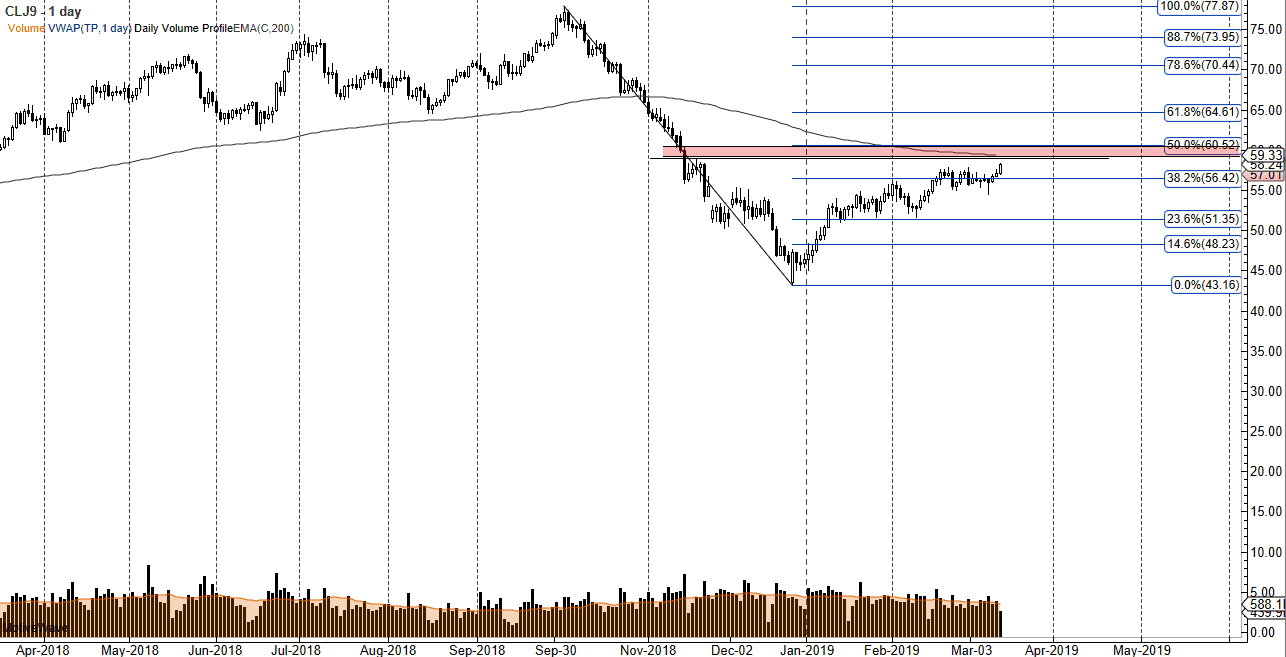

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Wednesday, reaching towards fresh, new highs, at least as far as recent trading is concerned. We have the 200 day EMA just above, sitting at the $60 region. There is a red rectangle on the chart as well that represents a significant amount of resistance. It is because of this that I think that although we are bullish, you are probably going to continue to buy short-term pullbacks more than anything else in this market. Granted, crude oil looks extraordinarily bullish but it isn’t exactly free and clear quite yet.

With that in mind, I don’t have any interest in shorting this market and I think that the closer we get to the $57 level, the more likely we are to see fresh buying enter this marketplace. If we can get good economic numbers or perhaps good news coming out of the US/China trade relations, that could also drive pricing higher.

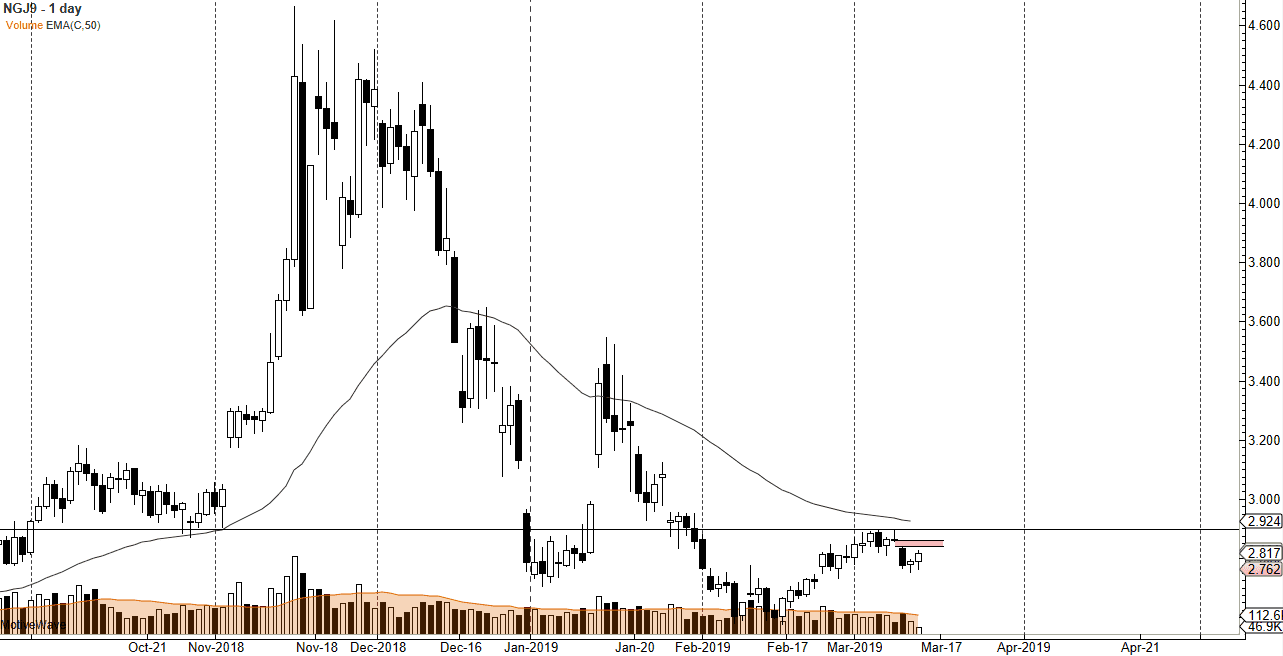

Natural Gas

Natural gas markets initially pulled back a bit during the trading session on Wednesday as well, reaching towards the highs later in the day. By doing so, it looks as if we are trying to fill the gap above, and with the inventory figures coming out during the day on Thursday, we could get a sudden move. However, I like the idea of shorting this market at the first signs of exhaustion, especially if it’s near the $2.85 level. The 50 day EMA is just above, and that should continue to put bearish pressure in this market going forward. I do think that eventually the sellers come back, but if we broke above the $3.00 level we would have to rethink the entire situation.