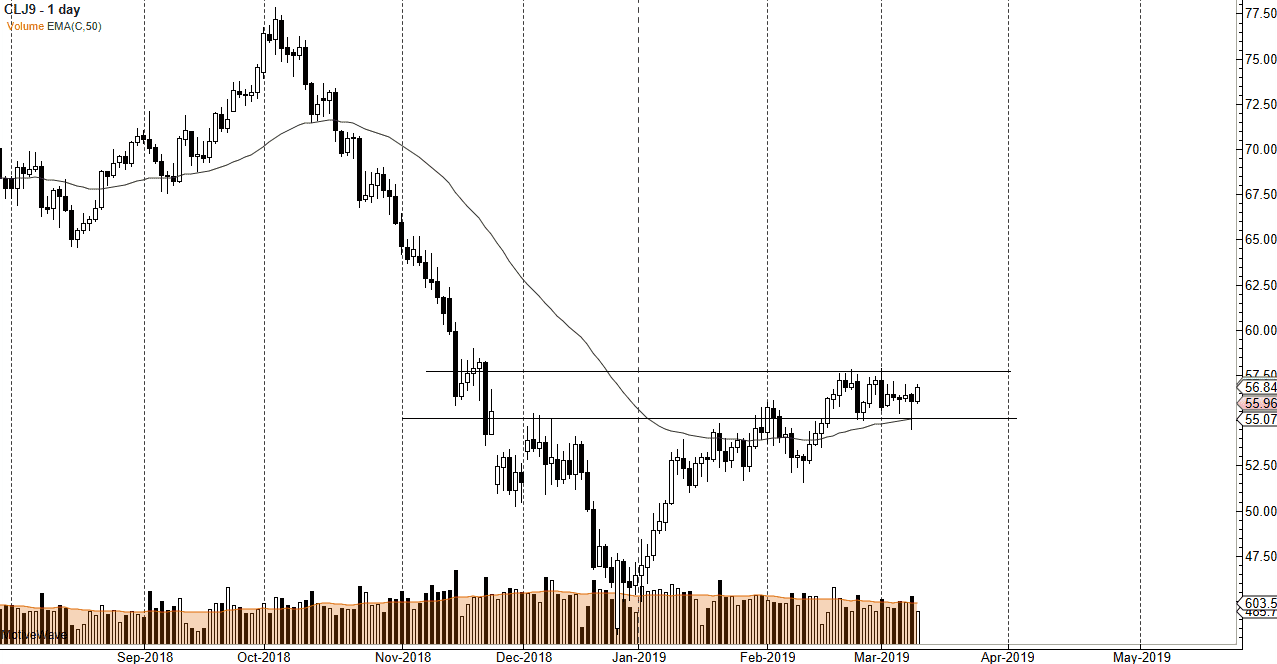

WTI Crude Oil

The WTI Crude Oil market rallied quite a bit during trading on Monday as we came back to work. However, there is significant resistance above, so it’s very likely that we will simply continue to go back and forth. There are a lot of concerns about potential global growth, although at the same time we have the OPEC production cuts going on. In other words, I think that the market is trying to figure out what the longer-term outlook for oil is going to be. Looking at the chart, it’s obvious that short-term back and forth trading will probably be the main thing that we see going forward. If we broke down below the $55 level, then perhaps we can unwind, just as a break above the $58 level would be very bullish and sending the market towards the $60 handle.

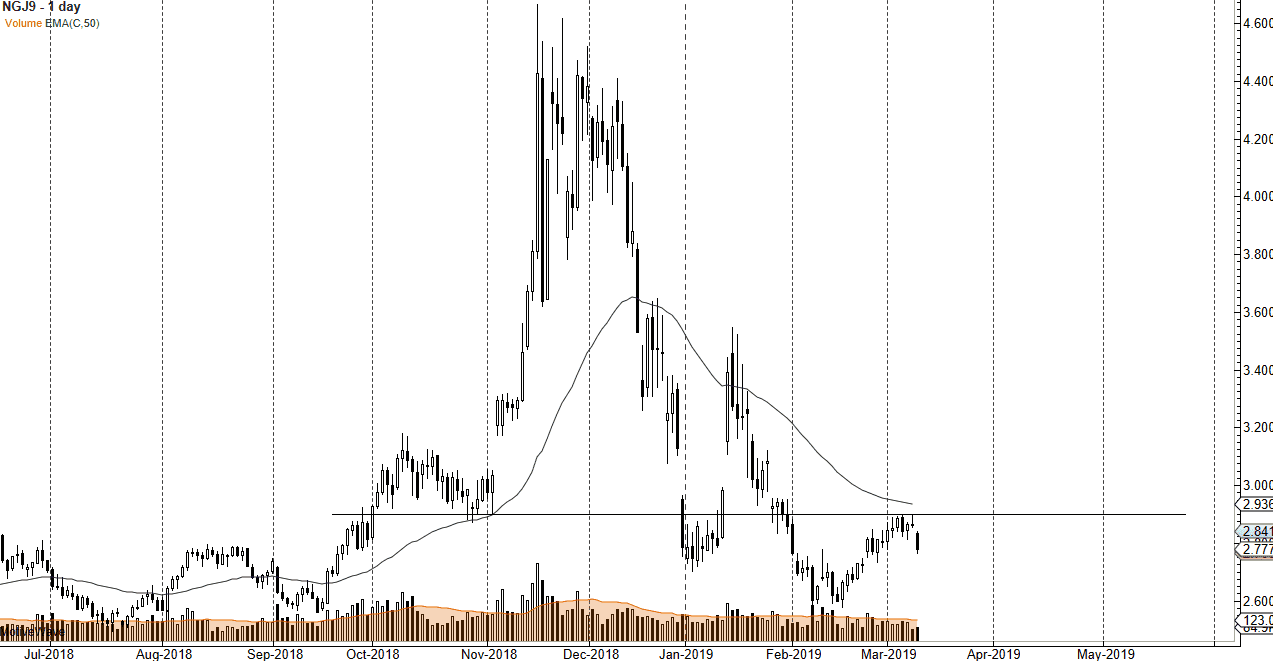

Natural Gas

Natural gas markets had a hard go of things during the Monday session as we gapped lower, and then continue to go even further to the downside. The $2.90 level is the beginning of major resistance, extending all the way to the $3.00 level. At this point, rallies should be sold, as natural gas is oversupplied to say the least, and of course we are in a massive downtrend. The 50 day EMA is just above current trading, which formed a shooting star last Friday. With all of that in mind, it makes sense that sellers will continue to jump in on short-term rallies, as we push towards the $2.60 level underneath which extends all the way down to at least the $2.50 level. I would be a bit surprised if we break down below that level, but I certainly feel as if we will try to get back down there.