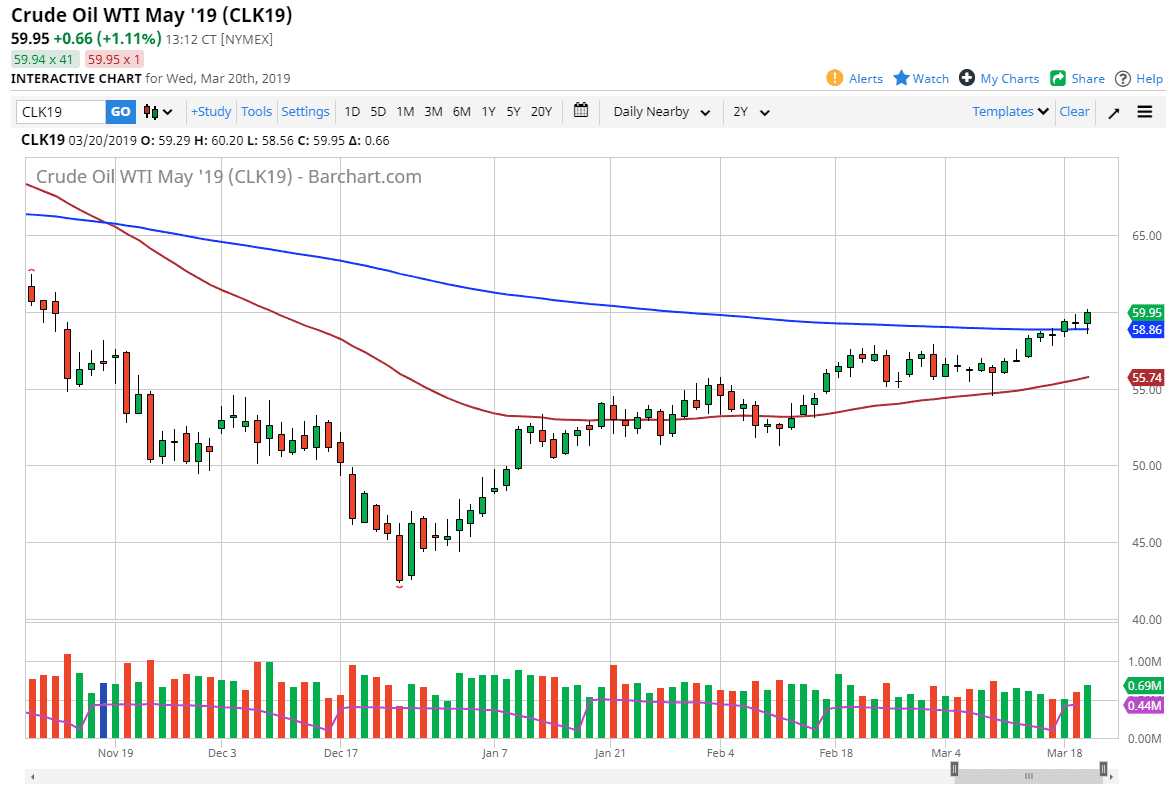

WTI Crude Oil

The WTI Crude Oil market initially fell during trading on Wednesday but has found enough support at the 200 day EMA to turn things around and rally towards the $60 level. In fact, we have even broken above the $60 level during the session and it now looks as if we are ready to continue going higher. Short-term pullbacks will continue to be buying opportunities for those who are patient enough to take advantage of them. Otherwise, if we do break down below the bottom of the range for the Wednesday session, we could drift a little bit lower, perhaps down to the $57.50 level. With this being the case, it’s very likely that we are going to continue to see a lot of choppiness but obviously with a massive upward bias as crude oil continues to be in demand. The inventory number was extraordinarily bullish.

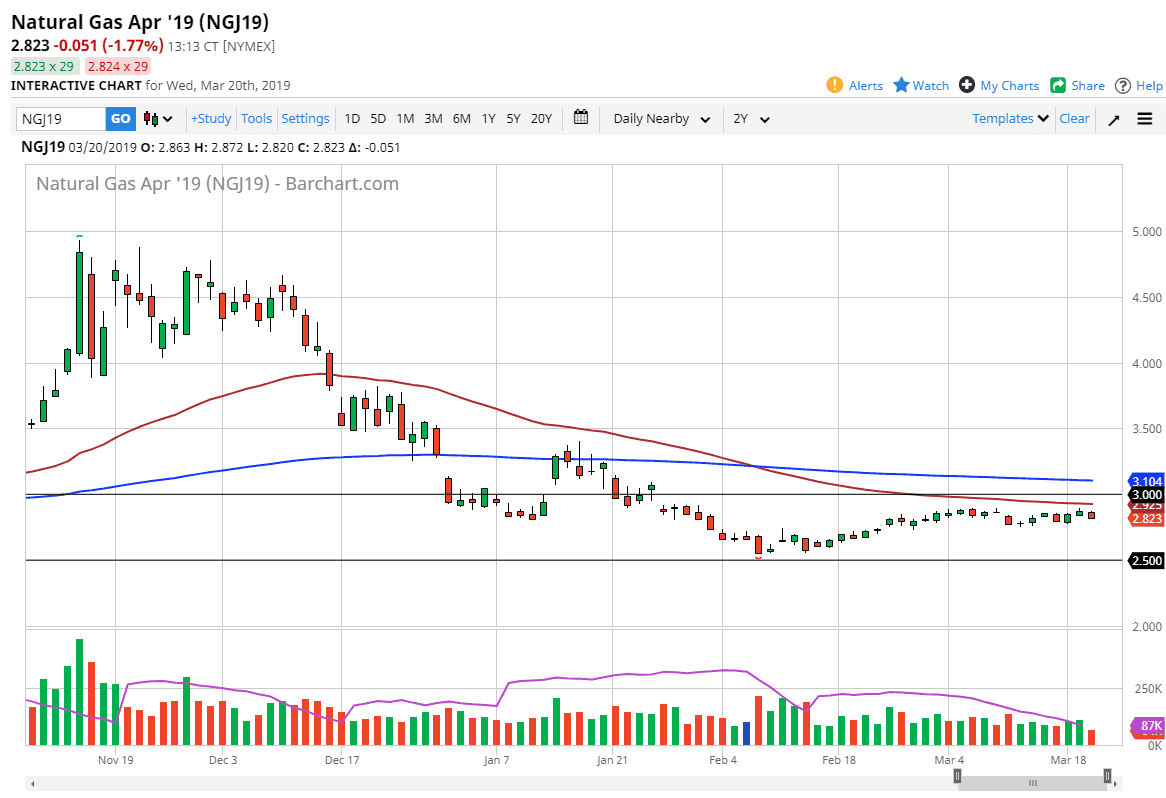

Natural Gas

Natural gas markets fell a bit during the trading session on Wednesday, as we continue to see a lot of noise in the market. There’s also a lot of bearish pressure, so it’s difficult to imagine a scenario that I would be a buyer of this market, as the natural gas markets worldwide are simply oversupplied. Ultimately, this is a market that should continue to see a lot of sellers due to the longer-term problems with the fact that there is simply far too much out there. The market continues to be affected by fracking, which of course means that there is more than enough out there to keep people supplied. We are also exiting the time of year which is a historically strong, so that’s another reason to think that we continue to drop. The $2.90 level begins a significant amount of resistance while the way to $3.00 above. To the downside, I anticipate that we will eventually go looking towards the $2.60 level.