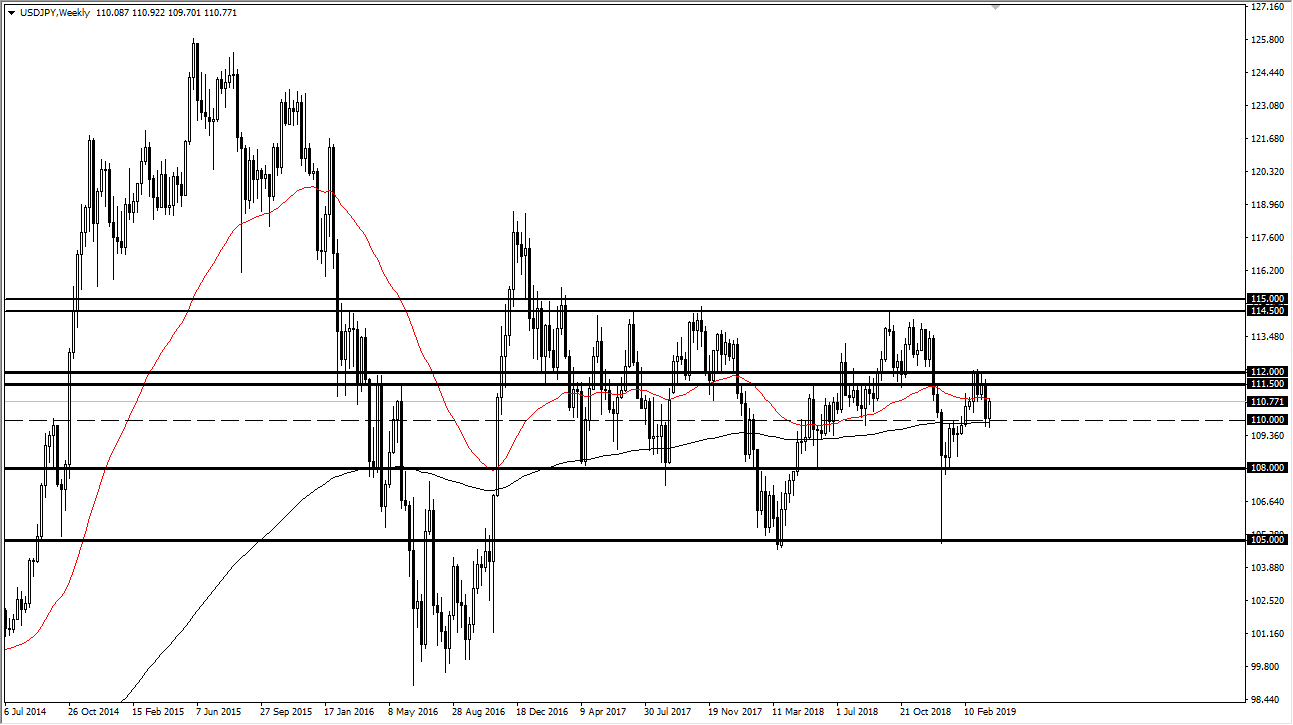

The US dollar has been very choppy against the Japanese yen during the month of March, as we have no idea which direction we are going to go. That being the case, it’s very likely that the market is going to be difficult to deal with. Looking at the chart you can see that is very easy to get confused as there are plenty of lines of support and resistance.

That being the case, it’s obviously a situation where we have a lot of tight trading, and of course back-and-forth banter. This makes sense though, considering that the S&P 500 and other risk assets continue to go back and forth. This pair is sensitive to a lot of that, so ultimately it’s probably going to be just as noisy as those markets.

We also have the Federal Reserve stepping away from a monetary tightening policy, while the same time the Bank of Japan is being…well, the Bank of Japan. Japan is light years away from doing anything remotely close to monetary tightening, so this is a pair that will continue to drift back and forth. However, if we do get a “risk on” type of attitude around the world, that will be good for this market and should send this pair well above the crucial ¥112 level. If that happens, I believe that the market will probably go looking towards the ¥113.50 level next.

The ¥110 level underneath is massive support, but not necessarily unbreakable. If we do break down below there, the market probably goes to the ¥108 level next. In general, I think this is going to continue to chop around struggle to make a larger move. With that being the case, I believe that this month will be very neutral, choppy, and short-term focused.