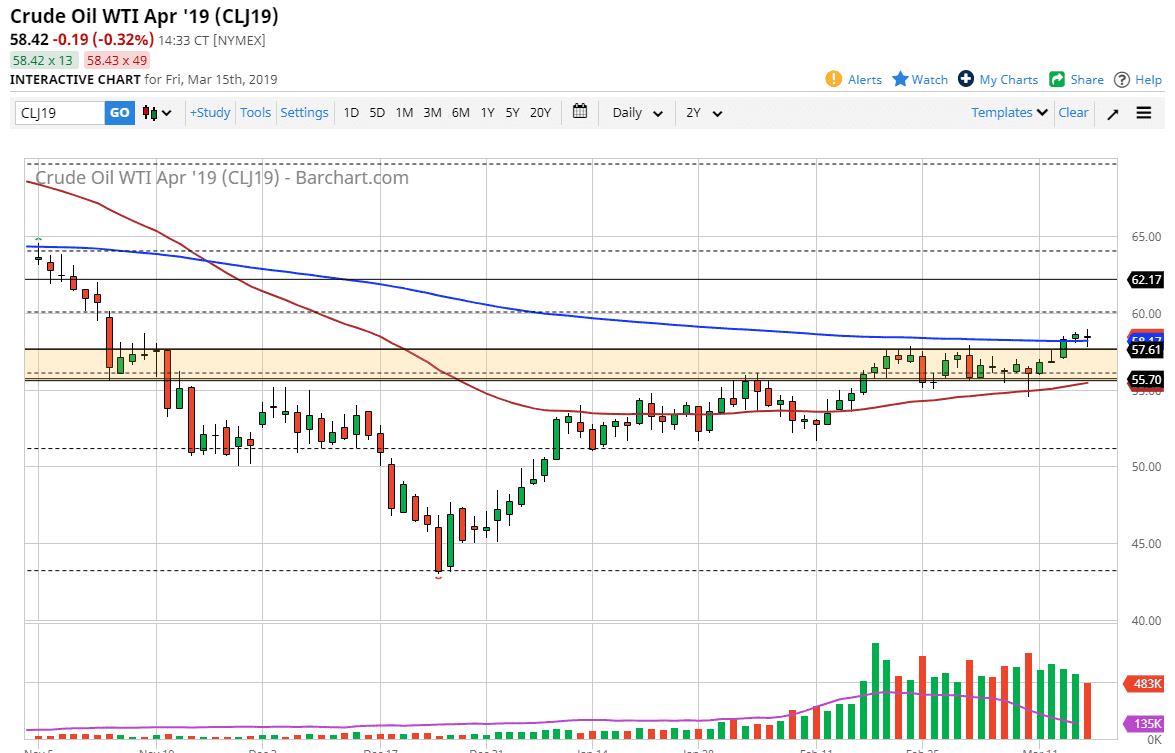

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session in rather volatile trading on Friday. This is a market that continues to see a lot of bullish pressure longer-term though, so I do think that we are getting close to breaking out to the upside for a larger move, initially to the $60 level. We are also sitting just above the 200 day EMA, so that’s something to pay attention to as well. All things being equal I think that we will continue to see people look to this market as one that’s in demand, may be due to production cuts, or perhaps due to the massive amounts of stimulus that the Chinese are starting to put into their own economy. That should help with crude oil demand as China is the biggest consumer in the world.

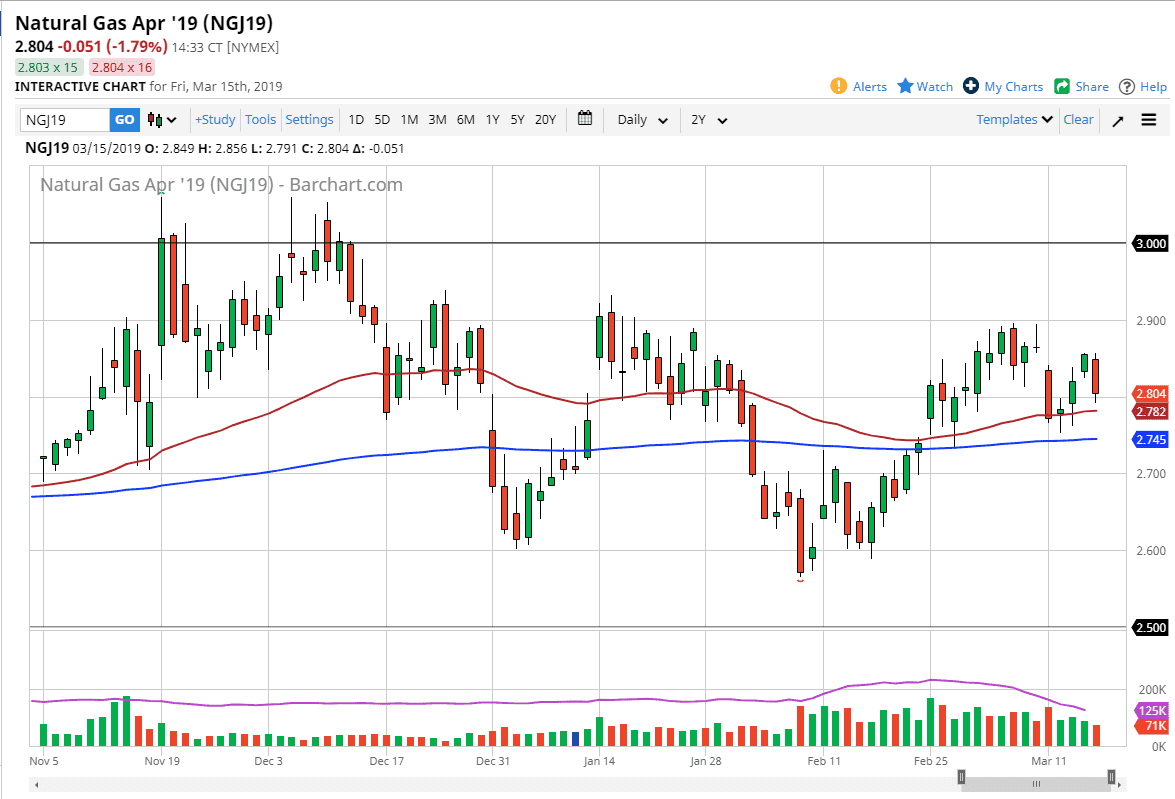

Natural Gas

Natural gas markets fell rather hard during the trading session on Friday, reaching down to the $2.80 level. After filling the gap on Thursday, this pullback made quite a bit of sense and it suggests that we are getting ready to reach down towards the $2.75 level. Overall, I think this market is very likely to be very noisy as it typically is, and I think overall it’s likely a situation where you are better off selling rallies that show signs of exhaustion. To the downside, I think the $2.70 level will be a target, followed by the $2.60 level, both of which will be very interesting to pay attention to. Just above, the $2.90 level is the beginning of massive resistance that extends all the way to the $3.00 level above which of course will have a certain amount of psychological importance attached to it as well.