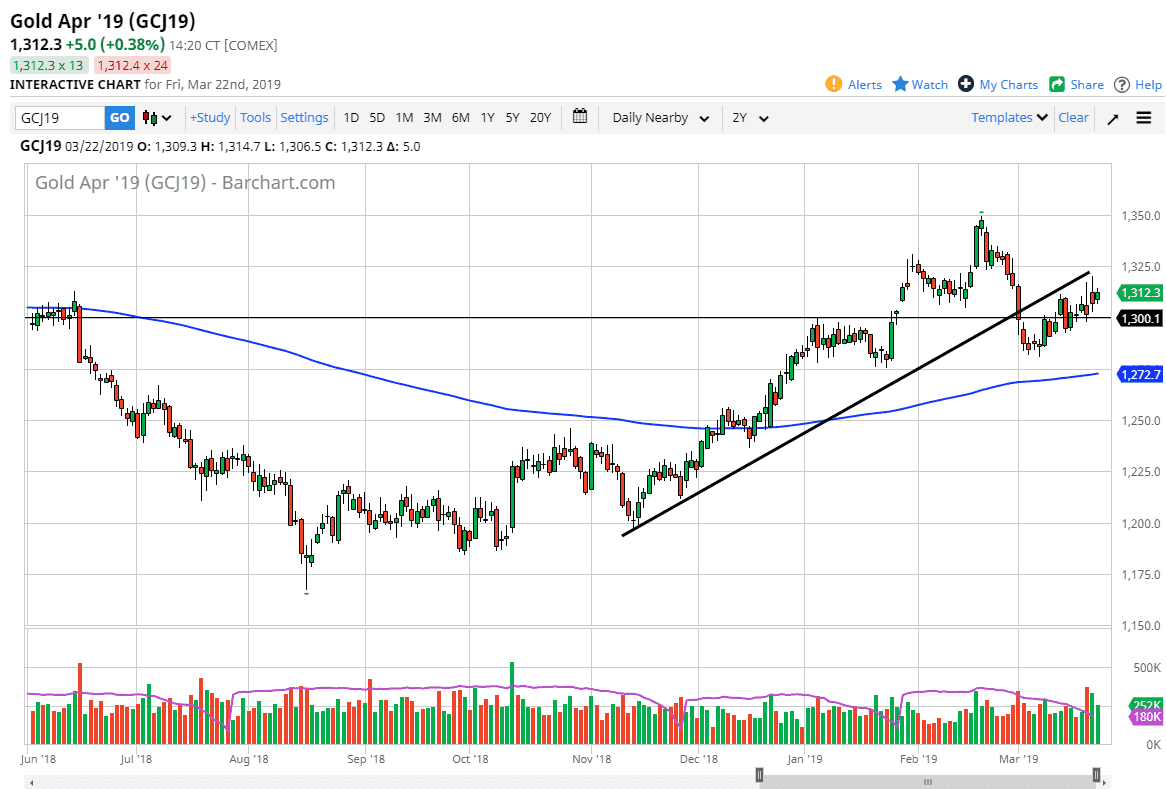

Gold markets rallied a bit during the day on Friday, which has been the trend for several weeks now. However, we are still seeing a significant amount of resistance just above that coincides with the previous uptrend line. The market certainly has been bullish for some time, but it is worth noting that we have given back quite a bit of the gains after the Federal Reserve came out and suggested that there was going to be no interest rate hikes for the rest of the year. That does give me a bit of pause when it comes to gold, and beyond that the silver market looks as if it’s ready to roll over. Quite often these two markets do move in the same direction.

That being said, if we can clear the $1325 level it would be a very bullish sign as we would not only cracked the top of a couple of shooting stars, we would also break above the previous uptrend line, and the psychologically important $25 level, which gold tends to pay close attention to.

On the downside, a market moves below the $1300 level could open up the door to the $1280 level which is the beginning of support down to $1275. We also have the 200 day EMA just below there, so it’s very likely that we continue to see noisy action in this general vicinity and I think that short-term trading is probably about as good as it gets. I do suspect that you will have to pay attention to the US dollar overall, and as it rises that should push gold lower. However, if the dollar gets sold off we will then see gold rally a bit overall.