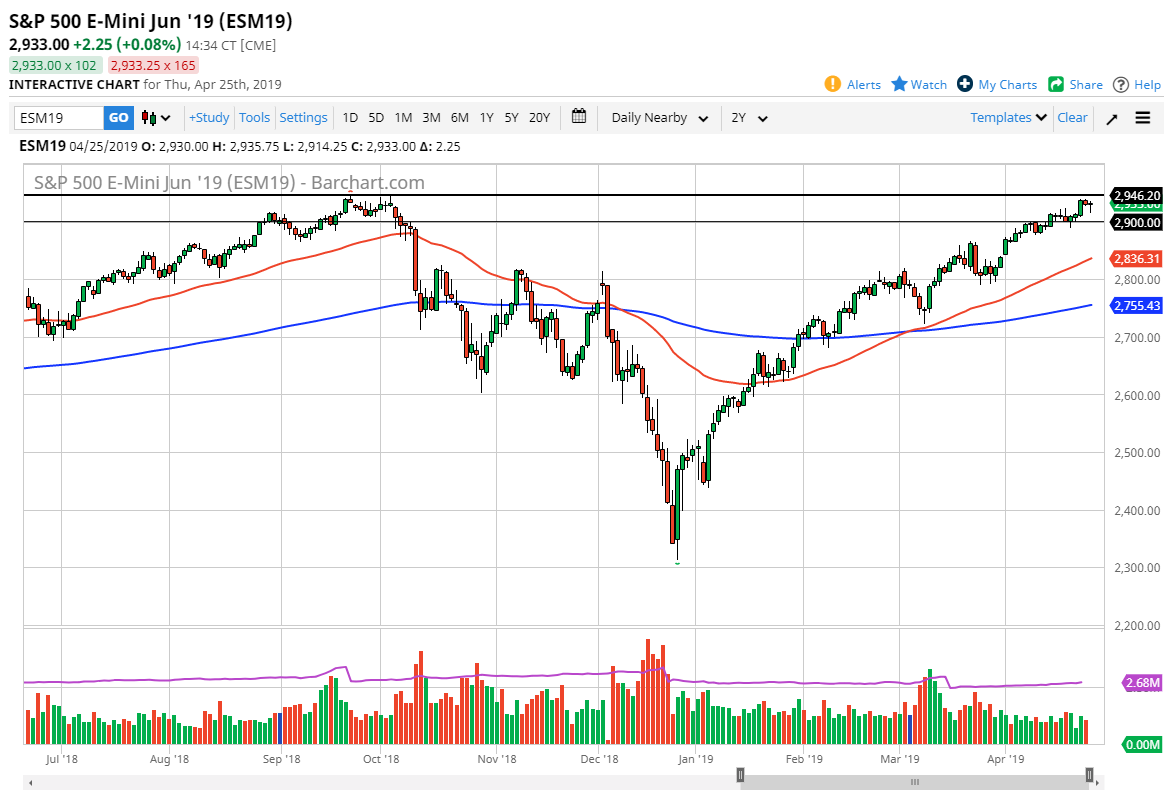

S&P 500

The S&P 500 went back and forth during the trading session on Thursday, as we initially fell rather hard but then recovered to form something to the effect of a hammer. The hammer is towards the top of the overall market, so having said that it’s very difficult to break higher. At this point, pullbacks continue to be bought, reaching towards the 2900 level should find plenty of value. On the other hand, if we were to break out to a fresh, new high, the S&P 500 will probably go looking towards the 3000 level which is a target that most of Wall Street is waiting for. We are in the middle of earnings season, so that of course can cause a lot of volatility. Overall, this is a bullish market and therefore it looks likely that we will eventually get that break out.

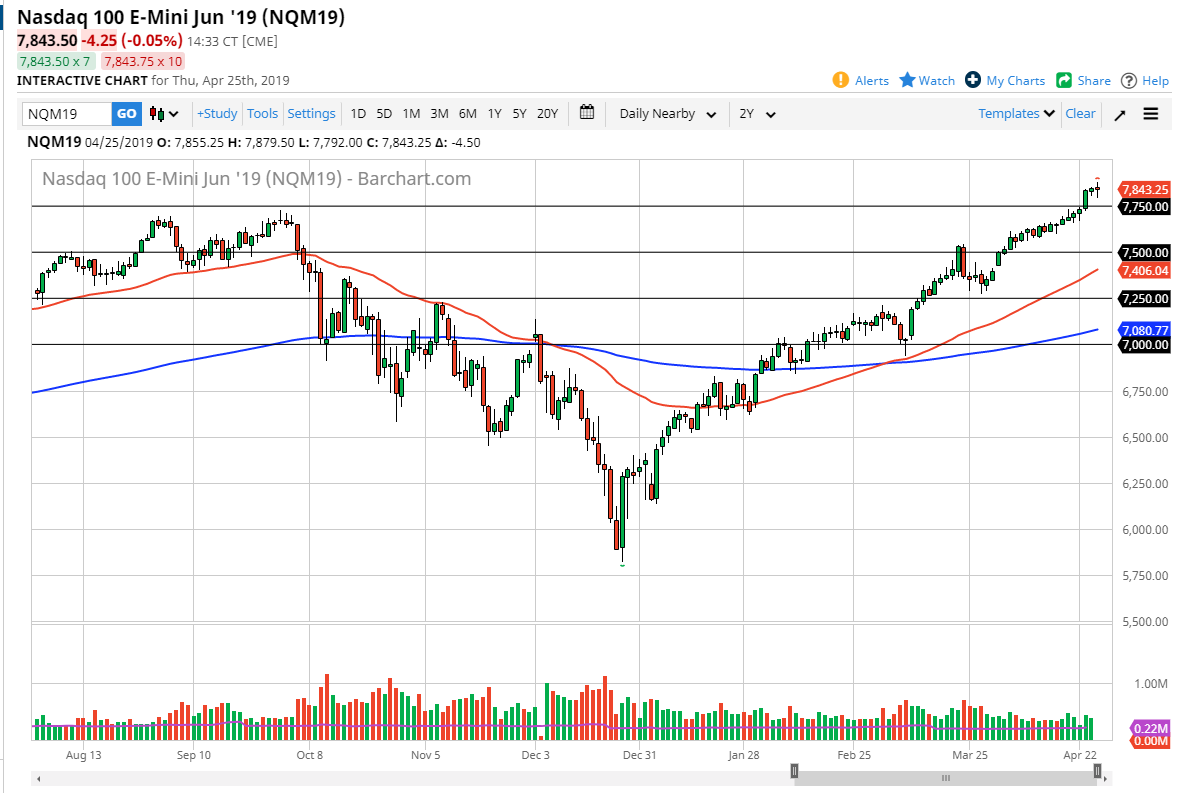

NASDAQ 100

Unlike the S&P 500, the NASDAQ 100 has already made a fresh, new high and formed a somewhat neutral looking candle during the trading session on Thursday. Earnings season will of course continue to push the NASDAQ 100 higher or lower based upon the large tech companies that really drive the car, but it looks as if the 7750 level underneath is support, as it was previous resistance. It should find plenty of buying pressure in that area, and therefore I think that short-term dips will probably continue to be looked at as a gift. To the upside, the market will probably go looking towards the 8000 level, but it’s going to take a lot of effort to get up there.

If we do break down below the 7700 level, the market will probably reach down towards the 7500 level. Ultimately, a move below the 7500 level would be rather negative in general.