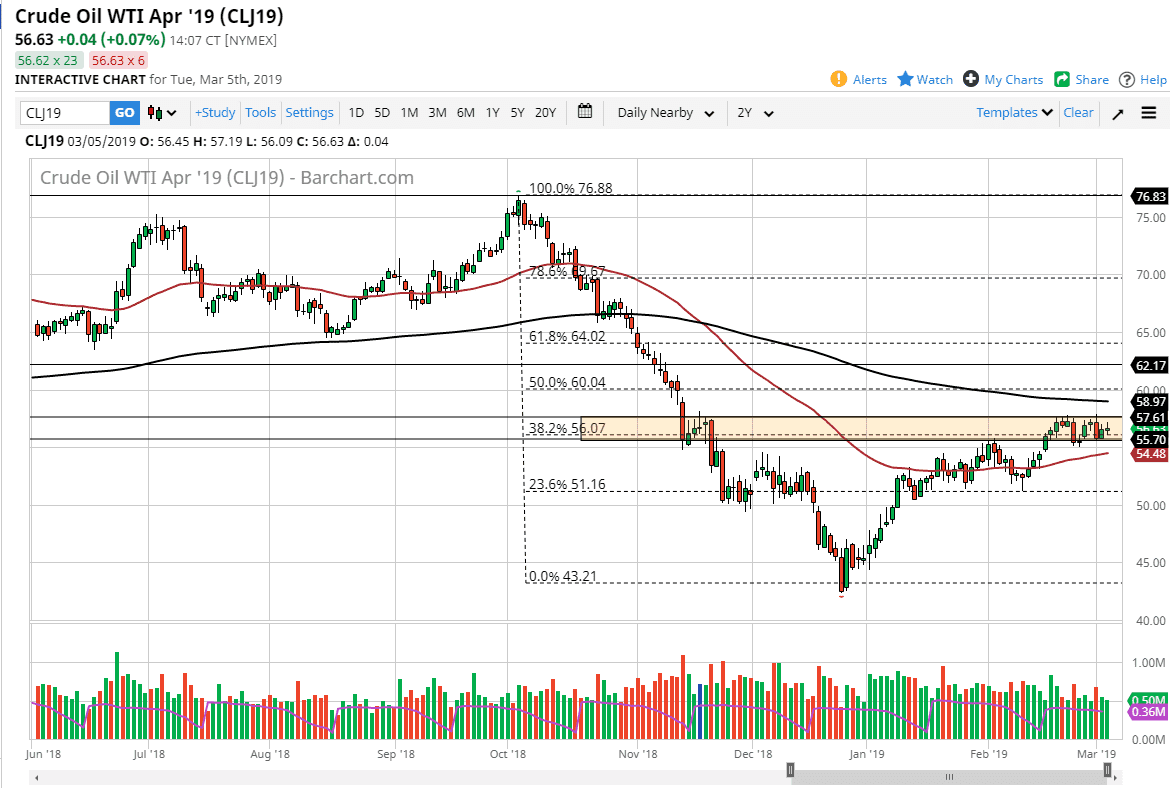

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Tuesday, as we continue to be very choppy and very sideways. We have several macroeconomic events coming out this week, and therefore I think it makes sense that we will continue to struggle to find serious directionality. Just below, we have the 50 day EMA, and we have the 200 day EMA just above. This shows that the market is extremely tight, and therefore it’s going to take something rather special to break out or break down. In the short term, I’m willing to play this market back and forth with a small position. However, once we get the impulsive candle, and you will know it when you see it, then we know which direction we are going for a much bigger move. It’s a simple game of waiting at this point.

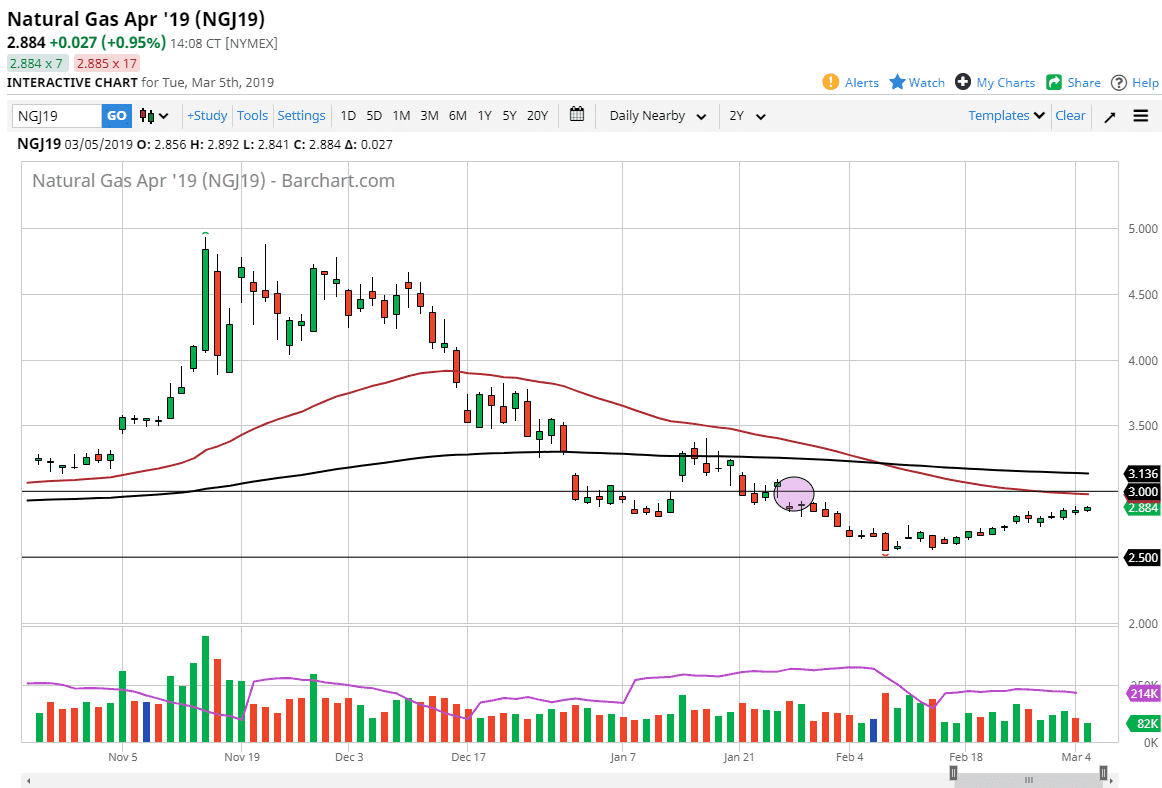

Natural Gas

Natural gas markets rallied slightly during trading on Tuesday, as we continue to grind towards the $3.00 level. That’s an area that has a gap at it, and that of course should cause a certain amount of resistance. At the first signs of failure on the rally in that region, I will not hesitate to start selling at that point. Beyond that, the 50 day EMA is currently sitting in that level, so I think there is going to be far too much from a technical standpoint for the buyers to go into this market and rally much further. Even if they do, the $3.13 level above features the 200 day EMA, so I think it’s much easier to short this market on signs of exhaustion that it is anything else.