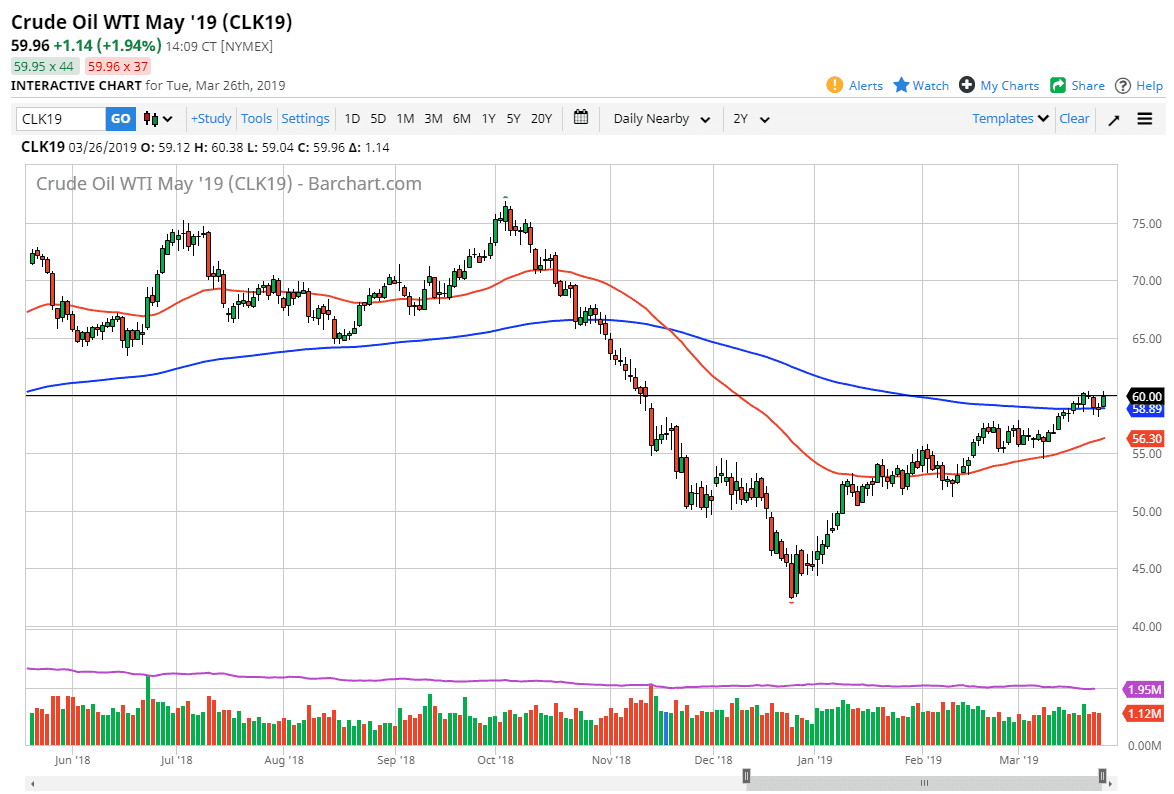

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Tuesday reaching towards the $60 level. That’s an area that is obvious resistance, as it was the top of the gap from a while back. Because of this, it’s going to take a certain amount of momentum to break above, but at this point if we can break above the $60.50 level, then the market will continue to go towards the $62.50 level, possibly the $65 level. Short-term pullbacks continue to find support at the 200 day EMA, so at this point it’s very likely that value will reenter the picture, prompting a bit of buying on dips. With the OPEC meeting not happening until June, it’s very likely that we won’t have any production output increases between now and then driving this higher.

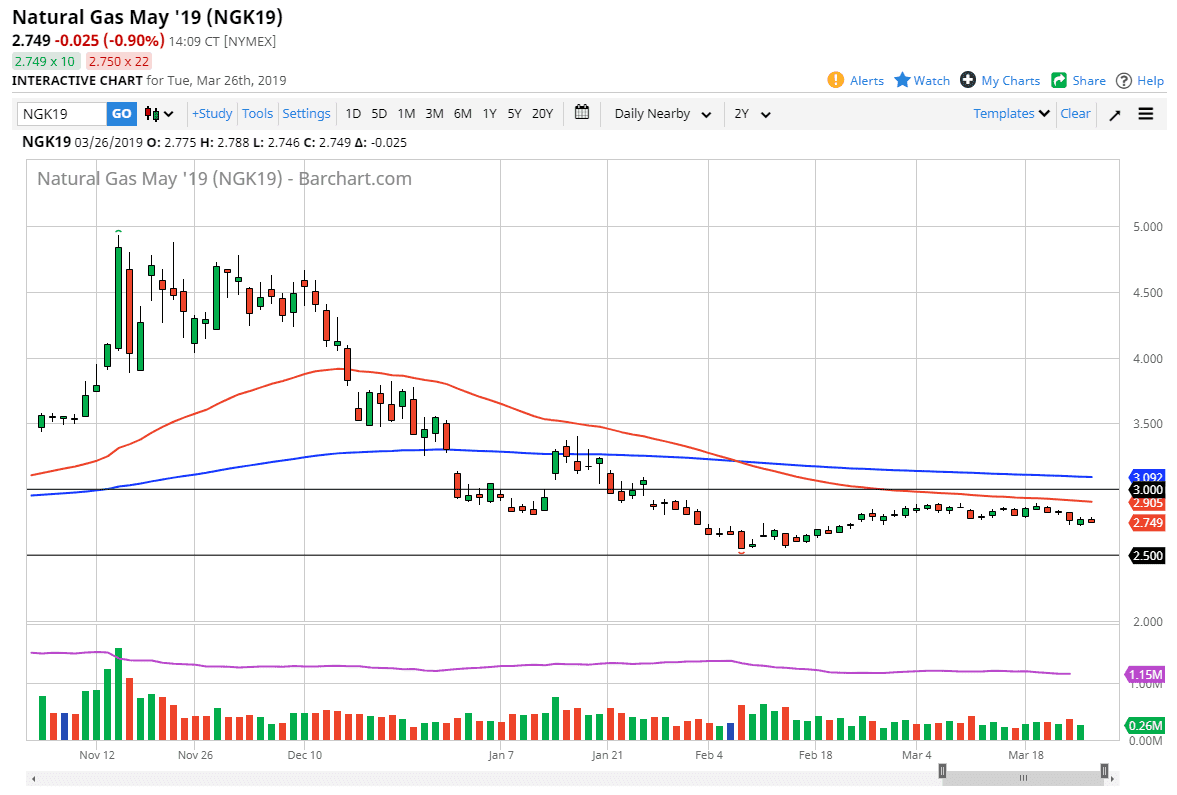

Natural Gas

Natural gas markets fell slightly during the trading session on Tuesday, but at this point in time we are essentially stuck in the middle of the larger consolidation range. The $2.90 level is the beginning of massive resistance to the $3.00 level above, and therefore I more than willing to sell natural gas as we get to the range as it showed so much in the way of resistance. Ultimately, there is a lot of downward pressure due to and oversupplied marketplace longer-term, so therefore structurally we remain bearish.

To the downside, the $2.60 level begins a major area of support that extends down to the $2.50 level. If we were to break down below the $2.50 level that would be a very major turn of events, but right now I think what happens is that we simply go back and forth so therefore you might as well take advantage of the range while it lasts.