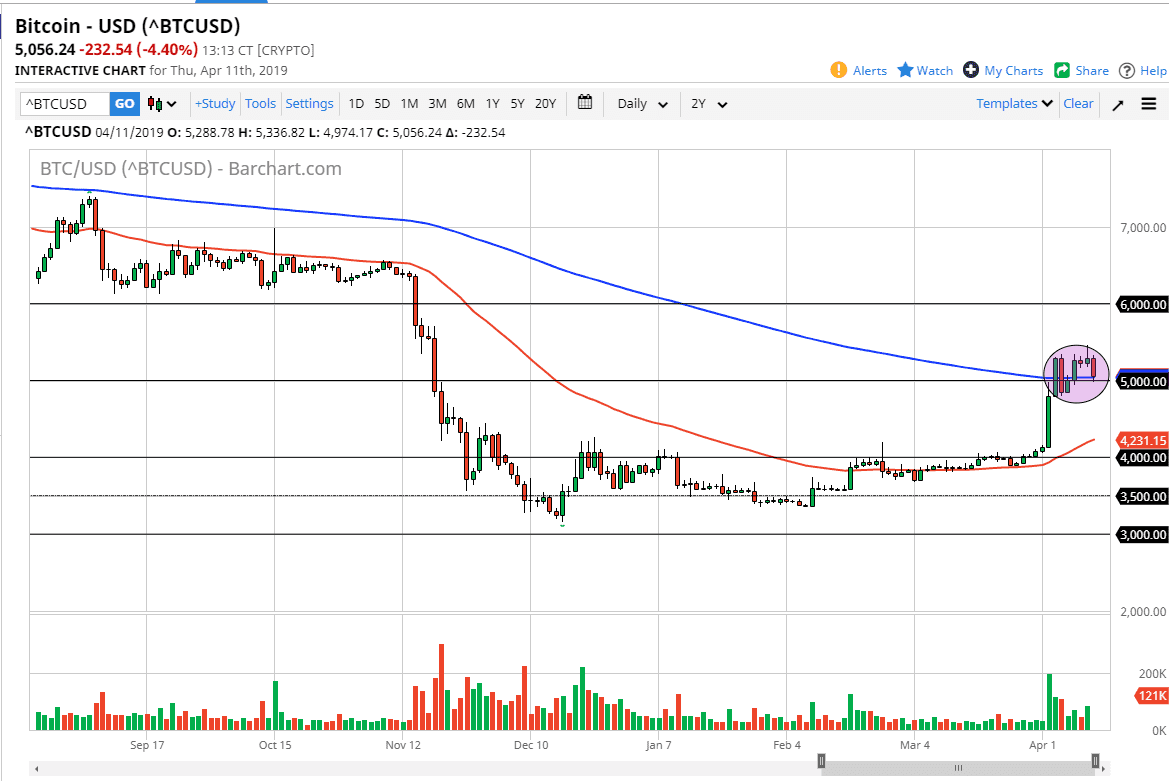

Bitcoin fell rather hard during trading on Thursday, as we continue to see a lot of noise in this marketplace. That makes a lot of sense though, because we are at major technical levels, and of course we are in the process of changing the overall trend from what I see. That is almost always a combination that makes a lot of messy action, and let’s be honest here: markets overall are messy these days.

We are dancing above the $5000 level, which of course is a significantly important round figure and it makes sense that perhaps we continue to look to the $5000 level as an area of interest that people will continue to take advantage of. Overall, I do like the idea of buying bitcoin on dips, just like the one that we got during the trading session on Thursday. The fact that the $5000 level held as support is a very encouraging sign.

Beyond that, the 200 day EMA offers significant support based upon algorithmic trading and of course the psychology of the 200 day EMA. Overall, this is a market that is consolidating in general around a major area of confluence, so I think it’s only a matter time before the market reaches to higher levels, perhaps even reaching towards the $6000 level above which was massive support in the past, and now will more than likely have massive resistance. If we were to break above that level, then it’s possible that we could go much higher. That being said I don’t expect it to happen in the short term, but clearly that’s the target for buyers now. On the other side of the equation, if we break down below the $4750 level, the market probably drops back towards the break out from several days ago. That could also be a nice buying opportunity.