WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Monday to kick off the week, breaking above the 200 day EMA. That’s a very bullish sign but we do have a small gap just above that is going to continue to be a bit of an issue at the $60 level. Ultimately, short-term pullbacks should offer plenty of buying opportunities, while a break above the $60 level should send this market much higher, perhaps sending it as high as the $65 level. OPEC has canceled the meeting that was going to discuss possibly cutting back on production cuts, so that being the case it looks as if we will continue to see OPEC try to push prices higher. With that, I remain bullish but I recognize that the occasional short-term pullback will of course be a feature in the market.

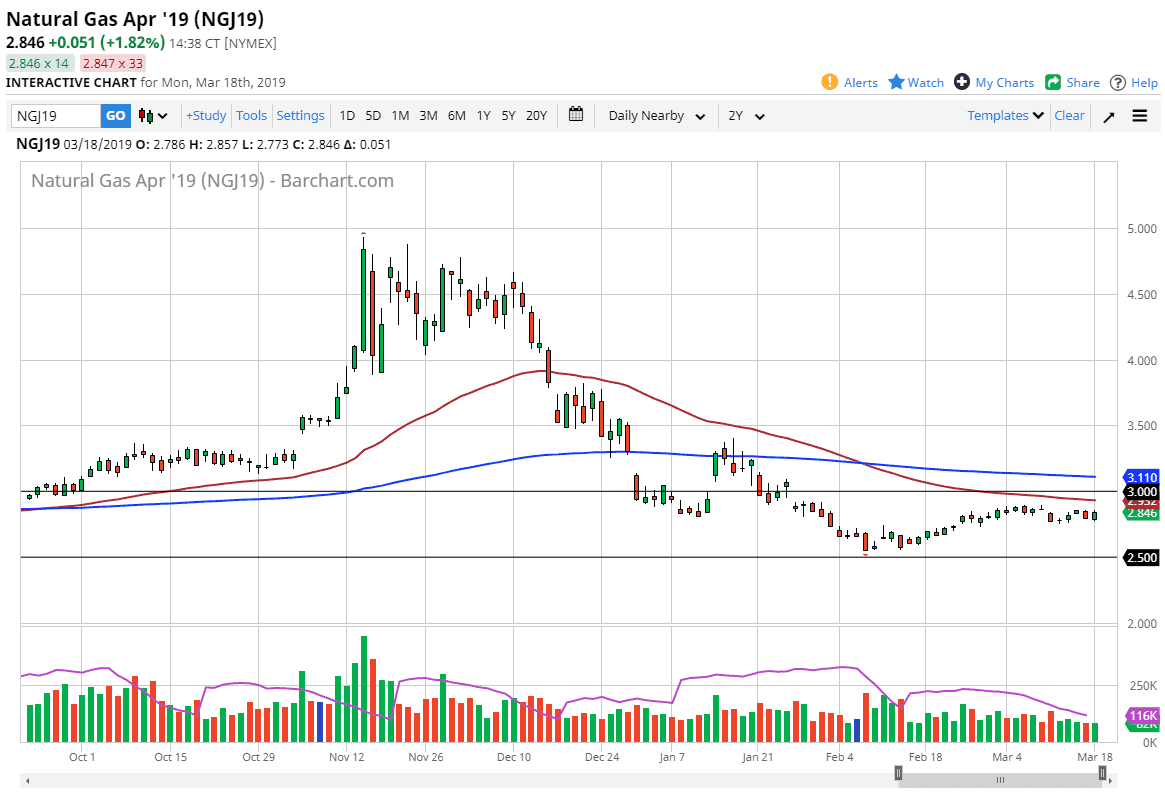

Natural Gas

Natural gas markets rallied a bit during the trading session on Monday, reaching towards the $2.85 level which of course is an area that has seen a bit of resistance. Beyond that, we have a lot of resistance at the 50 day EMA as well, so I think that it’s only a matter of time before we roll over. Natural gas did form a shooting star on the hourly chart, so that of course is the beginning of bearish pressure that could turn things around.

We have been in a longer-term downtrend for some time, so therefore I don’t think there’s any reason to fight that mood. That being said, the $2.50 level underneath is massive support, so that will more than likely be a bit difficult to break down through. I think of it more as a target than anything else at this point.