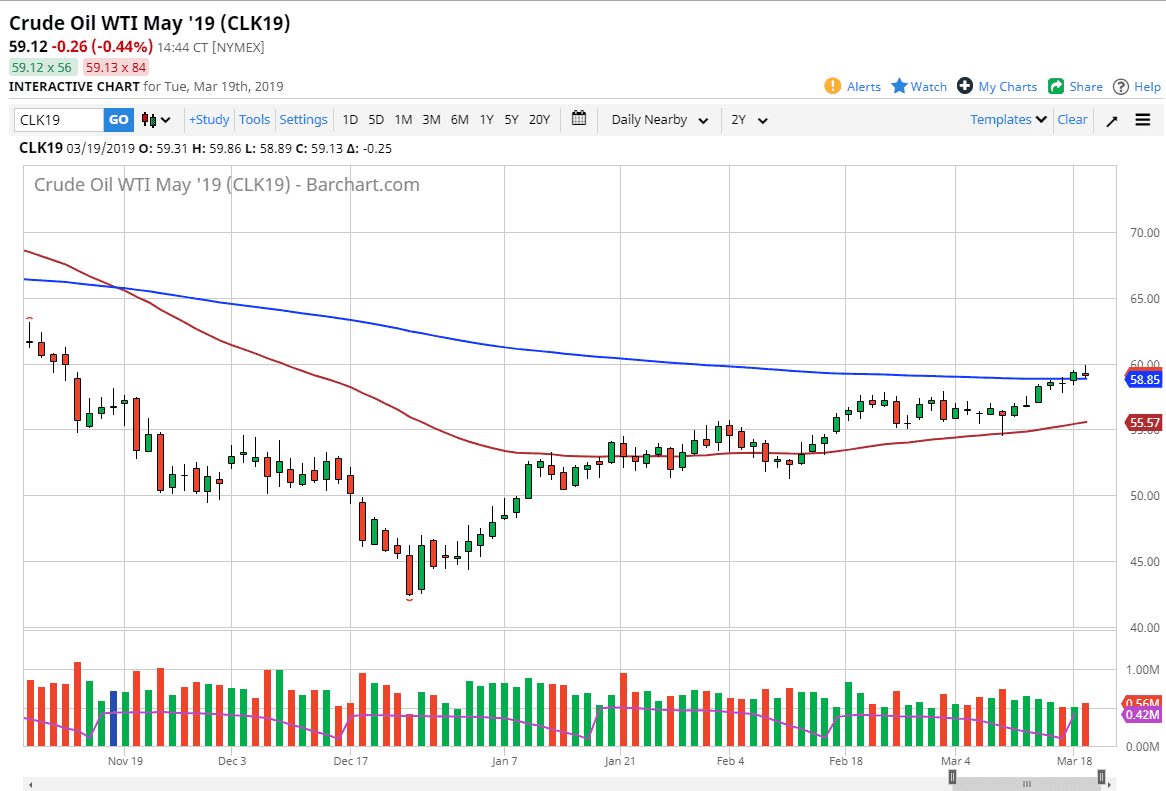

WTI Crude Oil

The WTI Crude Oil market tried to rally during the trading session on Tuesday, but gave back the gains at the $60 level, which of course was the scene of a major gap. By doing so, we ended up forming a bit of a shooting star which is negative, but we are also sitting just above the 200 day EMA. On shorter-term charts, there is support just below, so although this is a negative candle stick, I suspect that it’s likely we will continue to press a bit higher. On the fundamental side, it makes sense that crude oil goes higher as OPEC has pushed back a meeting until June, meaning that they will not be reversing their output cuts. With that being the case, one would assume that any pickup in the global demand will continue to push this pair higher. Remember, China has recently been adding stimulus, which could have an effect here.

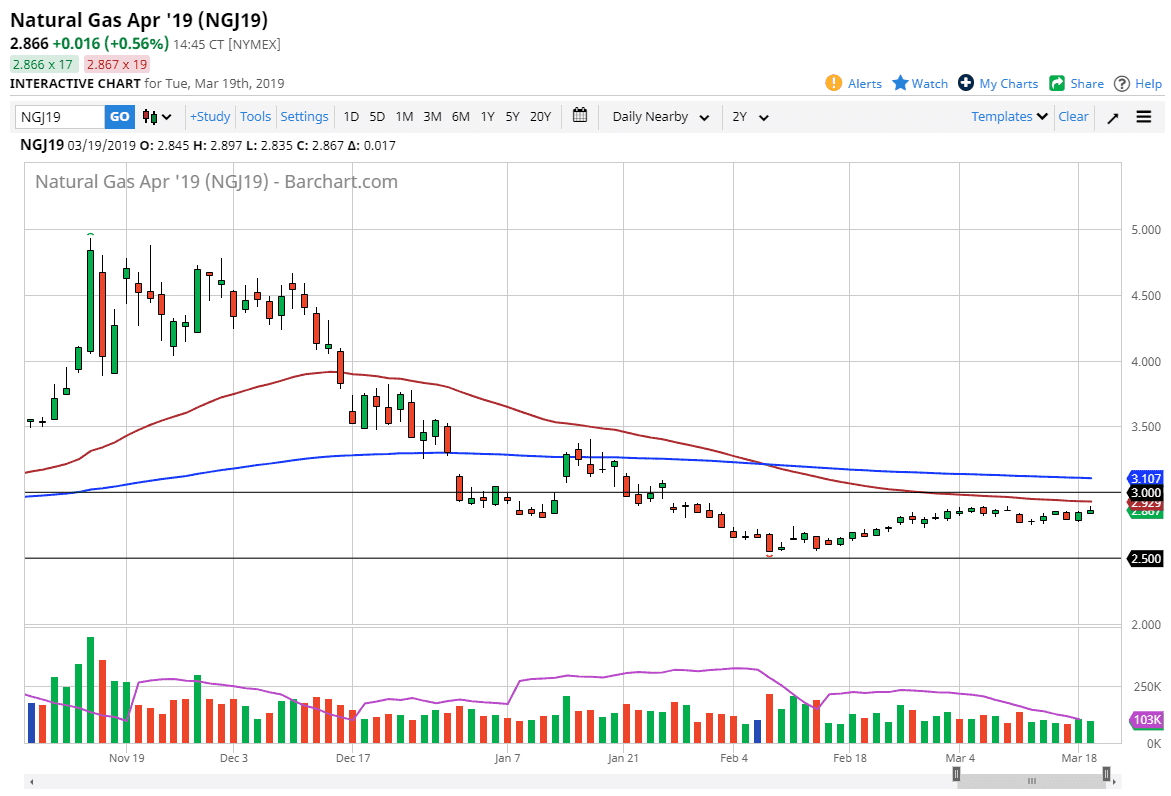

Natural Gas

Natural gas markets tried to rally during the day and did keep a little bit of the gains but gave back quite a bit at the top. The 50 day EMA is just above, and although we did form a shooting star, the candle stick is very similar and tells me essentially the same thing. We continue to struggle with the rallies, and short-term traders continue to fade any type of positive momentum.

Looking at the chart, we are most certainly in a major downtrend and that should continue to see a lot of trouble in the area just above, so I don’t have any interest in buying, at least not until we break well above the $3.00 level, something that doesn’t look very likely to happen.