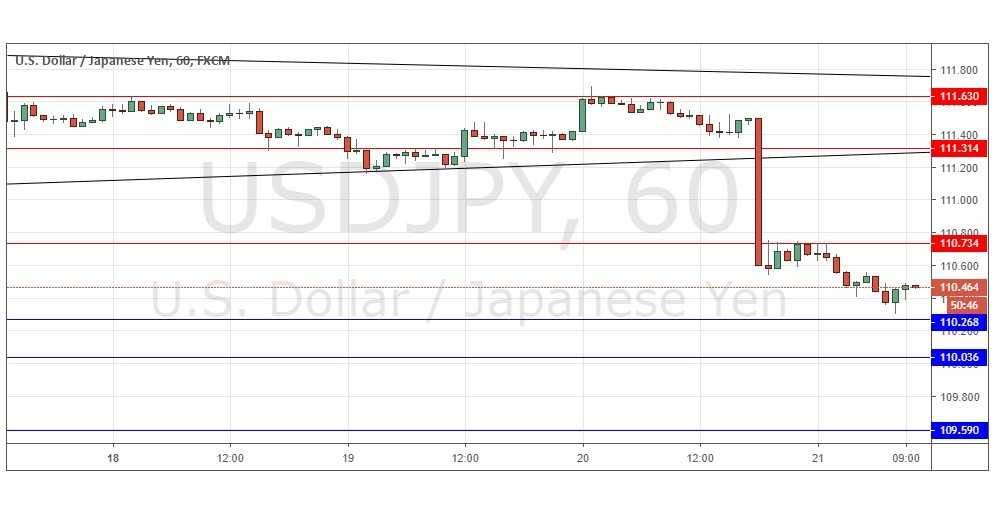

Yesterday’s signals could have produced a losing long trade from the bullish doji which rejected the former support level at 111.45, but I did warn about trading before the FOMC release which gave a huge downwards move.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be taken from 8am New York time Thursday until 5pm Tokyo time Friday.

Short Trades

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.73 or 111.31.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 110.27, 110.04, or 109.59.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that we would probably get some more direction and possibly a decisive breakout after the FOMC release due later. Until then, the price was likely to continue to range between levels. This was a great call, as this exactly what happened. The bearish breakout has been strong, firmer than the break almost anywhere else, although it has not reached very long-term lows. The key thing is to understand that the Fed weakened the USD yesterday by lowering rate hike forecasts and predicting weaker economic growth. This has led to a sell-off in the USD and stock markets which has sent money flowing into safe havens such as the Japanese Yen and Gold. For this reason, it makes sense to take a medium-term bearish bias, although the price may not fall lower than 110.26 over the short-term. I would take a bearish bias today if the price retraces to 110.73 and rejects it firmly.

There is nothing of high importance due today concerning either the JPY or the USD.