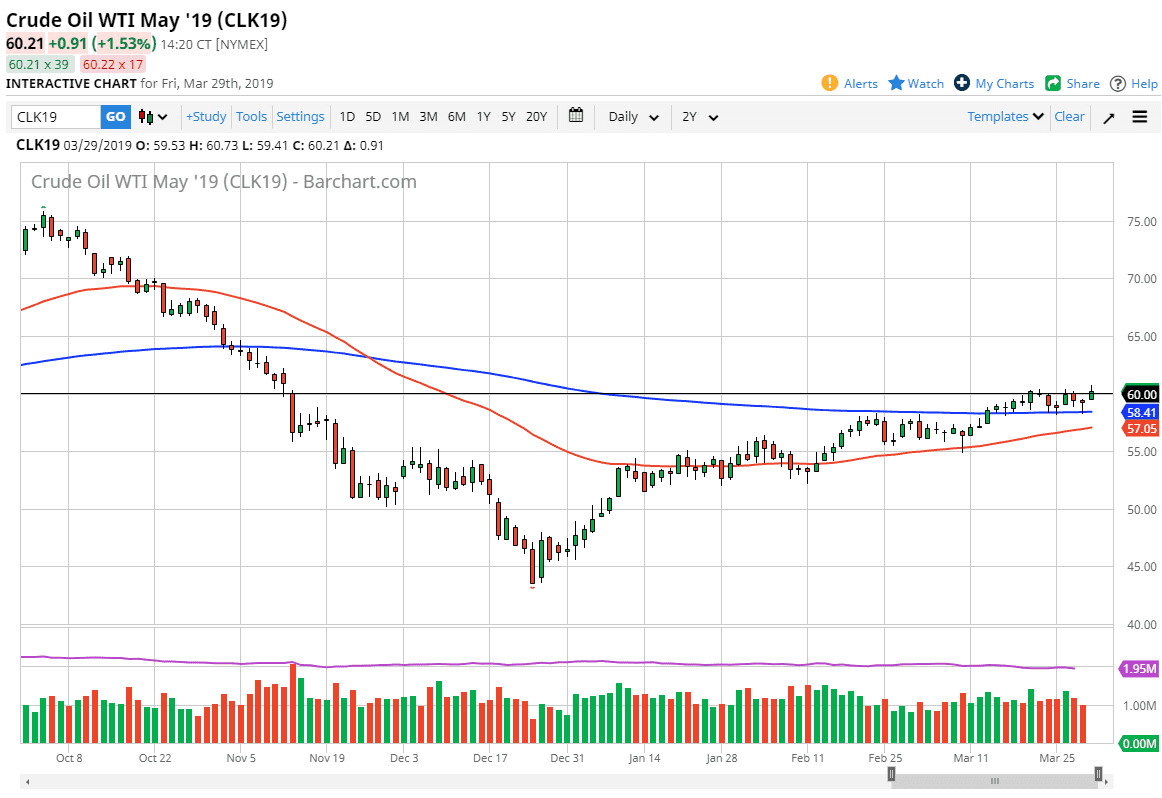

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday, closing above the $60 level which is a good sign. However, there is still a significant amount of resistance above at the top of the candles that form the last couple of days that it’s going to take significant bullish pressure to break out. Short-term pullbacks should be thought of as opportunities though, as the 200 day EMA is sitting at the bottom of the hammer from the Thursday session. If we were to break down below that it could cause a bigger reset, but at this point it’s likely that we break out to the upside more than anything else. Look at short-term pullbacks as buying opportunities but breaking out above the top of the range for the session on Friday should send this market looking towards the $62.50 level and then the possibly the 65 dollars level after that.

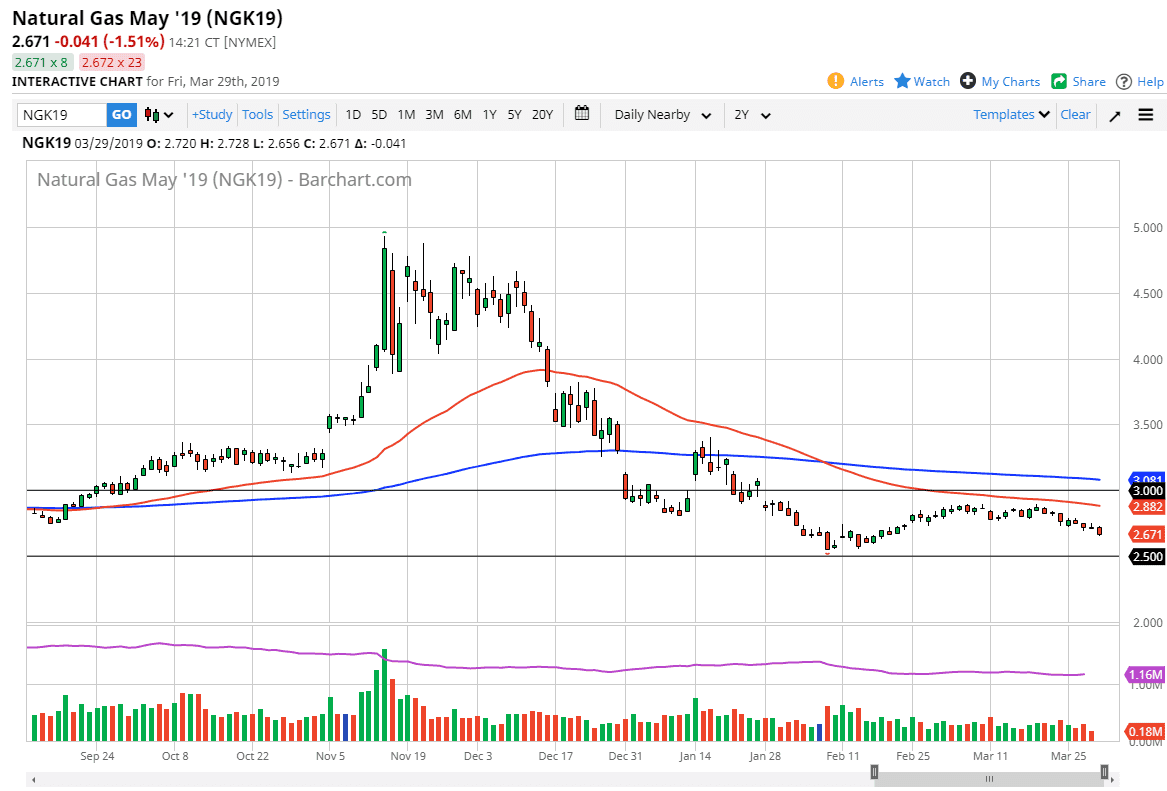

Natural Gas

Natural gas markets continue to drift sideways with a downward slant. While I do not like natural gas from a longer-term standpoint and recognize that it is far too oversupplied to hold price for any length of time, I also recognize that there is significant support underneath. That support starts near the $2.60 level that extends down to the $2.50 level. With that in mind I’m looking for bounces or supportive candles to take advantage of closer to the $2.60 level. To the upside, I see massive resistance starting at the $2.90 level, so I’m more than willing to sell in that region as we show signs of weakness. As we are in the middle, I think it’s probably best to sit on the sidelines and wait until we reach one of those levels to put money to work.