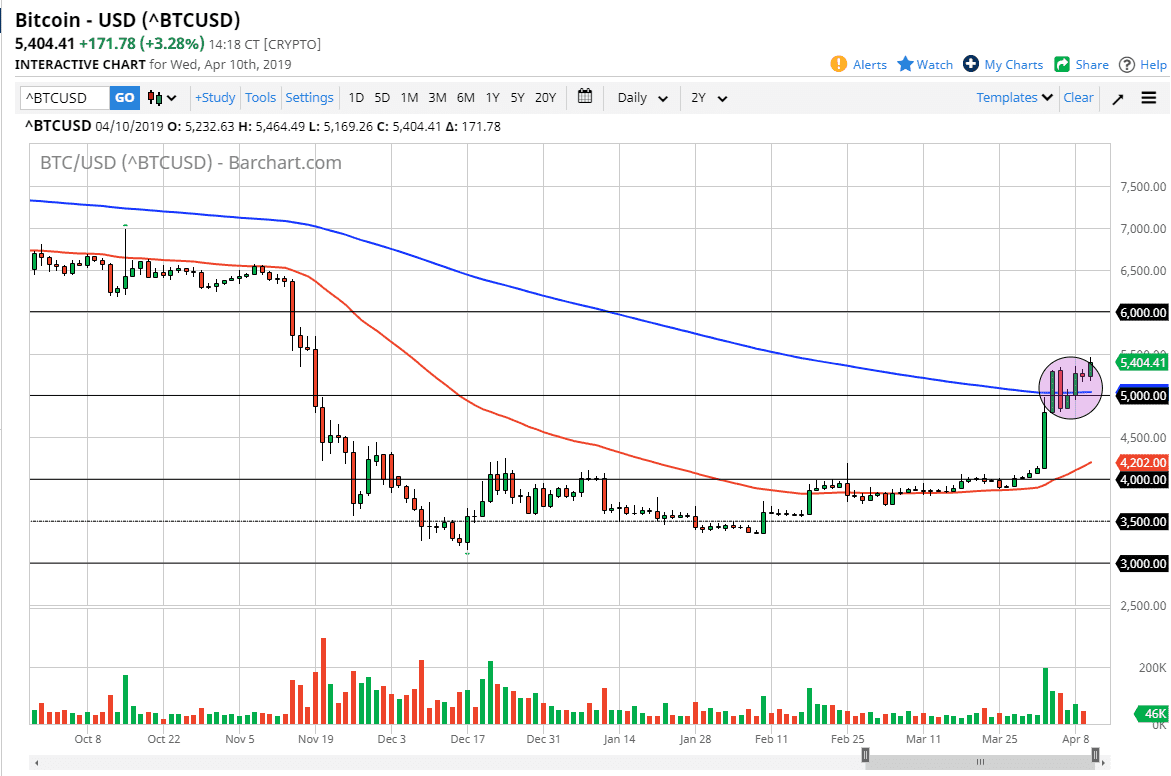

Bitcoin markets rallied again during the trading session on Wednesday in one of the biggest winning streaks that we’ve seen for some time. Just a week ago we were down closer to the $4000 level, and now we find the market testing the $5500 level during trading. This of course is a very bullish sign, but there are several other technical factors that you should be looking at that also suggest the same thing.

Bitcoin has broken above the highs of the last several sessions, an area that I thought could be a bit of consolidation. Consolidating around the 200 day EMA after breaking above it is a very strong sign and it shows that the market is trying to digest the gains and perhaps become more comfortable with the $5000 level. Now the obvious level is $5500, and if we can break above there it’s very likely that we will go looking towards $6000.

To the downside, if we were to break down below the $4800 level it could cause a bit of a correction but clearly at this point a lot of buying pressure has stepped up, and although it isn’t necessarily the most liquid market, it’s obvious that somebody has come in and started to break through major barriers. The target above $5500 would be $6000 which I see as much more resistive, and the natural target after the action of the last couple of weeks. It was previous support, so now I think it needs to be retested.

Don’t be surprised at all if we get a little bit of a pullback on short-term charts but clearly the momentum is to the upside and therefore shorting Bitcoin isn’t advisable at this point. This is the first time I’ve been able to say this and what seems like ages.