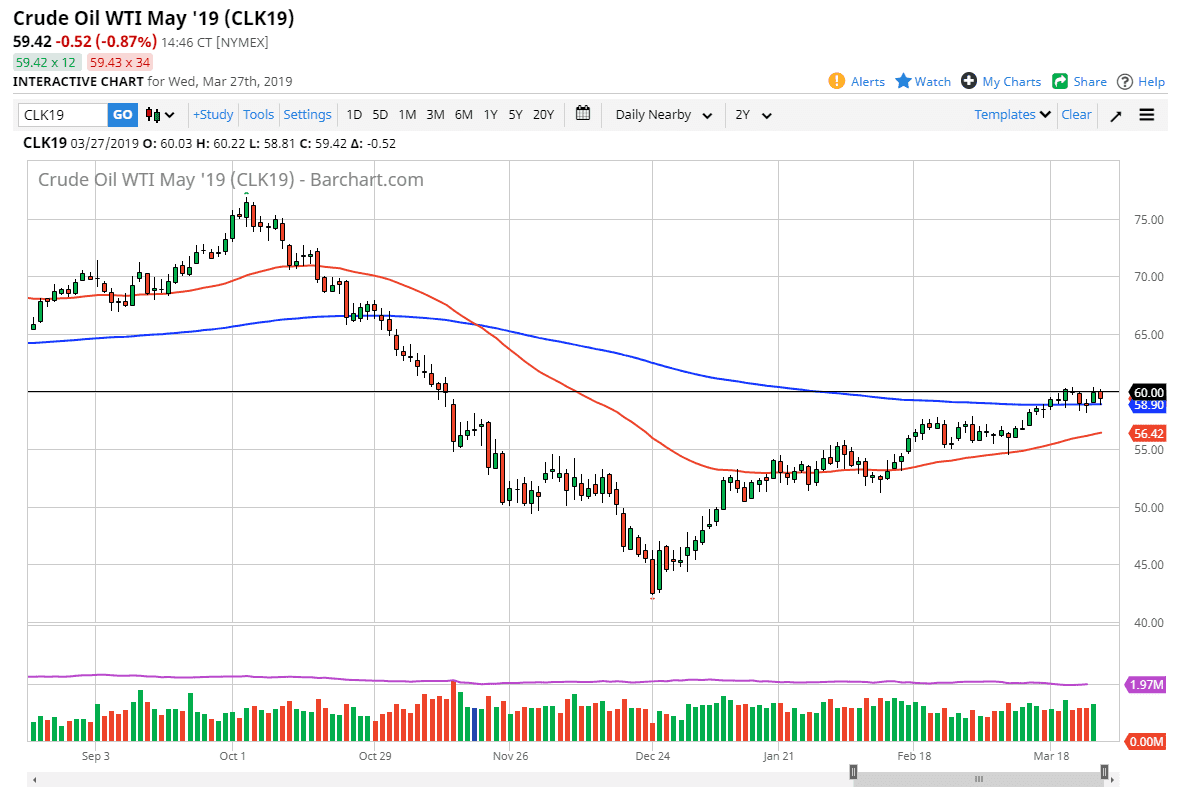

WTI Crude Oil

The WTI Crude Oil market went back and forth quite a bit during the trading session on Wednesday but found the area just above $60 to be resistance yet again, which was of course exacerbated by the fact that the EIA inventory numbers were a build of just over 2 million barrels, when it was anticipated that there would be a drawdown of 1 million. That of course is very bearish but by the end of the day we started to see buyers yet again. The 200 day EMA continues offer support just underneath, and of course we have the OPEC meeting being pushed back to the month of June that means we will have production cuts for several months. That should continue to be one of the main drivers of this market overall, but we need to clear the $60.50 level for us to finally reach towards the $62.50 level. Buying on the dips should continue to work on short-term charts.

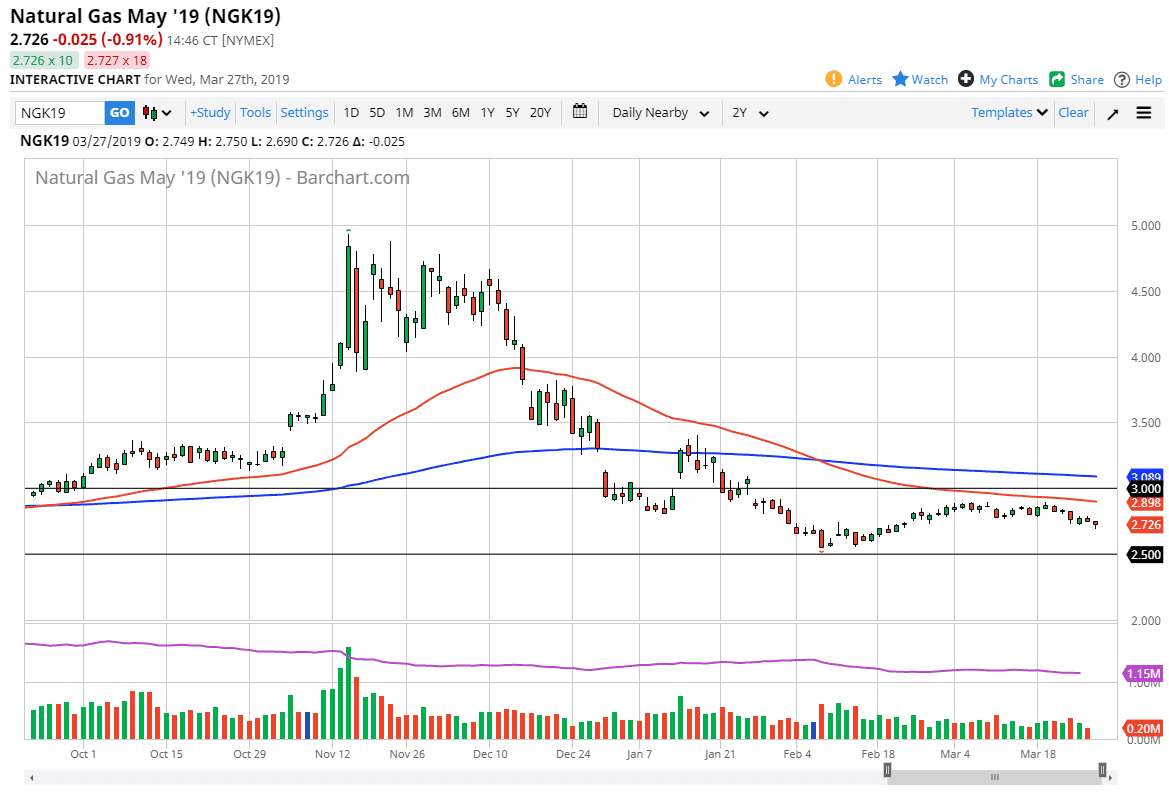

Natural Gas

Natural gas markets continue to be relatively quiet as we fell a bit on Wednesday only to turn around and show signs of support. At this point I suspect that there is a significant amount of support down at the $2.60 level that extends down to the $2.50 level. That’s been a major floor in the market for some time, so I don’t have any interest in trying to break it down. In fact, although I am very bearish of natural gas I’d be more than willing to buy down at that level. On the other hand, if we rally from here I much more interested in shorting near the $2.90 level as it is the beginning of resistance to the $3.00 level, and the 50 day EMA is right there as well.