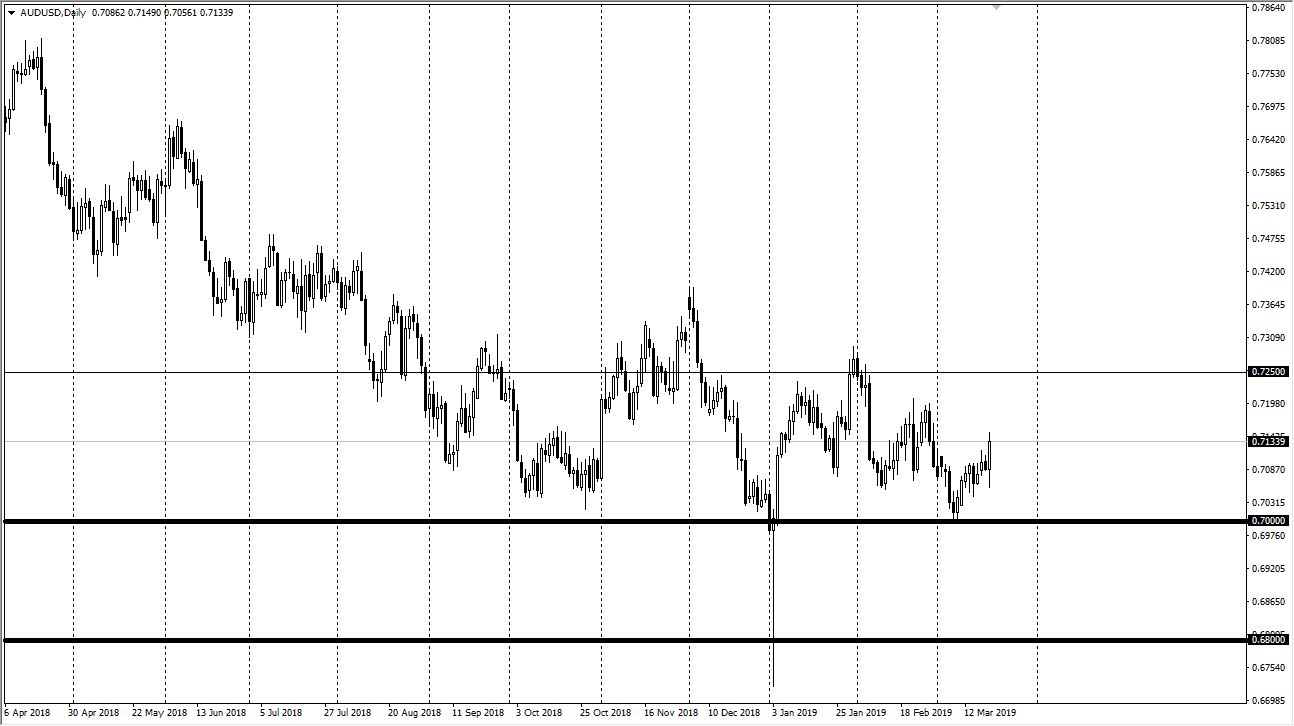

AUD/USD

The Australian dollar initially fell during the trading session, but then turned around to show signs of life again after the Federal Reserve had its statement. That being the case, the market looks as if it is ready to continue to try to go higher, but we have a lot of resistance overhead as well. Because of this, I believe that the same situation is in effect, meaning that we are simply buying the dips for short-term trades as we go along. The 0.70 level underneath is massive support that extends down to the 0.68 level.

I can see the support level on the monthly timeframe, so that of course is very impressive. Because of this, I think it’s all but impossible to short the Australian dollar and it’s very possible that we may be trying to form a longer-term bottom in the Aussie dollar.