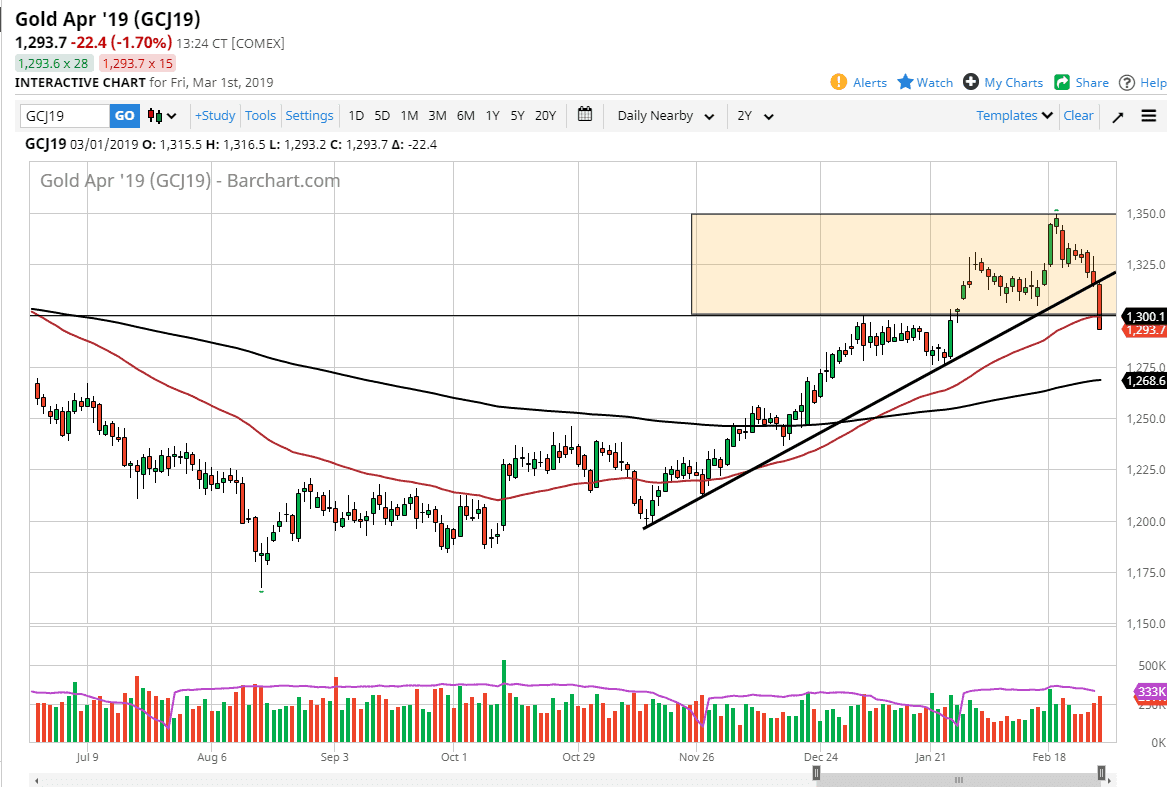

Gold markets got absolutely hammered during the day on Friday, breaking below the crucial $1300 level. This is a market that now finds itself below the 50 day EMA now, and it is closing out the week at the very bottom of the range. The US dollar strengthening has of course worked against the value of gold, so it’s obvious that we now have a different dynamic in this market. Being below the $1300 level suggests that we could now find the market looking towards the $1275 level.

At this point, the market certainly seems to have broken major support a couple of levels during the day, and now I believe that rallies are to be sold, at least for the short term. The 200 day EMA underneath is currently at $1260, and I think that could be part of the target. Breaking below there would of course be extraordinarily negative, but I think at this point with the trend line being broken and the 50 day EMA doing the same thing, it’s very likely that we will start to see systematic traders start to short this market. However, I do think there is a certain amount of demand underneath.

Short term, I believe that we are going to see the reaction to a Federal Reserve member – Bostic - saying on Friday that he still believes that the Federal Reserve will raise interest rates at least once in 2019, and I think this shows just how dovish most market participants think that the Federal Reserve is. That of course isn’t anything major, but it is the first hockey statement that we have had in a while. On the day the gold had broken down, this seemed to accelerate the move. I think we got a little bit of weakness ahead of us, but we should see some support in a few days.