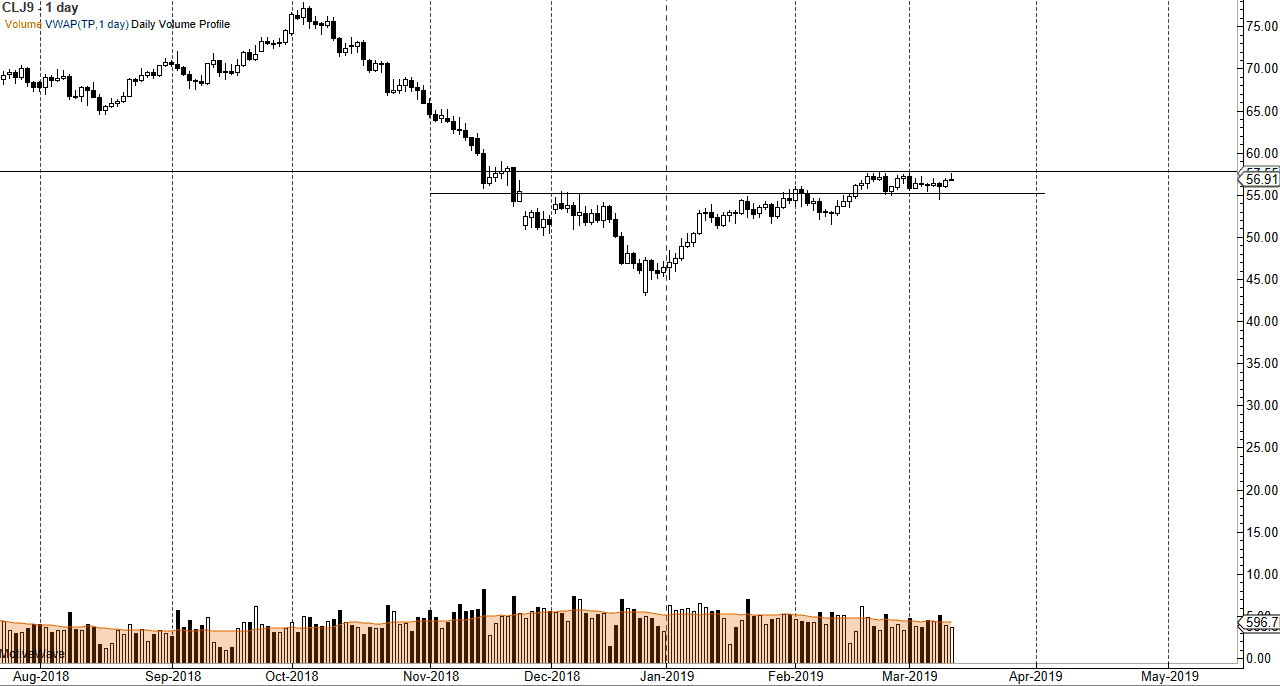

WTI Crude Oil

The WTI Crude Oil market tried to rally during most of the trading session on Tuesday but found resistance yet again at the $57 region. Because of this we ended up forming a bit of a shooting star, suggesting that we are going to continue to bounce around in the same consolidation area that we have been in for some time now. With that being the case, we also have to worry about the 200 day EMA just above, so it’s likely that the resistance will in fact hold. That isn’t to say that we should be selling, what it tells me is that we need to buy dips as the market is trying to build up the necessary momentum to go higher. Once we do get the break out, this market is going to scream to the upside. In the short term though, it’s very likely that we will continue to play small time frames.

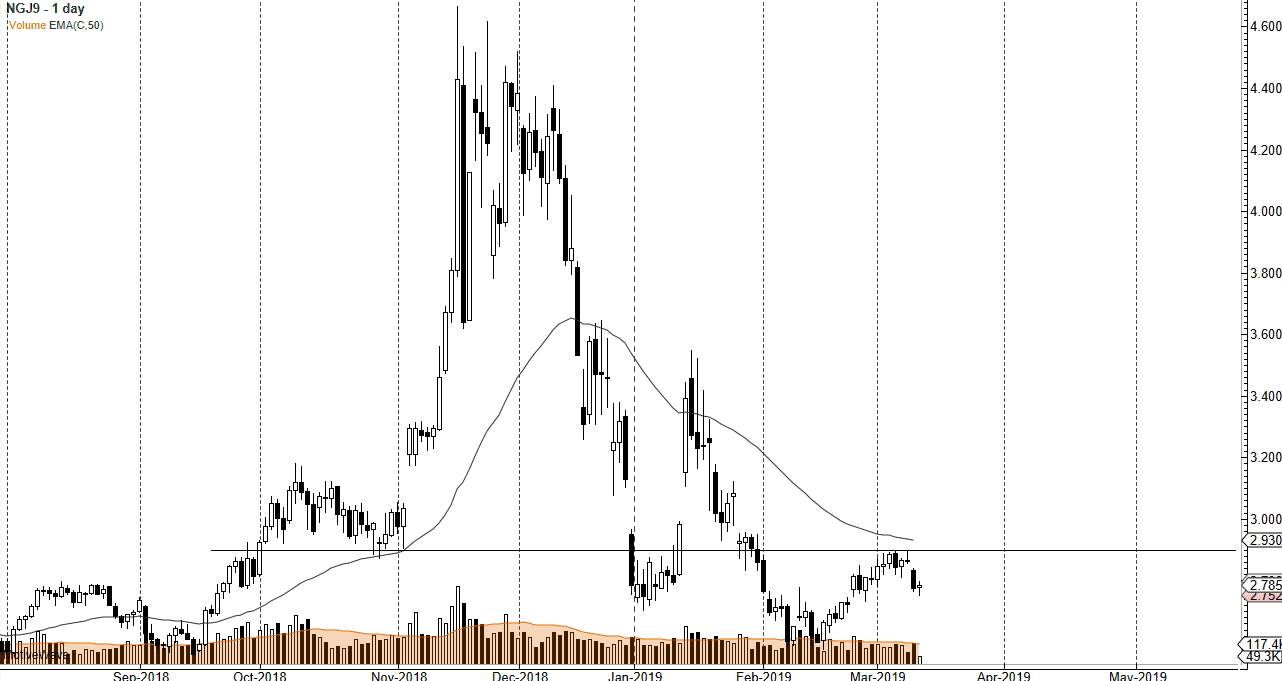

Natural Gas

Natural gas markets initially fell during trading on Tuesday, but then turned around of form a slightly positive candle stick. We have a gap above the Monday candle stick that is still very much intact, and I believe that the $2.90 level is also major resistance that extends to the $3.00 handle. At this point, I’m waiting for some type of bounce that I can start selling, perhaps near the $2.85 level or above. The alternate scenario of course is that we break down below the bottom of the candle stick for the Tuesday session, which is also a reason to start selling. There is massive support underneath near the $2.50 level, so I don’t think we are going to break down below it and go extraordinarily lower than that.