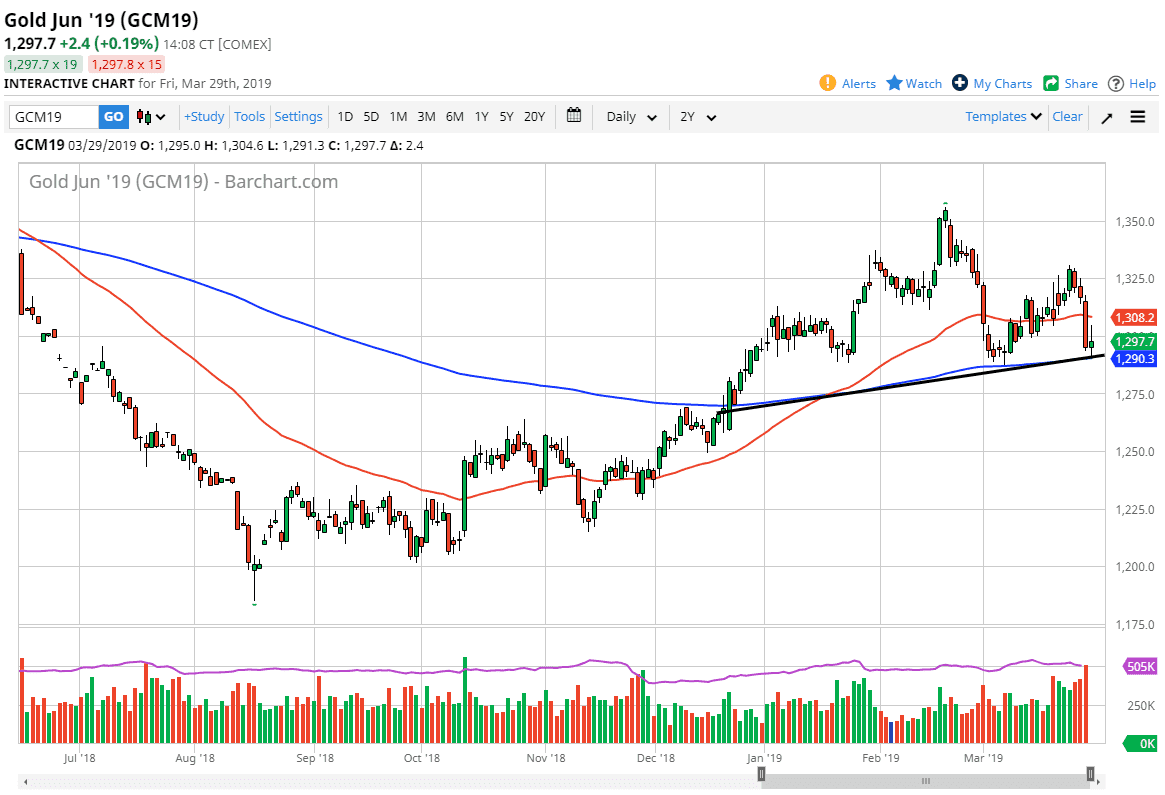

Gold markets went back and forth rather violently during the trading session on Friday, as we tested a trend line underneath. The 200 day EMA is walking right along that trend line, so one would have to think that there is plenty of interest in this area. Beyond that, the Gold markets are indicative of what we are seeing in the US dollar.

Speaking of the US dollar, it did rally quite a bit on Friday but it started to stabilize later in the day. The 1.12 level is massive support from a longer-term standpoint in the EUR/USD pair, and we did of course try to break down through it. However, we stayed above it and therefore it’s likely that the market is going to have to make serious decisions when it comes to the US dollar on Monday.

At this point, if we can break above the top of the candle stick on Friday it would become a significant bullish sign and could send this market back towards the $1325 level. At this point, we continue to see a lot of noise, but it appears that it is only a matter time before we break out in one direction or another. Once we do, there should be a bigger move ready to happen, and it could be rather sudden. All things being equal though, it’s likely that Gold will try to bounce from here based upon what’s going on in the US dollar. However, a break down significantly could cause Gold to struggle overall and dropped towards the $1275 level, and then down to the $1250 level after that. This is a market that is on the precipice of making serious decisions.