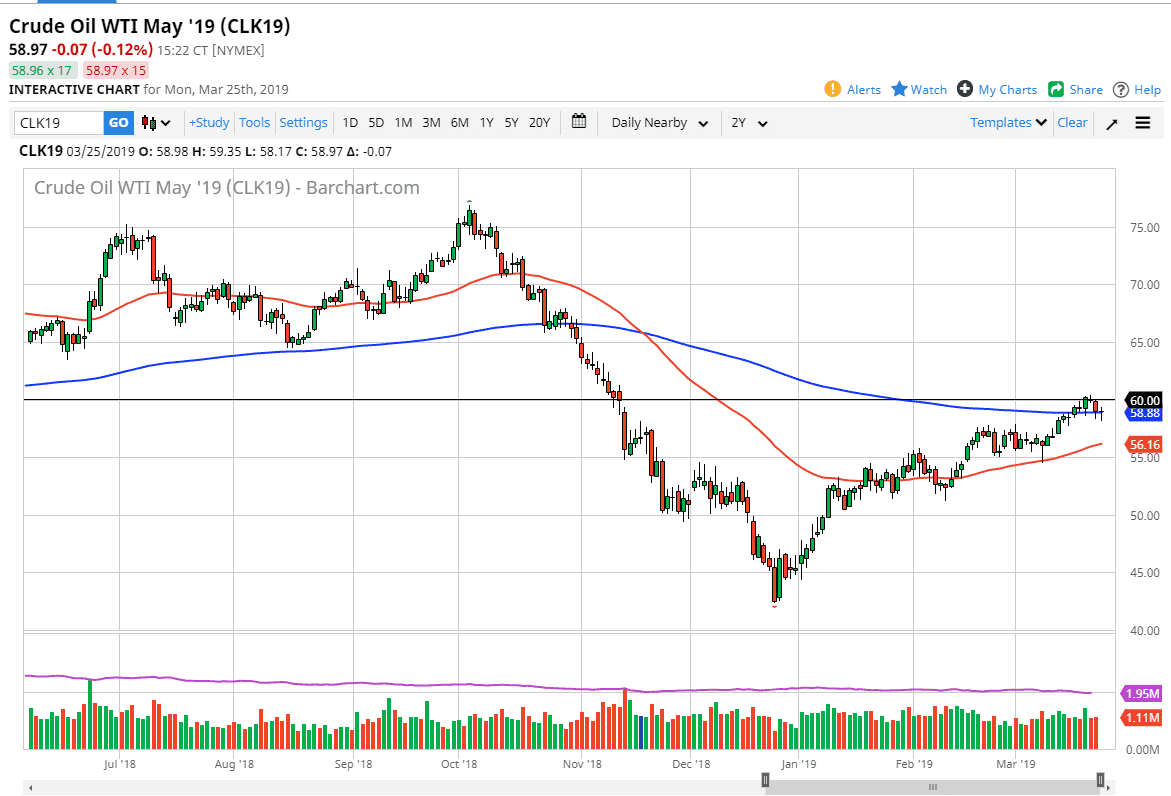

WTI Crude Oil

The WTI Crude Oil market initially pulled back during trading on Monday, but enough buying pressure came back into the marketplace to turn things around and reach above the 200 day EMA. We continue to see buyers in this market, and even though there has been a significant amount of selling lately, but it couldn’t pick up traction. Because of this I believe that the market is going to try to rally towards the $60 level again, as that was the scene of a gap that just got filled. If we can break above that level, then I think that the WTI market could go reaching towards the $65 level next. Keep in mind that OPEC has pushed back its next meeting, meaning that we will have production cuts in place until at least June. That should continue to help the markets find a bit of upward pressure.

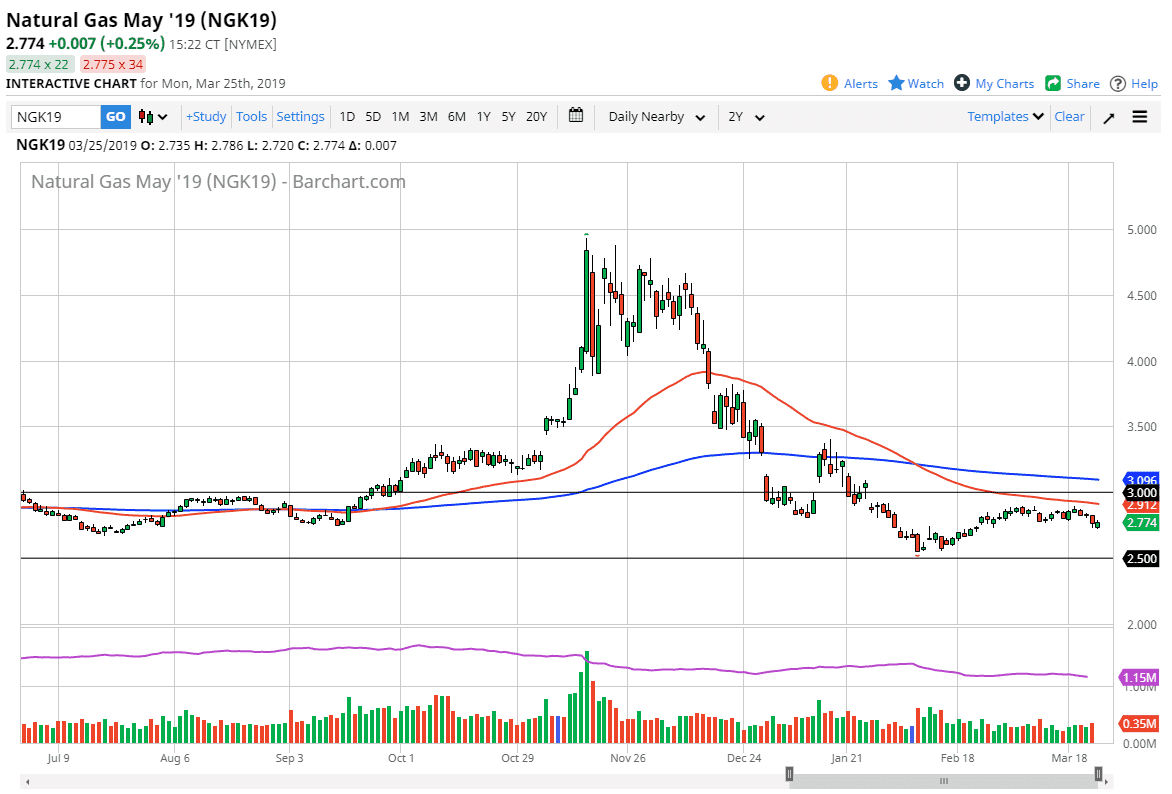

Natural Gas

Natural gas markets gapped lower to kick off the week, but then turned around to fill that gap. I think at this point we may see a little bit of follow-through to the upside but I suspect that there will be more than enough sellers above to keep the market down. We continue to consolidate between the $2.50 level and the $3.00 level, and that means we are essentially in the middle of the larger range. While I do have more of a downward proclivity in this market, trading in the middle of consolidation is a great way to lose money so I will simply be on the sidelines. However, I recognize that near the $2.90 level we start to see sellers come into the market in mass, just as we see a lot of buying pressure start at the $2.60 handle.