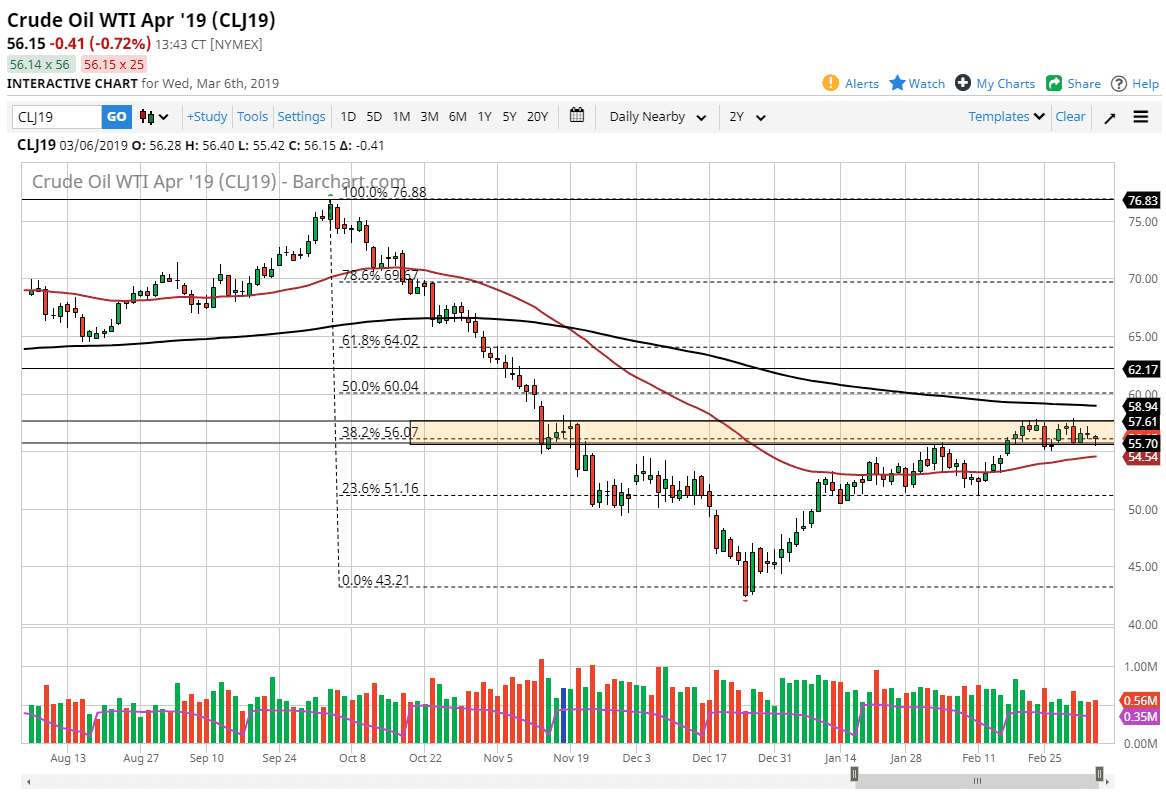

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Wednesday after a very poor inventory figures came out. You can see that the $55.50 level has offered support yet again though, and by the end of the day we are starting to show signs of a hammer, which of course is a very bullish sign. I think the market is going to focus more on the US/China trade relations and inventory in the short term, not to mention the fact that we have the jobs number coming out on Friday. The next couple of days will continue to be very choppy and mixed, but the one thing that we have seen lately is that the market seems to be very balanced in both directions. We will eventually making an impulsive move that we can follow, but it’s probably not going to be until after the jobs number.

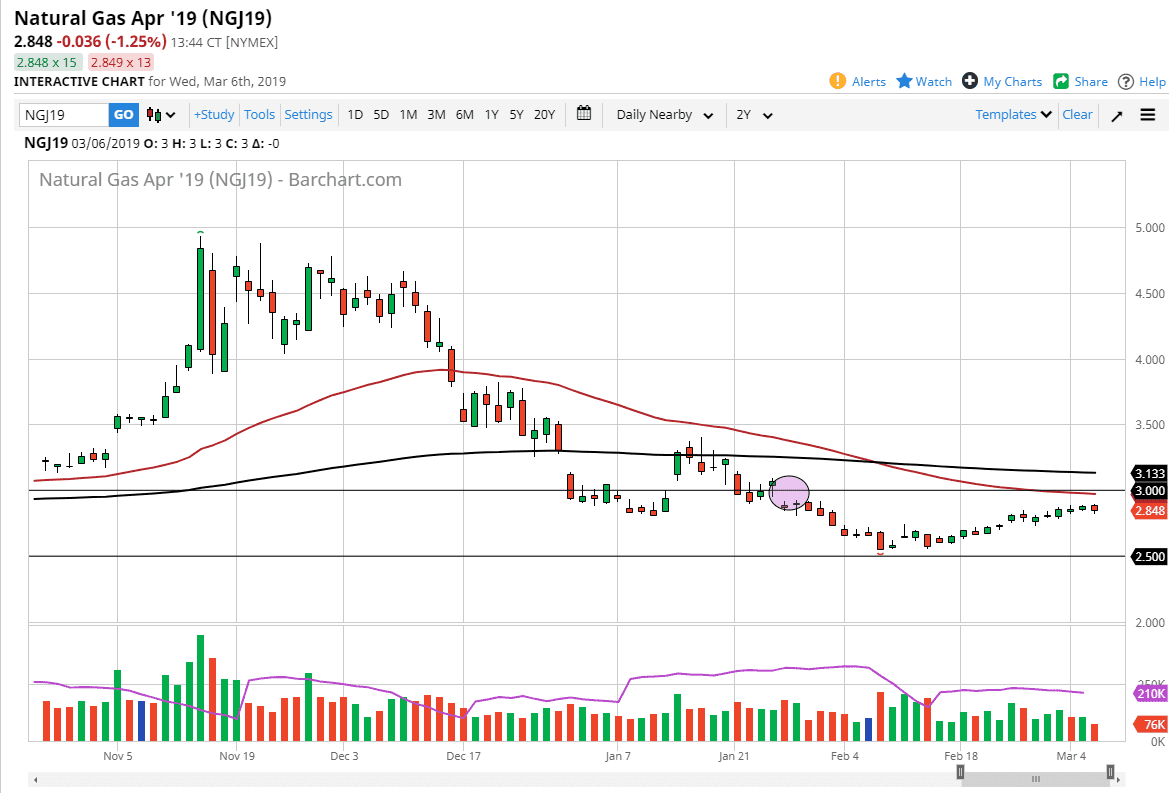

Natural Gas

Natural gas markets fell during the trading session on Wednesday, as we continue to see an overall bearish market for natural gas. Granted, we have had a bit of a cold snap recently in the United States, so that has driven the price up a little bit, but there is a significant amount of resistance at the $3.00 level, which coincides with a major gap lower. Beyond that, we have the 50 day EMA, which of course will cause a lot of attention. At this point, the market seems to have a bit of a “bottom” at the $2.50 level. I think at this point it’s only a matter of time before we get a little bit of a lift that we can sell. If you have the risk tolerance, some traders may wish to go ahead and short now but be advised that you may have to cover something like $0.20.